IPO News | Ruipai Pet Hospital submits Hong Kong Stock Exchange as the second-largest pet medical service provider in China

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 22, Ruipai Pet Hospital Management Co., Ltd. (abbreviation: Ruipai Pet Hospital) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CICC is the sole sponsor.

Company profile

According to the prospectus, the company is a national chain of pet medical institutions dedicated to providing high standards of diagnosis and treatment and health management services throughout the life cycle for pet owners with the aim of being professional, dedicated and expert.

Ruipai's founding philosophy stemmed from a forward-looking insight into the long-term development of China's pet care industry, particularly from the company's founder Dr. Li's keen understanding of the gap in pet care standards between China and the US 15 years ago, and the original intention of conveying value propositions to China's veterinary mission. After systematically examining the development history, success logic and operating paradigm of the European and American pet medical industry, the company was established in 2012. Based on insight consulting, it was the first pet medical service provider in China to achieve a nationwide chain operation, and established the goal of building a pet health management service system covering the whole country, standardized chains, and replicable. At that time, the pet medical industry in the United States had already achieved a high degree of specialization, standardization, and chain integration, while China's pet medical industry was still in its infancy, but it had huge potential for development. The company aims to establish professional capabilities through a chain model, implement a standardized system, improve service efficiency, and at the same time establish a management system for the systematic training and rapid growth of pet physicians, leading the Chinese pet medical industry towards specialization, standardization and large-scale development.

As a pioneer and leader of a nationwide chain of pet medical institutions, the company pioneered the establishment of a nationwide pet medical chain network in China, and pioneered the VeterinaryDevelopmentPartners (VDP) model, which became the soul of Ruipai's co-creation sharing mechanism, aiming to unite, motivate, and achieve a large team of high-level pet physicians in China. According to the Insight Consulting Report, as of June 30, 2025, with 548 operating pet hospitals, the company became the second-largest pet medical service provider in China. These hospitals include 120 self-built hospitals and 428 acquired hospitals, spread across mainland China and Hong Kong, including about 70 cities in 28 provinces.

According to the Insight Consulting Report, as of June 30, 2025, the company was the only company that achieved net profit among the service providers of large national pet hospital chains. After 14 years of development and continuous optimization, the company has formed a mature pet hospital management system and profit model, demonstrating the ability to maintain excellent operating efficiency during scale expansion.

Financial data

revenue

In 2022, 2023, 2024 and 2025 for the six months ended June 30, the company's revenue was approximately RMB 1,455 billion, RMB 1,585 million, RMB 1,758 million and RMB 943 million, respectively.

Earnings

In 2022, 2023, 2024 and 2025 for the six months ended June 30, the company's total overall revenue for the year/period was approximately RMB -61.863 million, -250 million yuan, -7126 million yuan, and RMB 15.277 million, respectively.

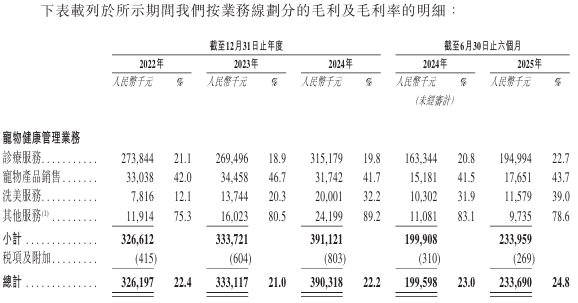

gross profit margin

For 2022, 2023, 2024 and 2025 for the six months ended June 30, the company's gross margins were 22.4%, 21.0%, 22.2% and 24.8%, respectively.

Industry Overview

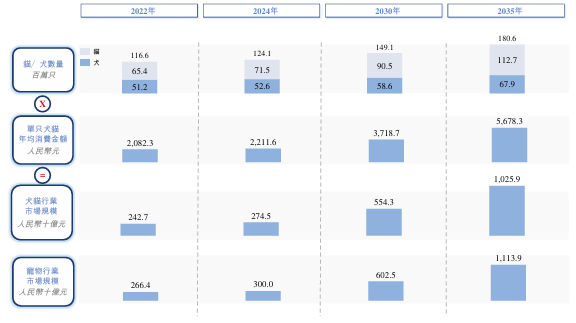

The Chinese pet market has entered a stage of rapid growth. The market size reached RMB 300 billion in 2024. China's pet market is expected to reach RMB 602.5 billion in 2030 and increase to RMB 1,113.9 billion in 2035, with compound annual growth rates of 12.3% and 13.1%, respectively.

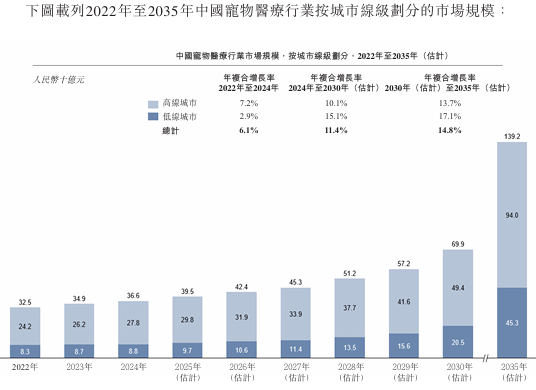

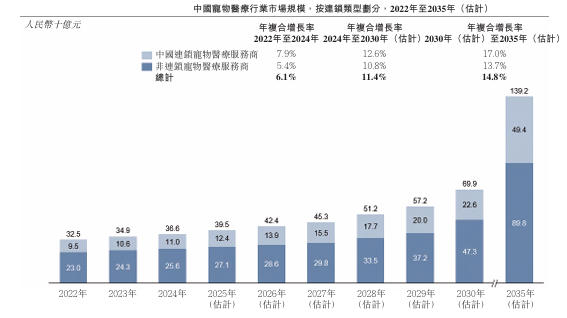

The pet medical circuit, which uses pet hospitals and clinics as service locations, is becoming the most valuable and definitive core field in the entire pet industry due to its rigid demand, broad market, and deep moat. The scale of the pet medicine industry reached RMB 36.6 billion in 2024, and is expected to grow to RMB 69.9 billion and RMB 139.2 billion by 2030 and 2035, with compound annual growth rates of 11.4% and 14.8%.

In China, high-tier cities are leading in the country in terms of household pet ownership rates and pet owners' spending on pet health services. Residents in these areas have high income levels and a strong sense of pet health management. As of December 31, 2024, 66.7% of China's pet hospitals were located in these cities, while 75.8% of the total revenue of the pet medical industry came from institutions in first-tier and second-tier cities. In 2024, total pet health revenue in high-tier cities has reached RMB 27.8 billion. It is expected to reach RMB 49.4 billion in 2030, and further jump to RMB 94 billion in 2035.

The chain pet medical service market has reached RMB 11 billion in 2024, and is expected to grow to RMB 22.6 billion by 2030, with a compound annual growth rate of 12.6% between 2024 and 2030; it is expected to further increase to RMB 49.4 billion in 2035, with a compound annual growth rate of 17.0% between 2030 and 2035.

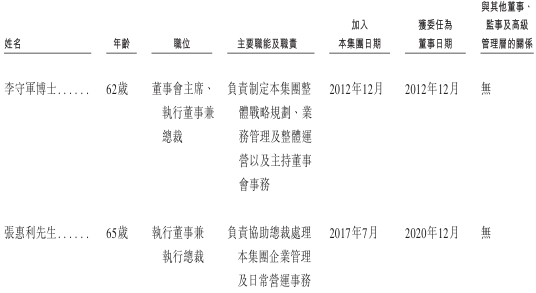

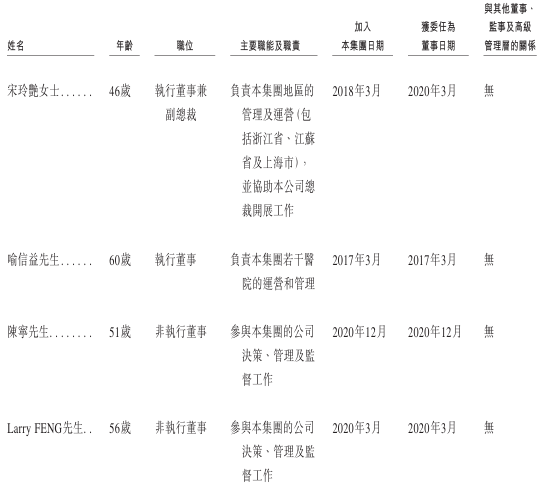

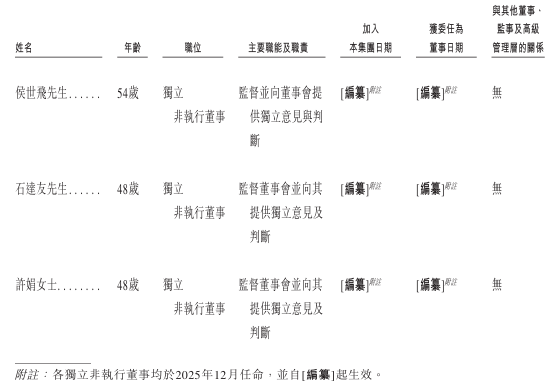

Board Information

The Board consists of nine directors, including four executive directors, two non-executive directors and three independent non-executive directors. All directors are elected by the shareholders' meeting for a term of three years and can be re-elected. The board of directors is responsible for the management and operation of the company, and has general powers of management and operation.

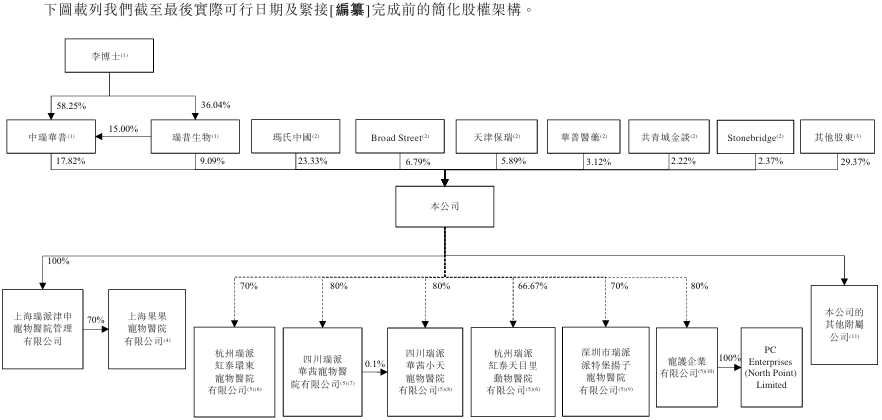

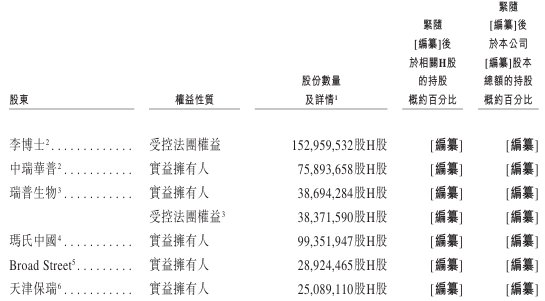

Shareholding structure

Dr. Lee is the company's single largest shareholder. As of the last practical date (December 15, 2025), Dr. Li has issued about 26.91% of the total share capital of Ruipu Biotech Control Company through Zhongruihua, while Dr. Li owns 58.25% and Ruipu Biotech owns 15.00%. Ruipu Biotech is a company listed on the GEM of the Shenzhen Stock Exchange (300119.SZ), and Dr. Li owns 36.04%.

Intermediary team

Sole sponsor: China International Finance Hong Kong Securities Limited;

Sole sponsor and legal counsel: Kaiyi International Law Firm, Fangda Law Firm;

Independent auditors and reporting accountants: KPMG;

Industry Advisor: Insight Industry Consulting Co., Ltd.

Nasdaq

Nasdaq 華爾街日報

華爾街日報