What Tutor Perini (TPC)'s New US$900 Million Corps Contract Means For Shareholders

- Tutor Perini, through subsidiaries Rudolph and Sletten and Perini Management Services, recently secured multiple large contracts, including a US$900 million U.S. Army Corps of Engineers agreement in Israel, a US$155 million Diego Rivera Performing Arts Center project in San Francisco, and a US$108 million UC Davis Health utility plant expansion.

- These awards meaningfully enlarge Tutor Perini’s backlog and reinforce its access to complex institutional and government work, which can improve revenue visibility and support the existing growth-focused investment narrative.

- We’ll now examine how these fresh contract wins, particularly the US$900 million Corps of Engineers award, shape Tutor Perini’s investment narrative.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Tutor Perini Investment Narrative Recap

To own Tutor Perini, you generally have to believe the company can convert its record backlog into steadier earnings while avoiding a repeat of past cost and litigation problems. The recent US$900 million U.S. Army Corps of Engineers award in Israel boosts backlog and near term revenue visibility, but it also adds another large, complex program where execution missteps could quickly become the main risk to the story.

The U.S. Army Corps of Engineers contract is the clearest swing factor among the recent announcements, because it reinforces Tutor Perini’s positioning in high value government and defense related work that underpins its growth-focused narrative. At the same time, the size and multi year structure of this agreement bring the company’s long standing concerns around mega project execution, fixed price exposure, and potential dispute risk back into sharp focus.

Yet investors also need to weigh how concentrated exposure to a handful of very large public and defense projects might...

Read the full narrative on Tutor Perini (it's free!)

Tutor Perini's narrative projects $7.1 billion revenue and $515.9 million earnings by 2028. This requires 14.2% yearly revenue growth and a $648.2 million earnings increase from -$132.3 million today.

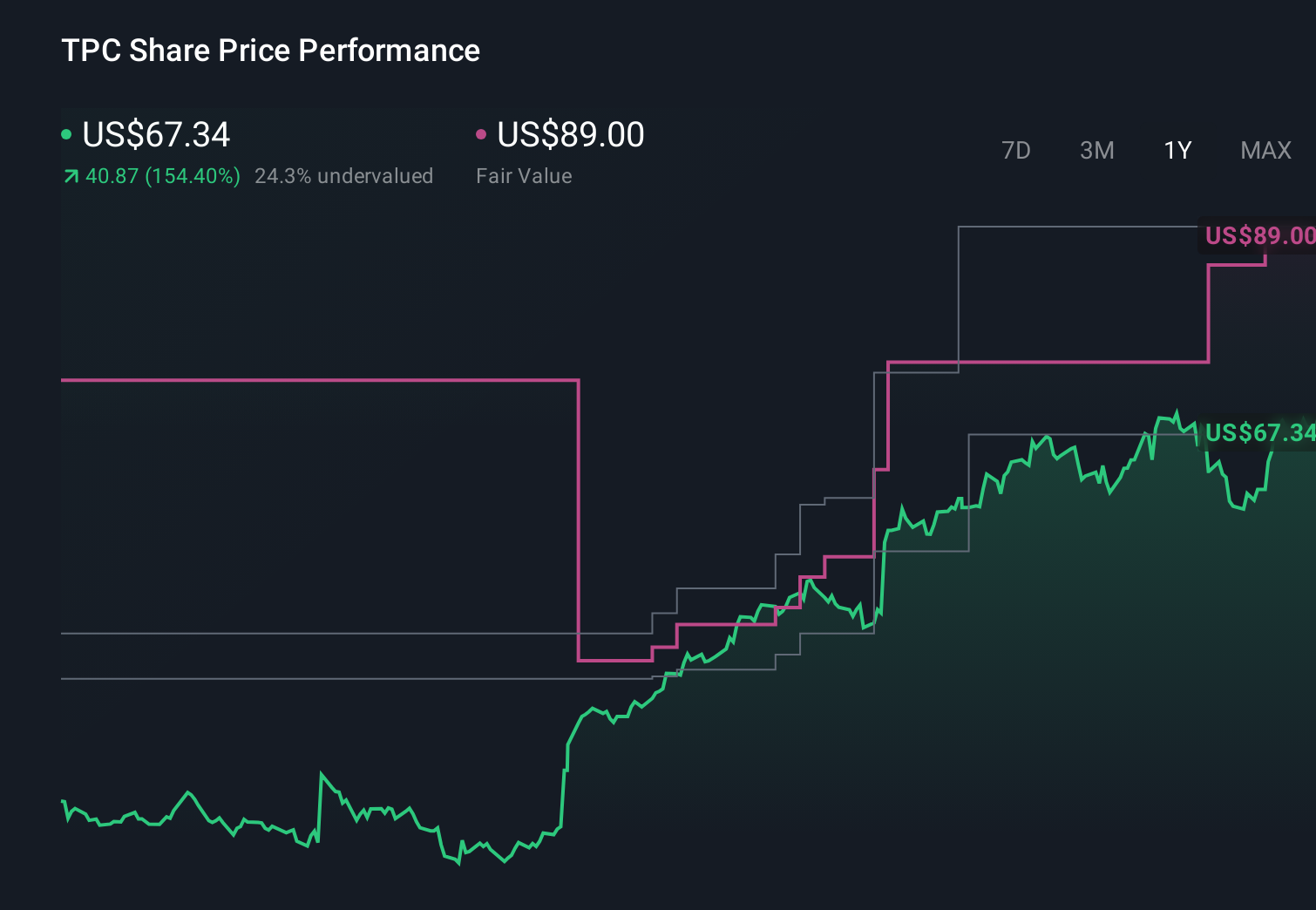

Uncover how Tutor Perini's forecasts yield a $89.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Four fair value estimates from the Simply Wall St Community cluster between US$80.19 and US$89 per share, highlighting how differently individual investors can size up Tutor Perini. You will want to set those views against the company’s growing dependence on a few large, complex public contracts that could materially sway future performance and consider several alternative angles before deciding what it all means for you.

Explore 4 other fair value estimates on Tutor Perini - why the stock might be worth as much as 27% more than the current price!

Build Your Own Tutor Perini Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tutor Perini research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Tutor Perini research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tutor Perini's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報