Franklin Resources (BEN): Valuation Check After Dividend Hike, Bigger Buyback and Expanded Credit Facility

Franklin Resources (BEN) just rolled out a trifecta of capital moves that income focused investors tend to watch closely: a higher quarterly dividend, a larger buyback pool, and expanded credit capacity.

See our latest analysis for Franklin Resources.

The backdrop here is a stock that has quietly rebuilt some momentum, with a roughly 10.7% 1 month share price return feeding into a 19.2% year to date gain and a 24.5% 1 year total shareholder return that suggests investors are warming to Franklin Resources’ mix of capital returns, product launches, and strategic partnerships.

If this kind of steady, income friendly story has you thinking more broadly about where to put new money to work, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover the next wave of high conviction ideas.

Yet with BEN now trading close to analyst targets and delivering a double digit one year run, the key question is whether this dividend rich asset manager still offers upside or if the market has already priced in future growth.

Most Popular Narrative Narrative: 2.9% Undervalued

With Franklin Resources last closing at $24 and the most followed narrative pointing to fair value just under $25, the story centers on how new growth engines scale from here.

The company is actively expanding its presence in non U.S. and emerging markets, now with $500 billion of AUM outside the US and new mandates in countries like Uzbekistan and Saudi Arabia positioning Franklin Resources to benefit from the rising global wealth and the increasing allocation of institutional capital worldwide. This is likely to support future AUM growth and top line revenue expansion.

Want to see what turns that global expansion into today’s fair value call? The narrative leans on richer margins, faster earnings, and a surprisingly restrained valuation multiple. Curious how those pieces fit together to justify only a slight upside from here?

Result: Fair Value of $24.73 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent client outflows and ongoing fee compression could quickly erode earnings momentum and challenge the modest upside case that is embedded in today’s valuation.

Find out about the key risks to this Franklin Resources narrative.

Another Angle on Valuation

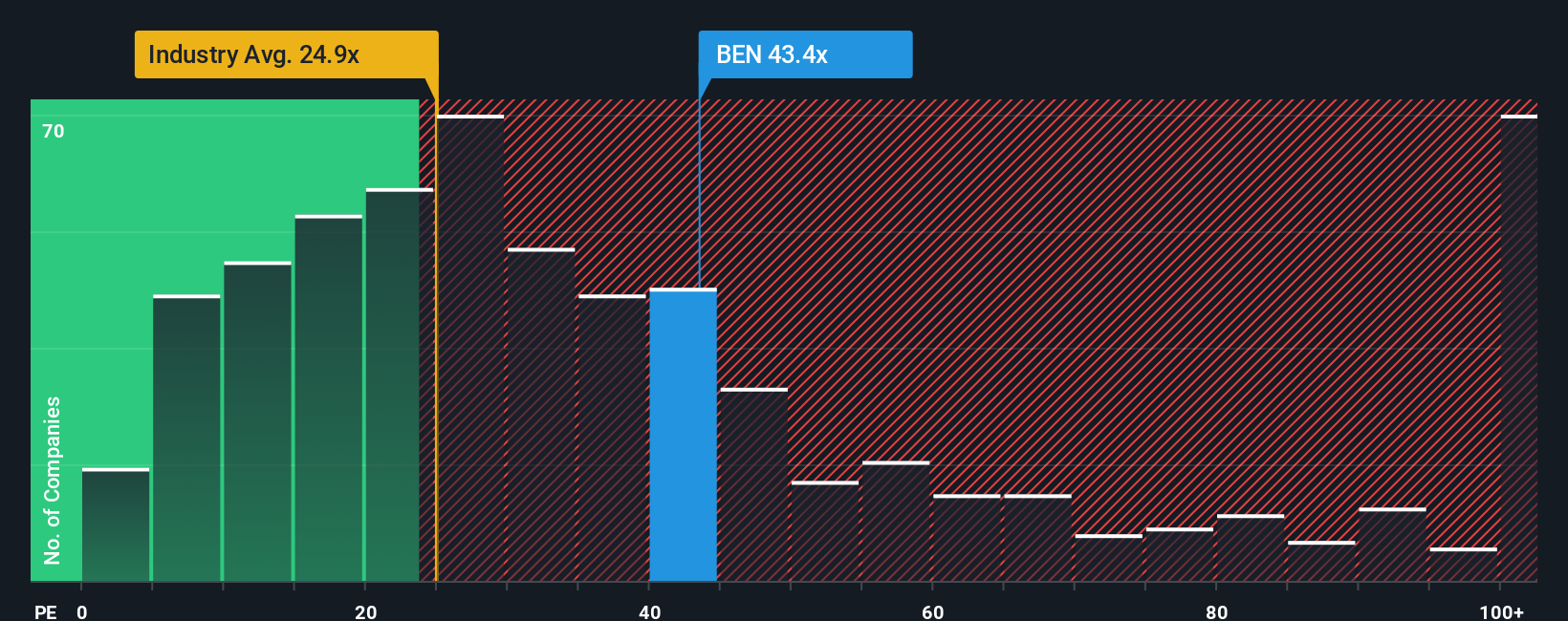

Step away from narratives and Franklin Resources looks far from cheap on its earnings. At about 26.5 times earnings, versus 25.1 times for the US Capital Markets industry and a fair ratio of 17.4 times, the stock carries a valuation premium that could easily unwind if growth disappoints.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Franklin Resources Narrative

If you are not fully aligned with this view or prefer digging into the numbers yourself, you can quickly craft a personalized narrative: Do it your way.

A great starting point for your Franklin Resources research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want more potential winners on your radar, use the Simply Wall St Screener now, before others act on the opportunities you could be missing.

- Capture mispriced potential by reviewing these 903 undervalued stocks based on cash flows that strong cash flow forecasts suggest the market has not fully appreciated yet.

- Tap into breakthrough innovation by scanning these 24 AI penny stocks positioned to benefit from accelerating demand for intelligent software and automation.

- Lock in reliable income by checking out these 12 dividend stocks with yields > 3% that combine solid yields with supportive balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報