Will Talen’s New President and CFO Refocus TLN on Digital Infrastructure and Low-Carbon Power?

- Earlier this month, Talen Energy reshaped its leadership structure by appointing former CFO Terry L. Nutt as President and naming Cole Muller as Chief Financial Officer, alongside a series of senior operational and development role changes to support its evolving power and infrastructure business.

- The extensive reallocation of responsibilities, from nuclear oversight and fleet operations to new generation asset development and data center strategy, signals a concerted push to align management expertise with Talen’s growth in digital infrastructure and low-carbon power.

- We’ll now assess how elevating Terry Nutt to President and installing Cole Muller as CFO could influence Talen Energy’s investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Talen Energy Investment Narrative Recap

To own Talen Energy, you need to believe its mix of nuclear, gas and emerging digital infrastructure can convert tightening power markets into sustained cash generation while managing leverage. The latest leadership reshuffle, with Terry Nutt as President and Cole Muller as CFO, looks incremental for now and does not materially change the near term focus on integrating new gas assets and executing the AWS nuclear contract, or the key risks around fossil exposure and balance sheet pressure.

The most relevant recent announcement here is Talen’s acquisition progress on the Freedom and Guernsey combined cycle gas plants, which adds almost 2.9 GW in core data center regions and intensifies the company’s fossil exposure just as it leans on higher future cash flows to pay down debt. How this new leadership team balances capital allocation between these gas assets, nuclear contracts and early stage clean projects will shape how quickly Talen can reduce leverage without over-relying on today’s strong pricing.

Yet behind the leadership refresh, investors should be aware of the concentration risk in gas generation and what happens if decarbonization policy accelerates...

Read the full narrative on Talen Energy (it's free!)

Talen Energy's narrative projects $4.2 billion revenue and $1.1 billion earnings by 2028.

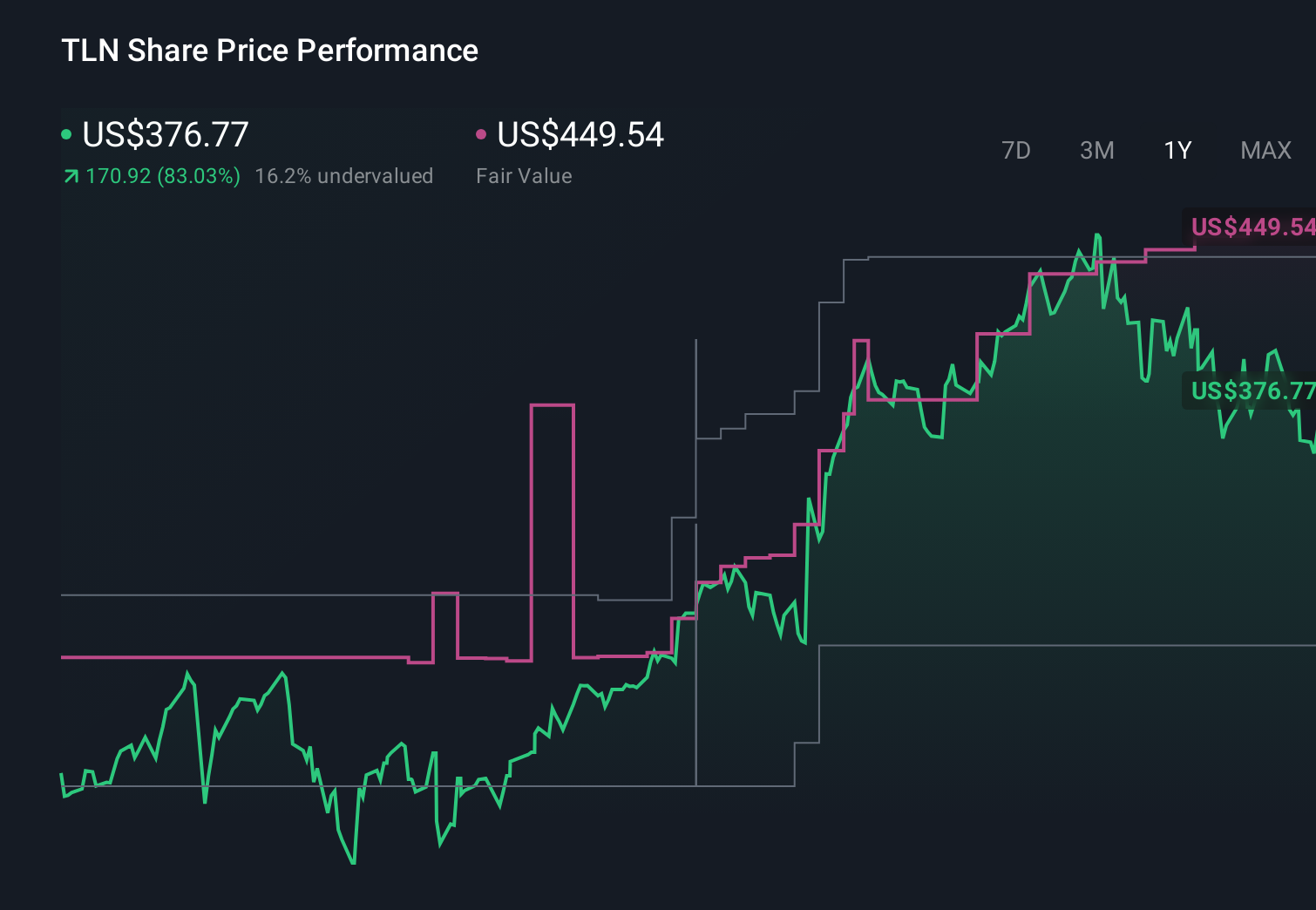

Uncover how Talen Energy's forecasts yield a $449.54 fair value, a 21% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community place Talen’s fair value between US$300 and US$1,089, with some seeing very substantial upside from current prices. Set that wide spread against the company’s heavy reliance on fossil generation and debt funded growth, and it is clear you should weigh several viewpoints before deciding how Talen fits your own expectations for future power markets.

Explore 5 other fair value estimates on Talen Energy - why the stock might be worth 19% less than the current price!

Build Your Own Talen Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talen Energy research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Talen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talen Energy's overall financial health at a glance.

Curious About Other Options?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報