Is SharpLink Gaming Attractively Priced After 21.4% Year To Date Rebound?

- Wondering if SharpLink Gaming at around $9.81 is a hidden value opportunity or a value trap? You are not alone; this stock has started to pop up on more radars lately.

- Over the last week the share price is up 3.2%, roughly matching its 3.0% gain over the past month, but the real eye catcher is the 21.4% return year to date after a tough 3 year slide of 74.1%.

- Recent headlines have focused on SharpLink Gaming's strategic push deeper into sports betting technology and partnerships with media and gaming operators, framing it as a potential picks and shovels play in the sector. These developments help explain why sentiment has improved, even as investors still remember the stock's long multiyear drawdown.

- Right now SharpLink Gaming scores a 4/6 valuation check rating, suggesting the market might be underestimating it on several fronts. Next we will break down those valuation methods, then finish with an even more practical way to think about what this price really implies.

Approach 1: SharpLink Gaming Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow model estimates what SharpLink Gaming is worth by projecting its future cash flows and discounting them back to today, to reflect risk and the time value of money.

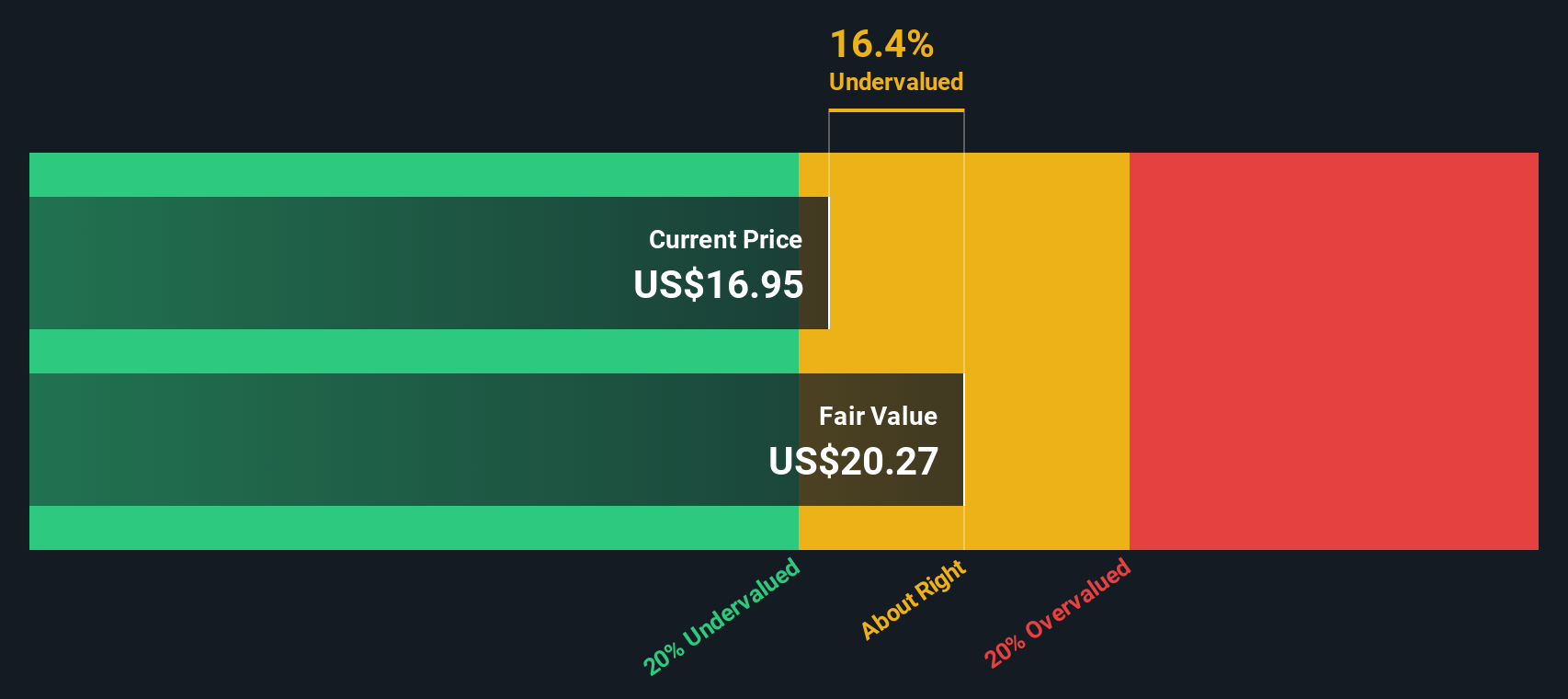

Right now the company is burning cash, with last twelve month Free Cash Flow around $9.7 million in the red. Analysts and internal estimates, however, expect a sharp turnaround, with Free Cash Flow projected to reach about $213.7 million by 2035, based on a 2 Stage Free Cash Flow to Equity model that ramps growth quickly before moderating in later years. These forecasts, expressed in $, blend one explicit analyst estimate for 2026 with further extrapolations from Simply Wall St for the following decade.

When all those future cash flows are discounted back, the model arrives at an intrinsic value of roughly $13.60 per share, versus a current market price around $9.81, implying the stock is about 27.8% undervalued on this basis.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SharpLink Gaming is undervalued by 27.8%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

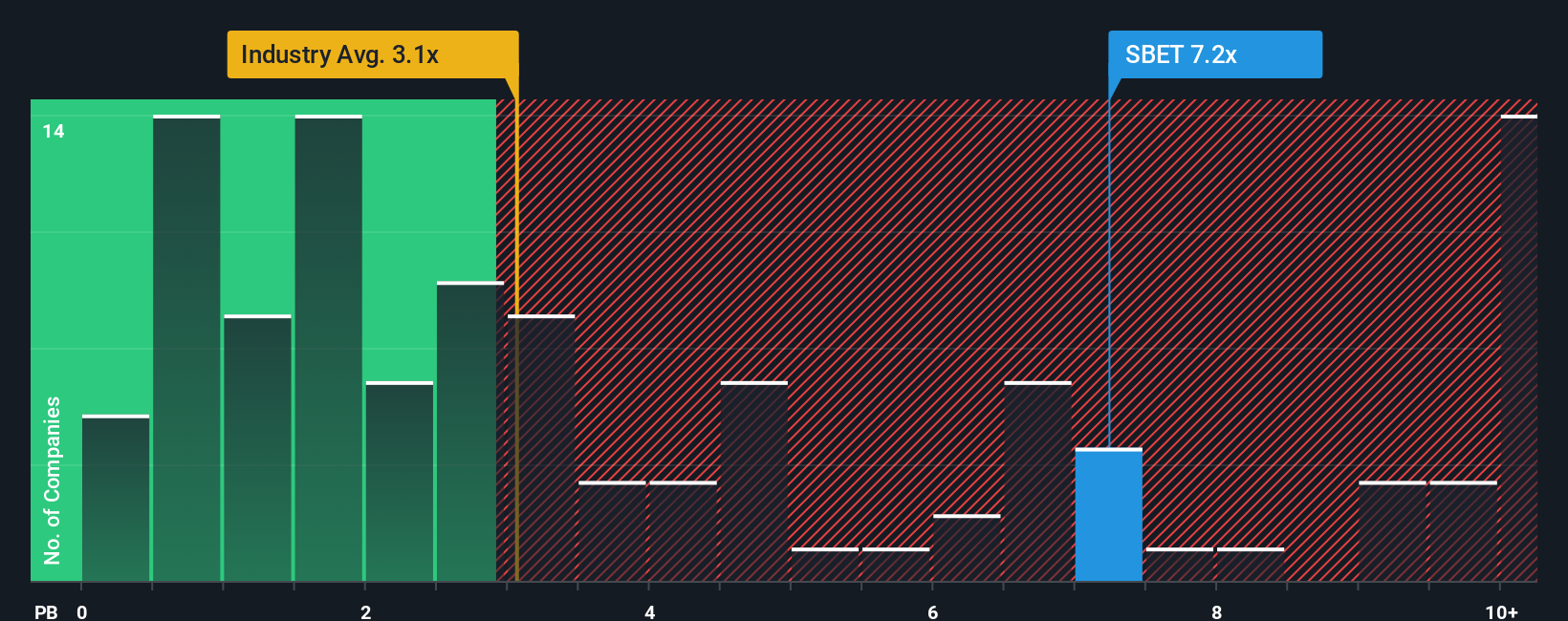

Approach 2: SharpLink Gaming Price vs Book

For asset intensive or still emerging businesses where earnings are volatile, the price to book ratio is often a better yardstick than earnings based metrics, because it anchors valuation to the company’s net assets rather than short term profitability swings.

In general, faster growth and lower risk justify a higher price to book multiple, while slower growth, weaker balance sheets, or higher uncertainty tend to pull a fair multiple closer to, or even below, the sector norm. Investors pay up when they believe each dollar of equity will compound strongly over time.

SharpLink Gaming currently trades on a price to book ratio of about 0.63x, which sits well below the Hospitality industry average of roughly 2.68x and also below the peer group average of around 5.54x. Simply Wall St adds another layer with its Fair Ratio, a proprietary estimate of what a normal price to book should be once you factor in the company’s growth outlook, risks, profit margins, industry positioning, and market cap. Because this Fair Ratio is tailored to SharpLink’s specific profile, it can be more informative than broad peer or industry comparisons when deciding whether today’s discount looks justified or excessive.

Result: UNDERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SharpLink Gaming Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework that lets you attach a clear story, your view of SharpLink Gaming’s future revenue, earnings and margins, to the numbers behind a fair value estimate.

A Narrative connects three pieces in a straight line: what you believe about the business, how that belief translates into a financial forecast, and the fair value that results from those assumptions.

On Simply Wall St’s Community page, used by millions of investors, Narratives are an easy and accessible tool that can help you think about whether to buy or sell by constantly comparing your Fair Value to the current market price.

Because Narratives update dynamically as new information such as earnings reports, guidance or major news is released, your view of SharpLink Gaming can evolve in real time without you needing to rebuild a full model from scratch.

For example, one SharpLink Gaming Narrative might assume rapid adoption of its betting technology and assign a much higher fair value, while another more cautious Narrative could expect slower customer wins and set a far lower fair value, illustrating how different perspectives can coexist around the same stock.

Do you think there's more to the story for SharpLink Gaming? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報