December 2025 European Stocks With Estimated Value Opportunities

As European markets experience a positive turn, with the STOXX Europe 600 Index climbing 1.60% amid signs of steady economic growth and supportive monetary policies, investors are increasingly keen on identifying undervalued stocks that may offer potential value opportunities. In this environment, a good stock is often characterized by strong fundamentals and resilience to market fluctuations, making it an attractive option for those seeking long-term value in the face of evolving economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK18.58 | SEK36.47 | 49.1% |

| Sanoma Oyj (HLSE:SANOMA) | €9.21 | €18.33 | 49.7% |

| Redelfi (BIT:RDF) | €11.82 | €23.33 | 49.3% |

| PVA TePla (XTRA:TPE) | €21.88 | €43.62 | 49.8% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.266 | €8.51 | 49.8% |

| Jæren Sparebank (OB:JAREN) | NOK380.00 | NOK752.16 | 49.5% |

| Inission (OM:INISS B) | SEK48.80 | SEK96.05 | 49.2% |

| Dynavox Group (OM:DYVOX) | SEK101.80 | SEK202.79 | 49.8% |

| AutoStore Holdings (OB:AUTO) | NOK10.41 | NOK20.69 | 49.7% |

| Aker BioMarine (OB:AKBM) | NOK90.20 | NOK177.20 | 49.1% |

Underneath we present a selection of stocks filtered out by our screen.

Amper (BME:AMP)

Overview: Amper, S.A. offers technological, industrial, and engineering solutions across defense, security, energy, sustainability, and telecommunications sectors in Spain and internationally with a market cap of €335.05 million.

Operations: The company's revenue segments include €300.94 million from Energy and Sustainability and €87.66 million from Defense, Security, and Telecommunications.

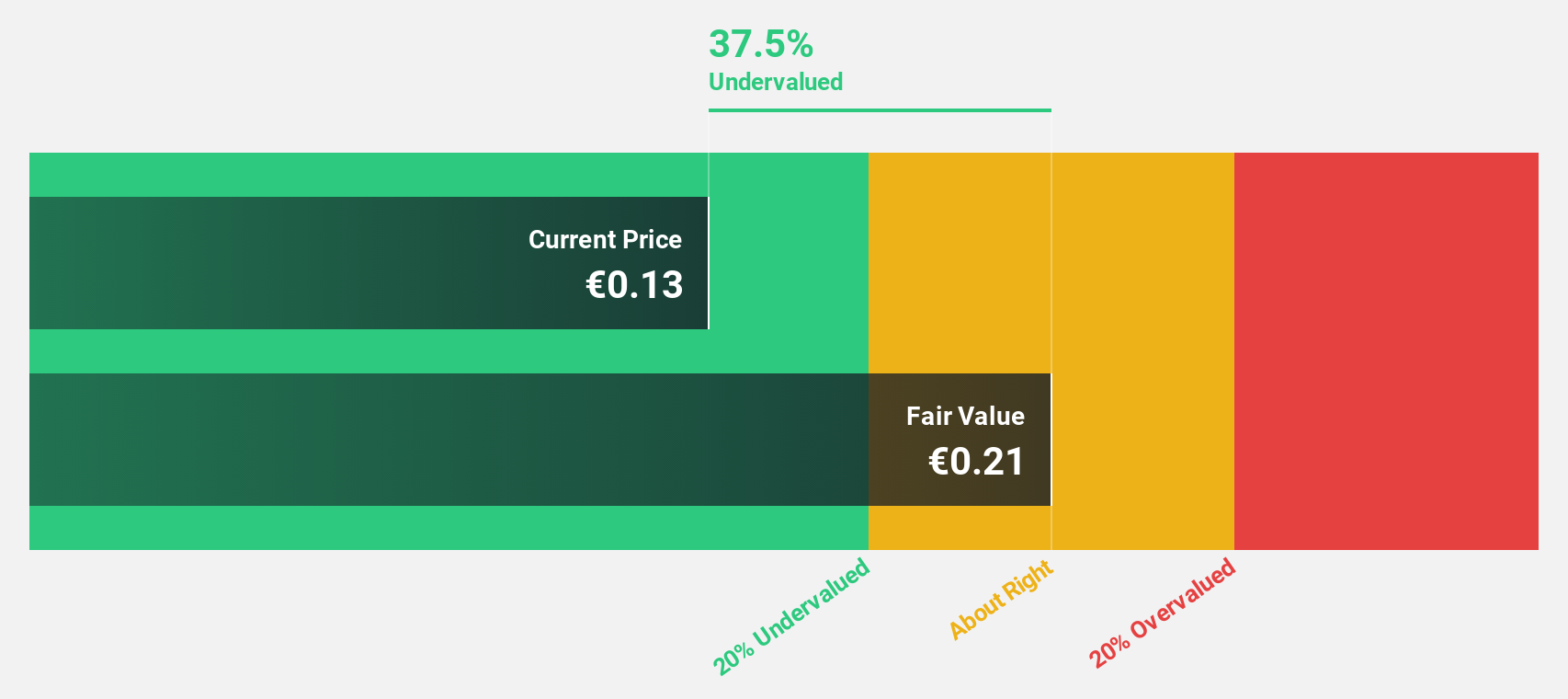

Estimated Discount To Fair Value: 32.5%

Amper is trading at €0.15, significantly below its estimated fair value of €0.22, suggesting it may be undervalued based on cash flows. Despite substantial shareholder dilution in the past year and low forecasted return on equity (16.5%), Amper's earnings are expected to grow significantly at 34.5% annually, outpacing the Spanish market's 6.9%. However, interest payments are not well covered by earnings, indicating potential financial strain despite becoming profitable this year.

- Our expertly prepared growth report on Amper implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Amper.

Fagerhult Group (OM:FAG)

Overview: Fagerhult Group AB, along with its subsidiaries, designs, manufactures, and markets professional lighting solutions globally and has a market cap of SEK7.05 billion.

Operations: The company's revenue is derived from several segments, including Premium (SEK2.62 billion), Collection (SEK3.63 billion), Professional (SEK1.08 billion), Infrastructure (SEK753.10 million), and Smart Solutions (SEK19.30 million).

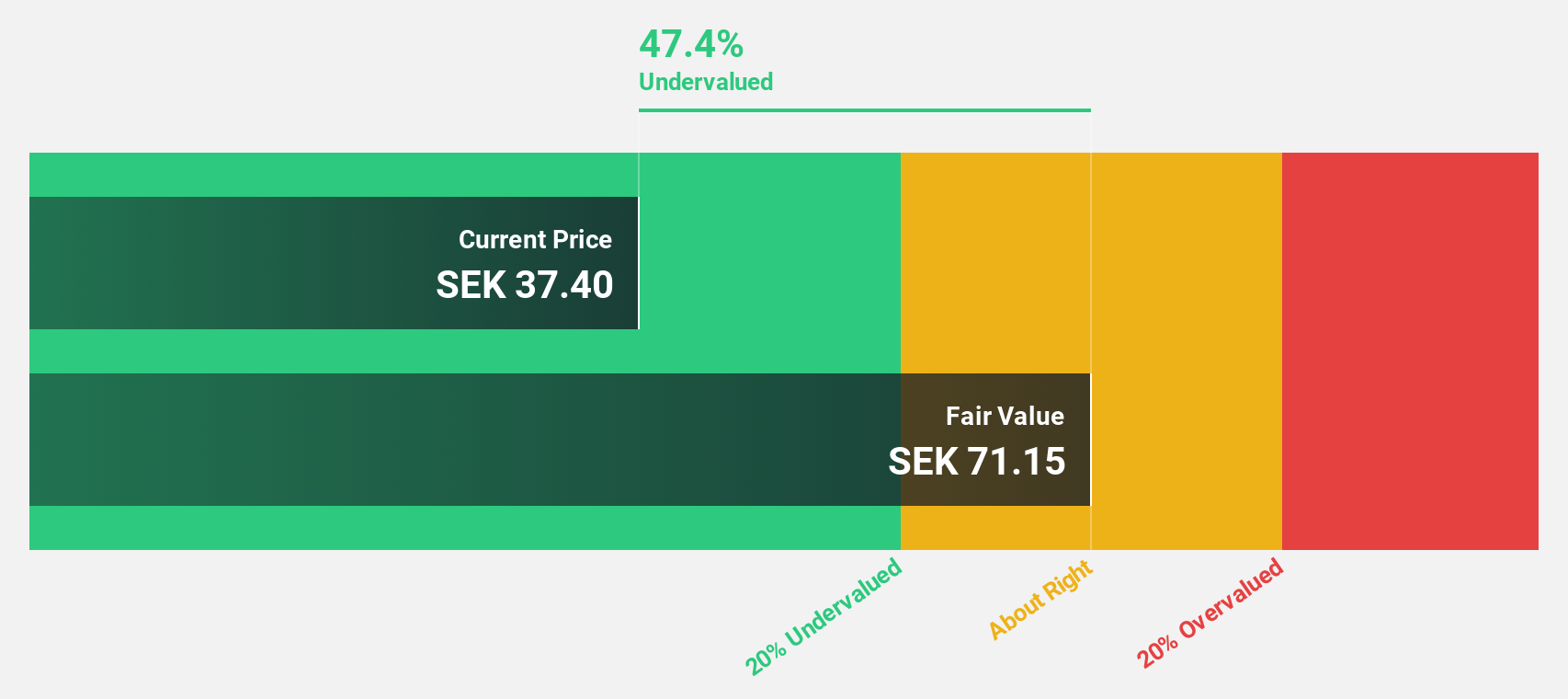

Estimated Discount To Fair Value: 38.2%

Fagerhult Group is trading at SEK 40, well below its estimated fair value of SEK 64.76, highlighting potential undervaluation based on cash flows. Recent earnings showed increased quarterly sales and net income, yet profit margins have declined from last year. While revenue growth forecasts exceed the Swedish market's rate, debt coverage by operating cash flow remains inadequate. Despite a low future return on equity forecast and unsustainable dividend coverage by earnings, significant annual profit growth of 33.7% is anticipated.

- Our growth report here indicates Fagerhult Group may be poised for an improving outlook.

- Take a closer look at Fagerhult Group's balance sheet health here in our report.

Truecaller (OM:TRUE B)

Overview: Truecaller AB (publ) develops and publishes mobile caller ID applications for individuals and businesses across India, the Middle East, Africa, and internationally, with a market cap of approximately SEK6.34 billion.

Operations: The company generates revenue primarily from its communications software segment, amounting to SEK2.02 billion.

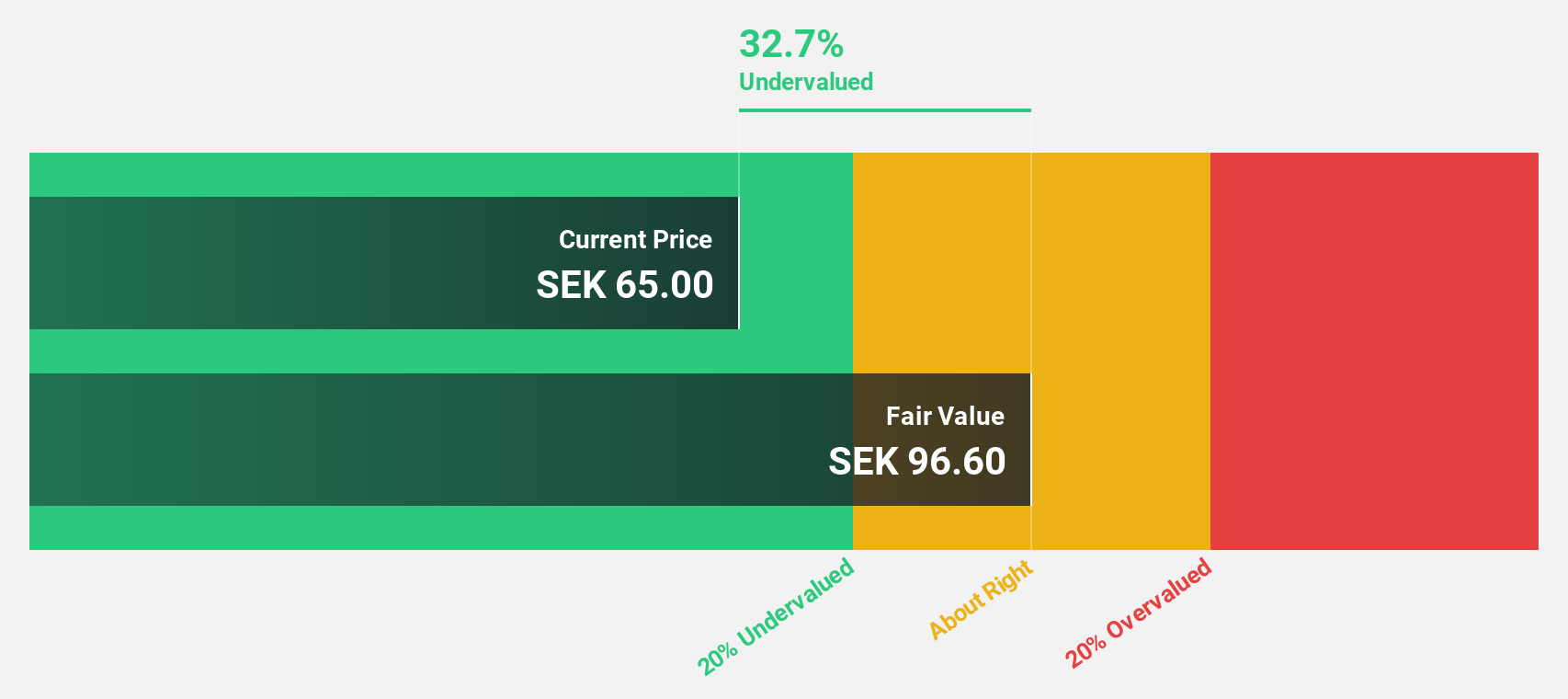

Estimated Discount To Fair Value: 49.1%

Truecaller trades at SEK 18.58, significantly below its estimated fair value of SEK 36.47, suggesting undervaluation based on cash flows. Despite volatile share prices, the company's revenue is expected to grow faster than the Swedish market at 11.3% annually, with earnings growth projected at 15.5% per year. Recent product launches like Family Protection and strategic partnerships enhance engagement and premium conversion potential, aligning with Truecaller's strategy to boost recurring subscription revenues and user retention through high-value features.

- Insights from our recent growth report point to a promising forecast for Truecaller's business outlook.

- Unlock comprehensive insights into our analysis of Truecaller stock in this financial health report.

Key Takeaways

- Click this link to deep-dive into the 194 companies within our Undervalued European Stocks Based On Cash Flows screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報