Neurocrine Biosciences (NBIX): Assessing Valuation After New Phase 2 Bipolar I Mania Trial Launch

Neurocrine Biosciences (NBIX) just kicked off a randomized, double blind, placebo controlled Phase 2 trial of NBI-1117568 in adults with Bipolar I manic episodes, a meaningful pipeline step that helps explain recent investor interest.

See our latest analysis for Neurocrine Biosciences.

At around a 145 dollar share price, Neurocrine has delivered a solid 1 year total shareholder return of roughly 6 percent, with the recent Phase 2 update helping underpin steadily improving sentiment despite some short term share price volatility.

If this bipolar trial has you rethinking your healthcare exposure, it is a good moment to explore other innovative healthcare stocks that could round out your watchlist.

With shares trading at a sizable discount to Wall Street targets despite double digit revenue and earnings growth, is Neurocrine an underappreciated CNS leader to buy now or are markets already pricing in its next leg of growth?

Most Popular Narrative Narrative: 40.8% Undervalued

According to kapirey, the latest narrative pegs Neurocrine's fair value far above the 145 dollar last close, framing the stock as meaningfully mispriced.

PipelineCrenessity@CRENESSITY Capsule 50/100 MG $766.66packaging 50 MG 60u $45,999.60packaging 100 MG 30u. Starts at approximately $21,338.71 USD for a monthly supply Ingrezza@Ingrezza (valbenazine) As of July 2025, the average pharmacy acquisition cost for Ingrezza capsules in the U.S. is approximately:

• $274.54 per capsule for the 60 mg and 80 mg strengths

• $250.16 per capsule for the 40 mg strength Other Products: Tetrabenazine Tablet 12.5 MG $62.52 Austedo Tablet 6 MG $100.06 Austedo XR Tablet 6 MG $100.06 Xenazine Tablet 12.5 MG $227.88 Assumptions Risks

Curious how premium pricing, ambitious growth forecasts, and a rich future earnings multiple combine to justify a far higher value than today’s price suggests? Read on.

Result: Fair Value of $244.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, pivotal trial setbacks or tougher pricing and reimbursement pushback on Ingrezza and Crenessity could quickly undermine the current undervalued thesis.

Find out about the key risks to this Neurocrine Biosciences narrative.

Another View: Rich Earnings Multiple Clouds The Picture

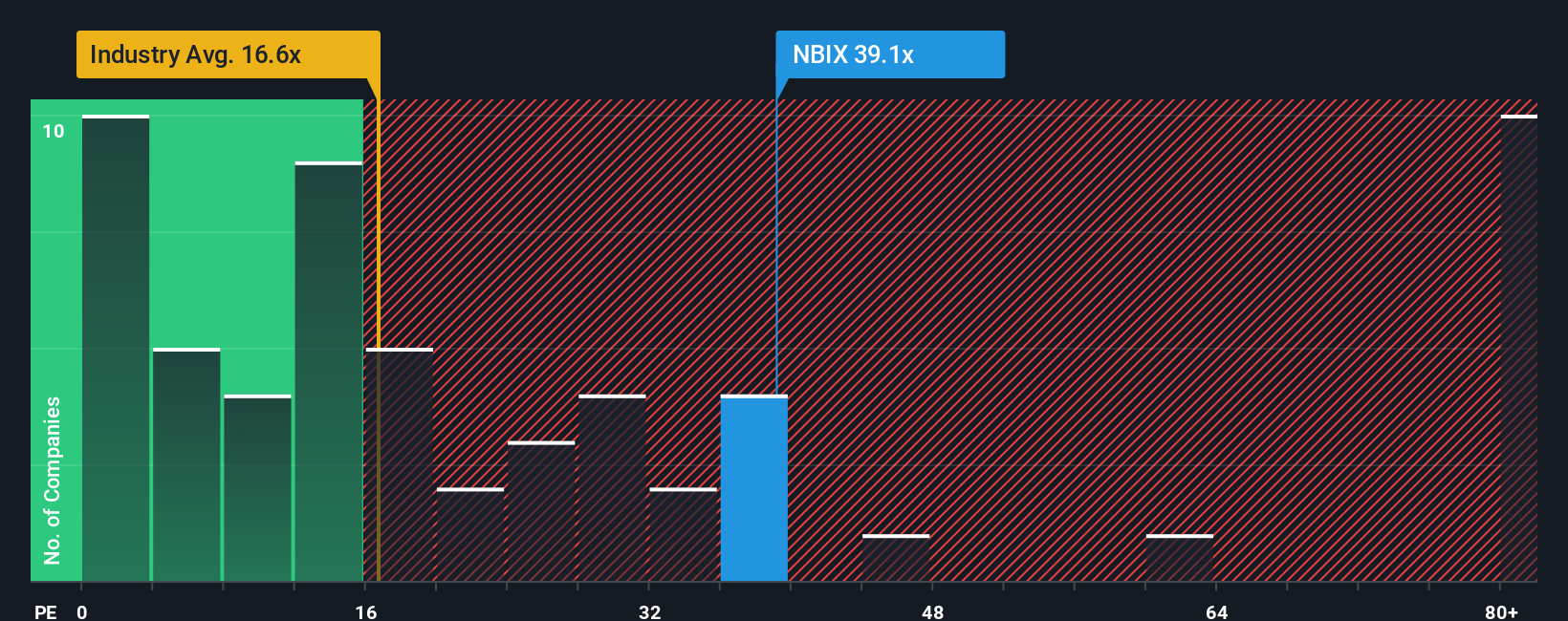

While the narrative and fair value work point to meaningful upside, today’s 33.8 times earnings looks demanding versus the US biotech sector at 20.7 times and peers at 18.7 times, and even above a 25.8 times fair ratio. This raises the risk that expectations outrun execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Neurocrine Biosciences Narrative

If this perspective does not fully align with your own, or you would rather dive into the numbers yourself, you can build a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Looking for more investment ideas?

Ready to sharpen your edge beyond Neurocrine? Use the Simply Wall Street Screener to explore potential opportunities and keep your portfolio working harder.

- Explore resilient cash generators by scanning these 903 undervalued stocks based on cash flows that markets may be overlooking despite strong fundamentals.

- Review innovation at the frontier of medicine with these 29 healthcare AI stocks harnessing algorithms to support diagnostics, drug discovery, and clinical workflows.

- Explore developments in digital finance by reviewing these 79 cryptocurrency and blockchain stocks building businesses around blockchain infrastructure and payment rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報