Natera (NTRA): Revisiting Valuation After New JAMA Oncology Data on Signatera’s Colorectal Cancer Benefit

Natera (NTRA) just got a fresh spotlight after JAMA Oncology published phase III data showing its Signatera test can flag stage III colorectal cancer patients who benefit meaningfully from adding celecoxib to standard chemotherapy.

See our latest analysis for Natera.

The latest JAMA Oncology data caps a string of Signatera wins and has helped fuel a sharp swing in sentiment, with a roughly 34 percent 3 month share price return and a powerful 3 year total shareholder return of about 458 percent. This suggests momentum is still building around the story at a current share price of $231.96.

If this kind of clinical momentum has your attention, it could be a moment to scout other innovative healthcare names using healthcare stocks for fresh ideas beyond diagnostics.

With shares near record highs, a single digit discount to analyst targets and rapid revenue and earnings momentum, is Natera still mispriced for its long runway, or are markets already baking in the next leg of growth?

Most Popular Narrative: 1.2% Undervalued

With Natera last closing at $231.96 versus a narrative fair value of about $234.68, the story leans toward modest upside powered by aggressive growth assumptions.

Investment in new product launches (e.g., Fetal Focus NIPT, Signatera Genome, AI-based biomarkers) and a robust R&D pipeline positions Natera to capture growth from long-term trends in personalized medicine and early detection, supporting potential future revenue expansion.

Curious how this pipeline could turn today’s losses into future profits, while supporting a valuation multiple usually reserved for elite growth franchises? The narrative leans heavily on accelerating revenues, rising margins, and a bold earnings trajectory that could reset expectations if it plays out.

Result: Fair Value of $234.68 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in key clinical trials or slower than expected reimbursement wins could quickly challenge today’s bullish assumptions and compress that premium multiple.

Find out about the key risks to this Natera narrative.

Another Lens On Valuation

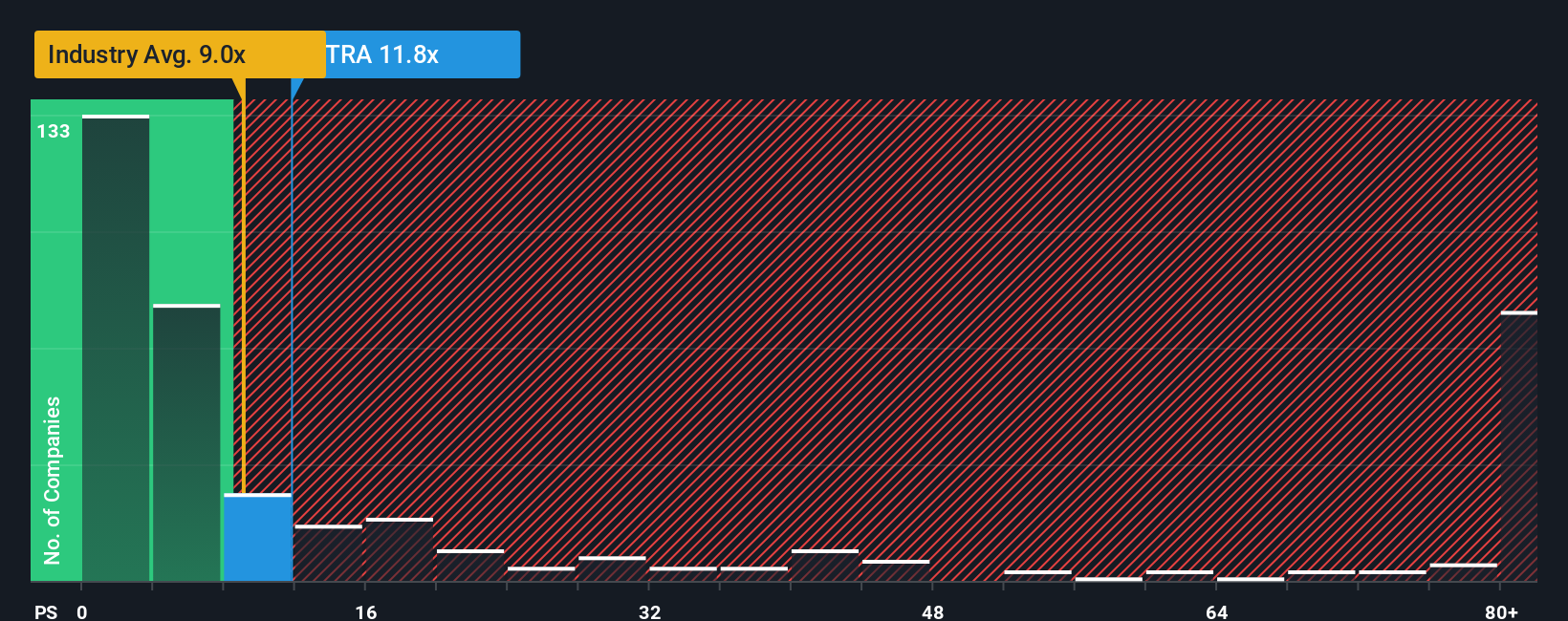

Multiples tell a very different story. Natera trades on a price to sales ratio of 15.2 times versus 12.1 times for the US Biotechs industry, 9.2 times for peers, and a fair ratio of 8.3 times. This implies investors are paying a steep premium that might unwind if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Natera Narrative

If this perspective does not fully align with yours, or you prefer hands on research, you can build a personalized view in minutes: Do it your way.

A great starting point for your Natera research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, give yourself an edge by scanning fresh, high conviction opportunities on Simply Wall Street’s Screener, so you are not left watching from the sidelines.

- Capture potential multi baggers early by targeting growth at sensible prices with these 903 undervalued stocks based on cash flows built on forward looking cash flow strength.

- Tap into the next wave of intelligent automation by focusing on companies powering real world innovation through these 24 AI penny stocks.

- Lock in reliable income streams while markets stay volatile by zeroing in on quality payers using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報