FirstEnergy (FE) valuation check as $276 million House Bill 6 settlement deal seeks to clear regulatory overhang

FirstEnergy (FE) is back in the spotlight after agreeing to a roughly $276 million settlement tied to the House Bill 6 scandal, a deal that could finally clear major regulatory overhangs for investors.

See our latest analysis for FirstEnergy.

The settlement headlines land after a choppy few months, with a roughly 5.7% 1 month share price return decline, but a still solid double digit year to date share price gain and a roughly 84% 5 year total shareholder return suggesting that longer term momentum remains intact.

If you are rethinking how you balance steady utilities with growth, now could be a good moment to explore fast growing stocks with high insider ownership as potential next wave candidates.

With regulatory clouds finally starting to clear, a juicy dividend intact, and the stock still trading below analyst targets, the key question now is simple: Is FirstEnergy quietly undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative Narrative: 11.5% Undervalued

With FirstEnergy last closing at $44.23 versus a narrative fair value near $50, the current setup suggests investors may be underestimating its long term grid story.

Large scale infrastructure modernization and grid hardening initiatives including the $28 billion investment plan through 2029 and a 15% CAGR in transmission rate base enable higher returns on equity, improved reliability, and ultimately enhance net margins and earnings growth.

Curious how steady revenue growth, rising margins and a richer future earnings multiple combine to back that higher value? Want to see which assumptions do the heavy lifting?

Result: Fair Value of $50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, distributed energy adoption and any resurgence of regulatory fallout from the House Bill 6 scandal could still derail the grid modernization driven upside.

Find out about the key risks to this FirstEnergy narrative.

Another Way to Look at Value

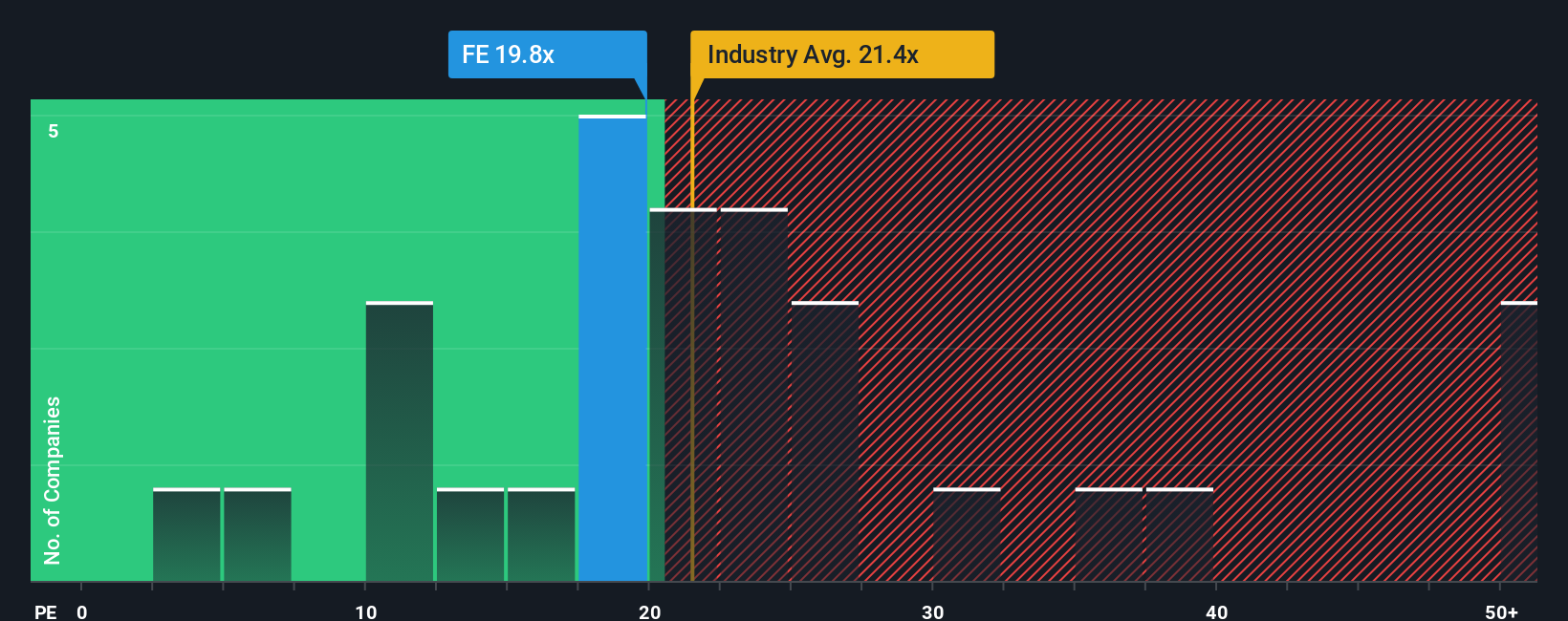

Our valuation checks suggest FE trades on a 19.2 times earnings multiple, slightly cheaper than the utilities industry at 19.4 times and well below a fair ratio of 23.4 times. That gap hints at upside, but is the discount rewarding, or a warning about slower growth?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FirstEnergy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 899 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FirstEnergy Narrative

If you see things differently or want to dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your FirstEnergy research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next opportunity by using the Simply Wall Street Screener to uncover focused stock ideas that many investors may be overlooking.

- Refine your search for potential opportunities by scanning these 899 undervalued stocks based on cash flows that may be trading at meaningful discounts to their estimated intrinsic value.

- Align your portfolio with emerging innovation by targeting these 24 AI penny stocks involved in automation, data intelligence and next generation platforms.

- Enhance your income stream by filtering for these 12 dividend stocks with yields > 3% that aim to provide regular cash distributions alongside potential capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報