Assessing CECO Environmental’s (CECO) Valuation After Record $135 Million Emissions Contract and Analyst Upgrades

CECO Environmental (CECO) just landed the biggest order in its history, a contract topping $135 million to supply emissions management gear for a Texas power plant feeding fast growing data center demand.

See our latest analysis for CECO Environmental.

The contract has come on top of powerful momentum, with an 86.97% year to date share price return and a 104.21% one year total shareholder return. This suggests investors see this backlog as the start of a longer growth runway rather than a one off win.

If CECO’s move has you thinking about where else structural demand could surprise, it might be worth scouting aerospace and defense stocks for other industrial names with multi year tailwinds.

After a fourfold five year total return and a stock trading just below near term analyst targets, the key question now is whether CECO is still trading at a meaningful intrinsic discount or whether markets are already pricing in years of growth.

Most Popular Narrative: 20% Undervalued

With CECO Environmental closing at $58.71 against a narrative fair value near $58.83, the story leans on long runway growth to justify upside.

Record high backlog and robust pipeline growth, especially in power generation, industrial water, and natural gas infrastructure, suggest that increasing global enforcement of environmental regulations is translating into sustained demand and forward visibility for CECO's solutions supporting topline revenue growth over the next 18 to 24 months.

Want to see what is baked into that growth runway, and how long it can last before margins start to feel the strain, and why the earnings multiple stretches beyond the usual range for this sector? The narrative quietly links recurring environmental demand, disciplined but aggressive expansion, and a future valuation profile that looks more like a secular compounder than a cyclical industrial. Curious how those moving parts add up to this fair value call, and what has to go right in the next few years to keep it intact?

Result: Fair Value of $58.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this bullish setup still hinges on flawless execution, as elevated leverage and potential inflation driven margin pressure are capable of quickly undermining the growth story.

Find out about the key risks to this CECO Environmental narrative.

Another View on Value

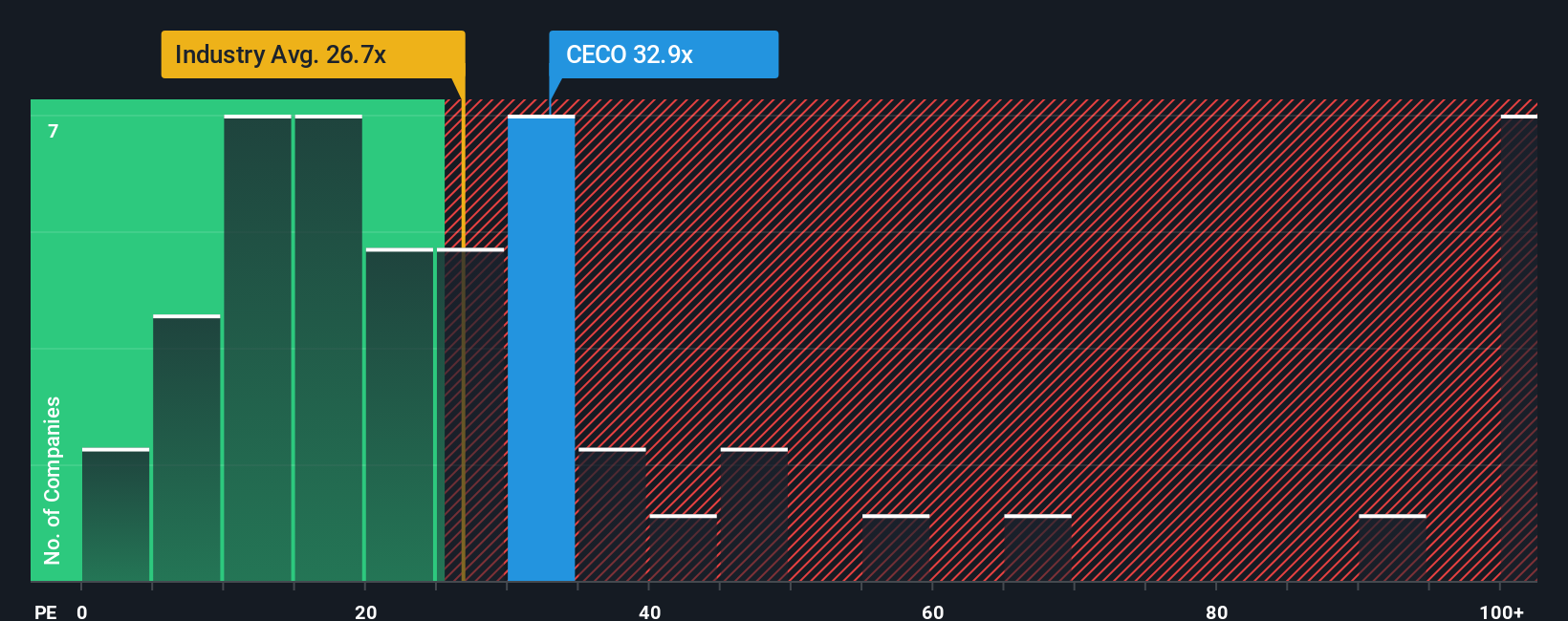

While the narrative fair value points to upside, a simple earnings lens paints a harsher picture. CECO trades on a 40.3x P/E, which is far richer than the 25.3x Machinery industry average and well above a 19.1x fair ratio. This means expectations already assume a lot of future perfection.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own CECO Environmental Narrative

If you see the story differently or simply prefer your own homework, you can spin up a custom view in minutes: Do it your way.

A great starting point for your CECO Environmental research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If CECO caught your attention, do not stop here. Use the Simply Wall St Screener to uncover more focused opportunities before the crowd sees them.

- Position your portfolio for potential outsized gains by targeting these 903 undervalued stocks based on cash flows that the market has not fully appreciated yet.

- Capture cutting edge growth by zeroing in on these 24 AI penny stocks harnessing artificial intelligence to reshape entire industries.

- Strengthen your income stream by reviewing these 12 dividend stocks with yields > 3% that can help support reliable cash returns through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報