Consolidated Edison (ED): Reassessing Valuation After New York Grid Reliability Scrutiny and Analyst Downgrades

Consolidated Edison (ED) just landed in the spotlight after New York regulators pressed the utility for a concrete grid reliability plan amid blackout warnings, as future delivery rate hikes and cautious Wall Street views converge.

See our latest analysis for Consolidated Edison.

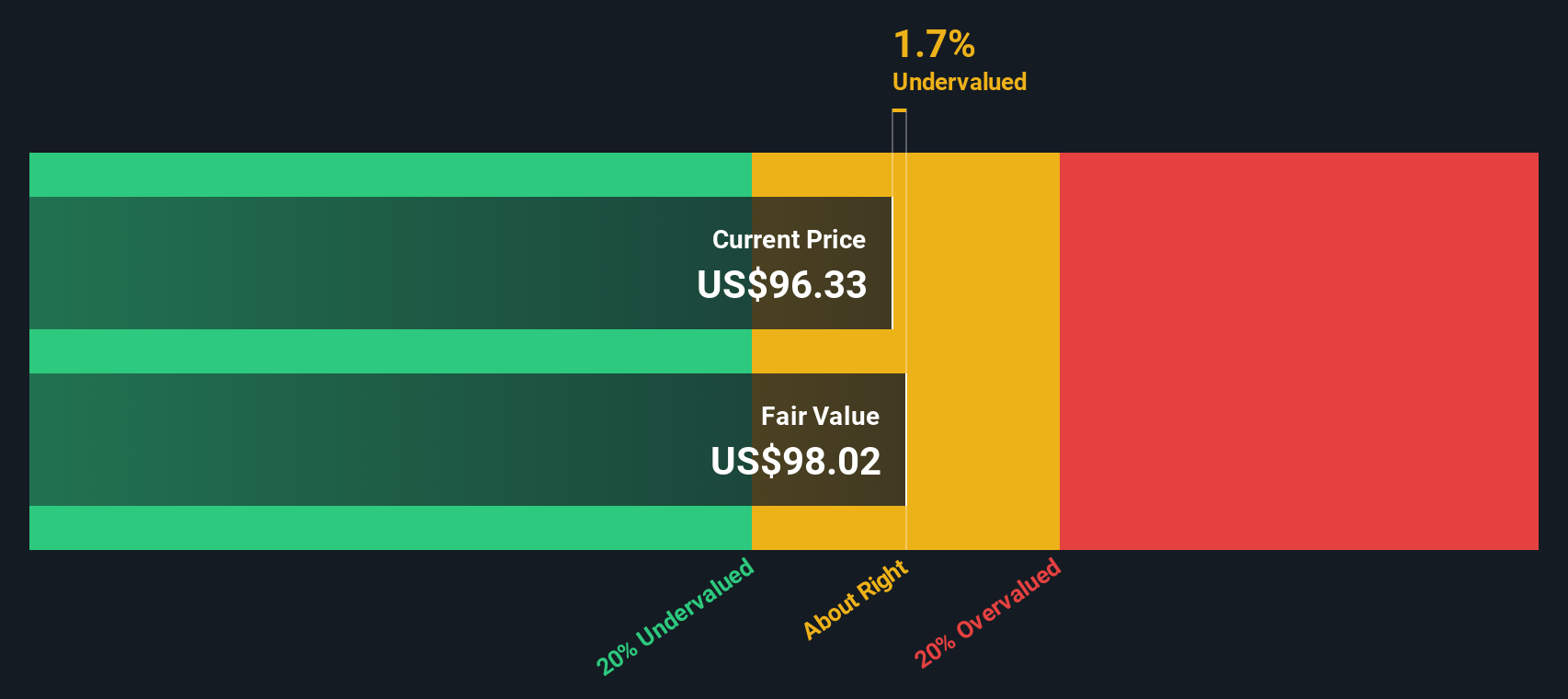

Despite the regulatory heat and recent stake sale announcement, Consolidated Edison’s share price has eased back to about $98, with a modest year to date share price return of just over 10 percent and a five year total shareholder return above 60 percent. This suggests that long term compounding remains intact even as near term momentum cools.

If this utility’s risk reward trade off has you reassessing your watchlist, it could be a good moment to broaden your search and discover fast growing stocks with high insider ownership

With regulators tightening the screws and analysts turning cautious while the stock trades only slightly below target, are investors overlooking an attractive defensive dividend play, or is Wall Street already pricing in every watt of future growth?

Price-to-Earnings of 17.4x: Is it justified?

With Consolidated Edison closing at $98.06, its 17.4x price-to-earnings multiple screens as modestly cheap versus both peers and the wider US market.

The price-to-earnings ratio compares today’s share price to the company’s per share earnings, a key yardstick for steady, regulated utilities where profits are relatively predictable. For ED, this multiple sits below the broader US market’s 19x, suggesting investors are not paying a premium for its earnings despite a long operating history and regulated cash flows.

What stands out is that the current 17.4x multiple is not only lower than the US market and peer average of 19.4x, but also below an estimated fair price-to-earnings ratio of 23.5x that the market could gravitate toward if sentiment or growth expectations improve. Against the global Integrated Utilities average of 17.9x, ED again trades at a discount, indicating the market is applying a slightly harsher lens than it does to comparable utilities, even though earnings have grown in recent years.

Explore the SWS fair ratio for Consolidated Edison

Result: Price-to-Earnings of 17.4x (UNDERVALUED)

However, persistent regulatory pressure and any unexpected slowdown in earnings growth could quickly compress that valuation gap and derail the defensive thesis.

Find out about the key risks to this Consolidated Edison narrative.

Another Angle on Valuation

Our SWS DCF model paints a cooler picture, putting fair value for Consolidated Edison at about $97.60, just below the current $98.06 share price. On this view, the stock looks slightly overvalued, which raises the question of whether P/E based optimism is leaning a bit too far ahead of the cash flows.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Consolidated Edison for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Consolidated Edison Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a full view in minutes: Do it your way

A great starting point for your Consolidated Edison research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next set of opportunities with targeted stock ideas powered by real data, not hype or headlines.

- Capture potential big movers early by scanning these 3633 penny stocks with strong financials that pair smaller share prices with stronger balance sheets and improving fundamentals.

- Position your portfolio for the next wave of innovation by focusing on these 24 AI penny stocks that connect artificial intelligence trends with real revenue growth.

- Stack the odds in your favor by filtering for these 903 undervalued stocks based on cash flows where discounted cash flows suggest the market may be underestimating long term potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報