Does NNN REIT’s New Term Loan and Hedging Shift the Risk-Reward Profile for NNN?

- NNN REIT, Inc. recently entered into a US$300,000,000 senior unsecured term loan agreement with Wells Fargo as administrative agent, featuring a six-month delayed draw period, an accordion option up to US$500,000,000, and a maturity in 2029 with two potential one-year extensions.

- By layering in forward-starting swaps that fix SOFR on US$200,000,000 of this capacity and removing the SOFR credit spread adjustment on its revolver, NNN REIT has increased its financial flexibility while tightening its handle on future interest costs.

- Next, we’ll examine how this expanded unsecured borrowing capacity and interest-rate hedging affect NNN REIT’s investment narrative and risk profile.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

NNN REIT Investment Narrative Recap

NNN REIT’s appeal rests on its ability to collect durable rent from necessity-driven, net-leased retail while steadily recycling capital into new deals. The new US$300,000,000 unsecured term loan, largely hedged with forward swaps, modestly reduces near term interest rate uncertainty but does not fundamentally change the key catalyst of continued accretive acquisitions or the central risk of tenant and credit stress in a still-competitive acquisition market.

Among recent announcements, the slight reduction in 2025 earnings guidance stands out alongside this new borrowing capacity. Together, they frame a picture of a REIT balancing slower near term earnings momentum with the option to fund future investments, which could matter for how investors think about using that incremental liquidity if acquisition competition and pricing remain intense.

Yet while the new facility improves flexibility, investors should still watch how higher financing costs and tighter covenants could interact with...

Read the full narrative on NNN REIT (it's free!)

NNN REIT's narrative projects $1.0 billion revenue and $425.2 million earnings by 2028.

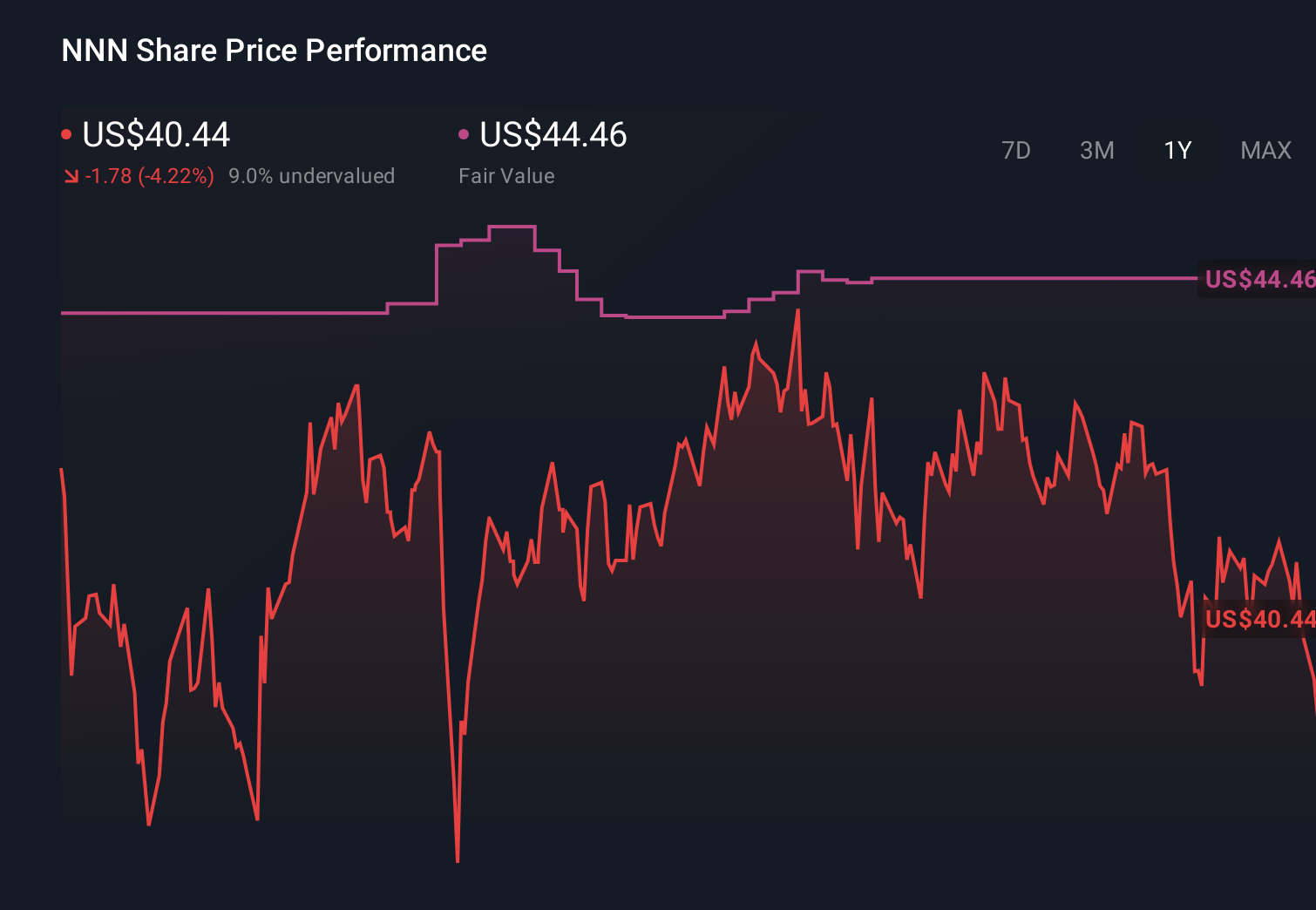

Uncover how NNN REIT's forecasts yield a $44.54 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community see NNN REIT’s fair value between US$41 and about US$76.54, reflecting very different expectations. When you compare that spread with the importance of funding costs and interest rate risk to this new term loan, it is clear that investors are weighing several distinct scenarios for future returns and may want to review more than one viewpoint before deciding what matters most.

Explore 4 other fair value estimates on NNN REIT - why the stock might be worth as much as 93% more than the current price!

Build Your Own NNN REIT Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NNN REIT research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free NNN REIT research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NNN REIT's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報