Reassessing China Lesso Group Holdings (SEHK:2128)’s Valuation After New Related-Party Accessories Agreement

China Lesso Group Holdings (SEHK:2128) has just signed a three year accessories cooperation agreement with related party Guangdong Liansu Electric, setting terms for electronic accessories purchases from 2026 to 2028 under Hong Kong connected transaction rules.

See our latest analysis for China Lesso Group Holdings.

The new connected transaction lands at a time when China Lesso’s HK$4.63 share price has delivered a 39.88% year to date share price return but a much weaker 3 year total shareholder return of minus 32.35%. This suggests recent momentum is rebuilding after a tougher stretch.

If this governance focused news has you rethinking where growth and alignment might be stronger, it could be worth exploring fast growing stocks with high insider ownership as potential alternatives.

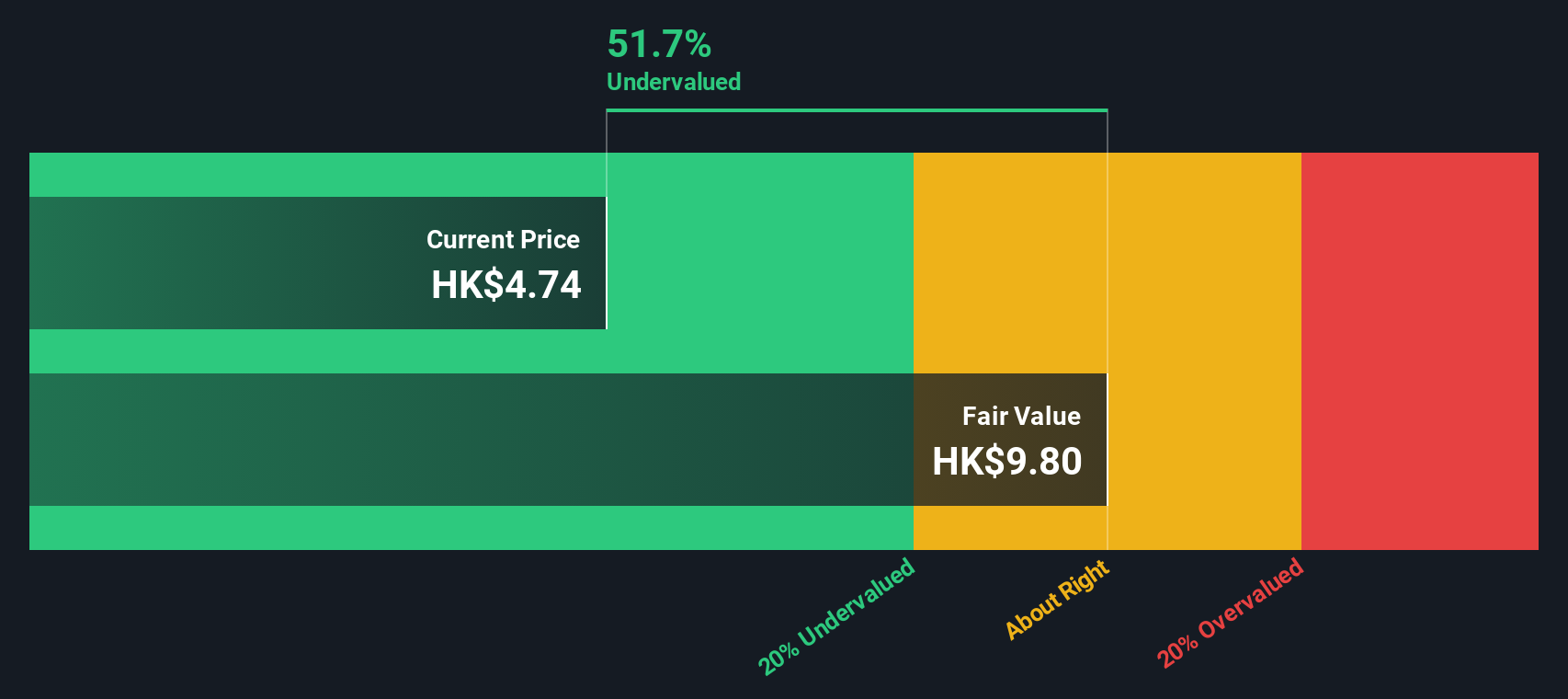

Yet with shares trading below analyst targets and our model implying an even steeper intrinsic discount, investors now face a key question: is China Lesso still undervalued or already pricing in its next leg of growth?

Price-to-Earnings of 7.7x: Is it justified?

On a price-to-earnings basis, China Lesso screens as materially undervalued, with its 7.7x multiple sitting well below both peers and the wider Asian building industry, despite the recent share price recovery to HK$4.63.

The price-to-earnings ratio compares the company’s market value to its current earnings. It is a core yardstick for mature, cash-generative industrial and building materials businesses like China Lesso that still post positive profits.

Here, the market is valuing each dollar of China Lesso’s earnings at a steep discount versus close peers on 31.3x and the Asian building industry on 18.4x. Our SWS DCF model and fair price-to-earnings estimate of 11.2x both point to a higher level that sentiment could gravitate toward if earnings growth and cash generation track current forecasts.

Relative to the sector, the gap is striking, with China Lesso’s 7.7x multiple less than half the industry average and only around one quarter of the peer group average. This implies investors are assigning a heavy discount despite forecast earnings growth that is expected to outpace the Hong Kong market.

Explore the SWS fair ratio for China Lesso Group Holdings

Result: Price-to-Earnings of 7.7x (UNDERVALUED)

However, investors still face risks around the cyclicality of construction demand and execution on diversified ventures, which could cap valuation re-rating despite attractive headline metrics.

Find out about the key risks to this China Lesso Group Holdings narrative.

Another Lens on Value

Our SWS DCF model paints an even starker picture than the 7.7x earnings multiple. China Lesso is trading about 52% below its estimated fair value of HK$9.70. If cash flows come through as expected, is the market overlooking a deeper rerating story, or are risks still underappreciated?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Lesso Group Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Lesso Group Holdings Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalised view in just minutes: Do it your way.

A great starting point for your China Lesso Group Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single idea; use the Simply Wall St Screener now to uncover targeted opportunities and avoid missing mispriced growth, income, and innovation.

- Capture early-stage potential by reviewing these 3632 penny stocks with strong financials that pair tiny market caps with balance sheets and earnings profiles built for serious upside.

- Position your portfolio at the forefront of automation by assessing these 29 healthcare AI stocks reshaping diagnostics, treatment pathways, and hospital efficiency.

- Strengthen your income stream by targeting these 12 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios and resilient cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報