Texas Roadhouse (TXRH) Valuation Check After Major Upgrade and Easing Cost Outlook

Texas Roadhouse (TXRH) is back on investors radar after a major brokerage upgrade, with the stock climbing as the firm pointed to easing beef costs ahead and a more appealing post pullback valuation.

See our latest analysis for Texas Roadhouse.

The upgrade lands after a choppy year for Texas Roadhouse, where a recent pullback set up room for today’s bounce, even as the 90 day share price return of 10.10 percent contrasts with a more muted 1 year total shareholder return of negative 1.07 percent. This suggests near term momentum is rebuilding on a still reasonable long term backdrop.

If this shift in sentiment has you reassessing your watchlist, it could be a good moment to explore restaurant like opportunities and discover fast growing stocks with high insider ownership.

With earnings momentum solid but insider selling elevated and shares now sitting only modestly below Wall Street targets, the key question is whether Texas Roadhouse remains undervalued or if the market is already baking in its next leg of growth.

Most Popular Narrative Narrative: 7.1% Undervalued

With Texas Roadhouse last closing at $175.77 against a narrative fair value near $189, the valuation case leans positive and hinges on several growth levers.

Successful digital integration enhancements to the mobile app, improved waitlist to go experience, and broad rollout of digital kitchen technology are boosting operational efficiency and guest convenience, which is likely to drive both sales growth and margin improvement.

Curious how steady traffic, rising margins and a richer earnings base all combine to support that higher value? The narrative leans on bold long term assumptions. Want to see exactly which growth rates and profit levels have to materialize for this story to hold up? Dive in and test whether those expectations match your own view.

Result: Fair Value of $189.16 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent beef and wage inflation, or slower digital adoption, could erode margins and traffic, challenging the upbeat growth and valuation assumptions.

Find out about the key risks to this Texas Roadhouse narrative.

Another Angle on Valuation

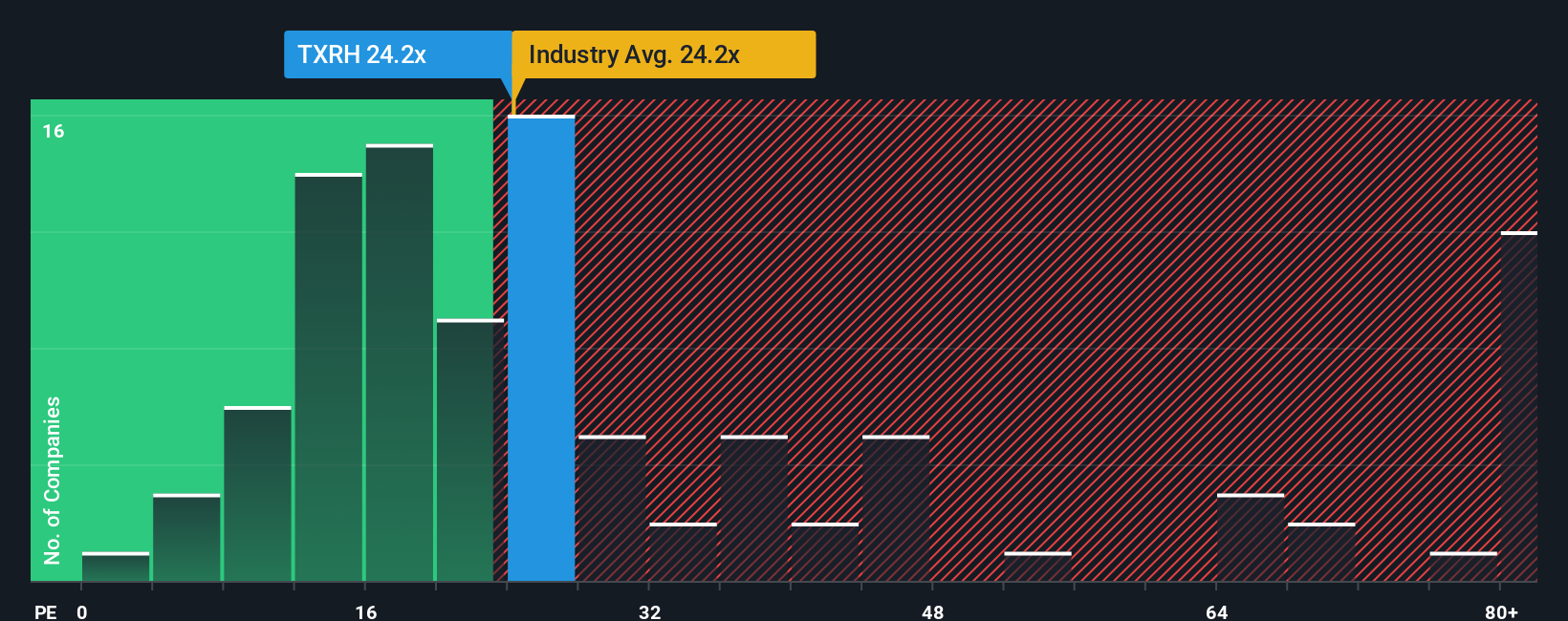

On an earnings-based valuation, Texas Roadhouse appears less favorably priced. The current P/E of 26.6 times is above both the US hospitality average of 22 times and the fair ratio of 21.3 times, which suggests there could be meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Texas Roadhouse Narrative

If you see the story differently or want to dig into the numbers yourself, you can quickly build a custom narrative in just minutes: Do it your way.

A great starting point for your Texas Roadhouse research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider scanning a few high conviction stock ideas tailored to different strategies and market themes.

- Capture potential upside in overlooked names by targeting these 910 undervalued stocks based on cash flows that trade at meaningful discounts to their cash flow prospects.

- Focus on these 24 AI penny stocks that may benefit from accelerating demand for intelligent automation.

- Strengthen your income strategy by reviewing these 12 dividend stocks with yields > 3% that combine attractive yields with the potential for long term capital gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報