Mercury Systems (MRCY): Reassessing Valuation After Earnings Beat and Defense Demand Tailwinds

Mercury Systems (MRCY) is back in focus after Aristotle Capital Boston called out the stock as a recent winner in its small cap fund, helped by earnings that topped expectations and strengthening defense demand.

See our latest analysis for Mercury Systems.

At around $69.65, Mercury’s share price has pulled back over the last week but still sits on a hefty year to date share price return. A 1 year total shareholder return above 70 percent signals that optimism around defense demand and its order backlog is still very much in play.

If this kind of defense driven rerating has your attention, it could be a good time to scan other aerospace and security contractors using aerospace and defense stocks for fresh ideas.

Yet with earnings momentum improving and the share price already up sharply, investors now face a key question: is Mercury still trading below its true value, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 19% Undervalued

With Mercury Systems last closing at $69.65 against a narrative fair value of $86, the current setup hinges on how confidently future growth is priced in.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 110.9x on those 2028 earnings, up from -106.7x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

Curious why a defense hardware name is being modeled with a premium growth multiple, sharp margin rebuild, and carefully discounted cash flows? The full narrative unpacks the earnings ramp, revenue trajectory, and profitability shift that have to line up almost perfectly for that valuation to stick.

Result: Fair Value of $86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution missteps on legacy contracts or weaker than expected defense budget growth could quickly undermine today’s upbeat margin and valuation assumptions.

Find out about the key risks to this Mercury Systems narrative.

Another View: Multiples Flash a Caution Signal

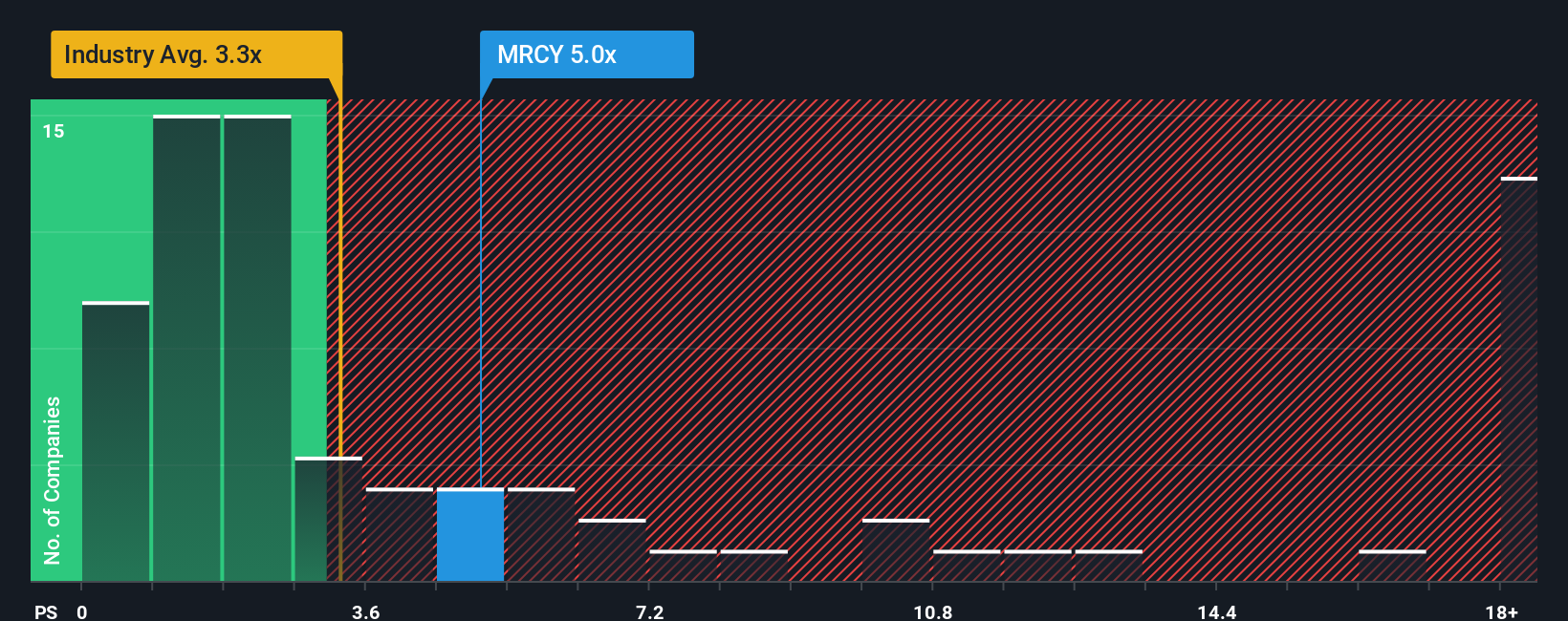

While the narrative fair value suggests upside, Mercury’s current price tells a different story on a sales-based valuation. At 4.5 times sales versus an industry average of 3.2 times and a fair ratio of 1.6 times, the stock screens as expensive and leaves less room for execution slip ups.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mercury Systems Narrative

If you see the story differently or want to stress test the assumptions with your own inputs, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Mercury Systems.

Ready for your next opportunity?

Do not stop at one defense winner. Use the Simply Wall Street Screener now to uncover fresh, data driven ideas before other investors move first.

- Capitalize on market mispricing by targeting these 902 undervalued stocks based on cash flows that align strong fundamentals with attractive entry points.

- Ride powerful technological shifts by focusing on these 24 AI penny stocks positioned at the core of machine learning and automation growth.

- Lock in attractive income potential by scanning these 12 dividend stocks with yields > 3% that combine solid yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報