Global Growth Companies With High Insider Ownership December 2025

As global markets navigate a complex landscape marked by mixed economic signals and shifting monetary policies, investors are keenly observing sectors with potential for growth amid these fluctuations. In this environment, companies with high insider ownership can be particularly appealing, as they often demonstrate strong alignment between management and shareholder interests, which may be advantageous in times of economic uncertainty.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Rasan Information Technology (SASE:8313) | 31.1% | 21% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

Let's explore several standout options from the results in the screener.

Electric Connector Technology (SZSE:300679)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Electric Connector Technology Co., Ltd. specializes in the research, design, development, manufacture, and sale of micro electronic connectors and interconnection systems globally, with a market cap of CN¥20.74 billion.

Operations: Electric Connector Technology Co., Ltd. generates its revenue from the research, design, development, manufacture, and sale of micro electronic connectors and interconnection system related products across various international markets including China, North America, Europe, Japan, and the Asia Pacific.

Insider Ownership: 38.9%

Earnings Growth Forecast: 30.9% p.a.

Electric Connector Technology is trading at a significant discount to its estimated fair value, with strong revenue growth forecasted at 22.1% annually, outpacing the Chinese market. Earnings are projected to grow significantly at 30.89% per year, surpassing market expectations. Despite these positives, recent earnings showed a decline in net income and EPS compared to last year. Insider ownership remains stable with no substantial buying or selling reported recently.

- Get an in-depth perspective on Electric Connector Technology's performance by reading our analyst estimates report here.

- The valuation report we've compiled suggests that Electric Connector Technology's current price could be quite moderate.

Micronics Japan (TSE:6871)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Micronics Japan Co., Ltd. specializes in the development, manufacturing, and sale of body measuring equipment as well as semiconductor and liquid crystal display inspection equipment globally, with a market cap of ¥247.32 billion.

Operations: Micronics Japan generates revenue from its TE Business, which accounts for ¥1.82 billion, and its Probe Card Business, contributing ¥65.25 billion.

Insider Ownership: 15.3%

Earnings Growth Forecast: 23.1% p.a.

Micronics Japan's earnings are projected to grow significantly at 23.08% annually, outpacing the Japanese market. Revenue growth is expected at 12.2% per year, faster than the market average but below high-growth thresholds. The company's Return on Equity is forecasted to reach a robust 25.9%. Despite volatility in share price and no recent insider trading activity, the company maintains substantial insider ownership, aligning management interests with shareholders'. Recent guidance confirms strong financial performance expectations for 2025.

- Delve into the full analysis future growth report here for a deeper understanding of Micronics Japan.

- Upon reviewing our latest valuation report, Micronics Japan's share price might be too optimistic.

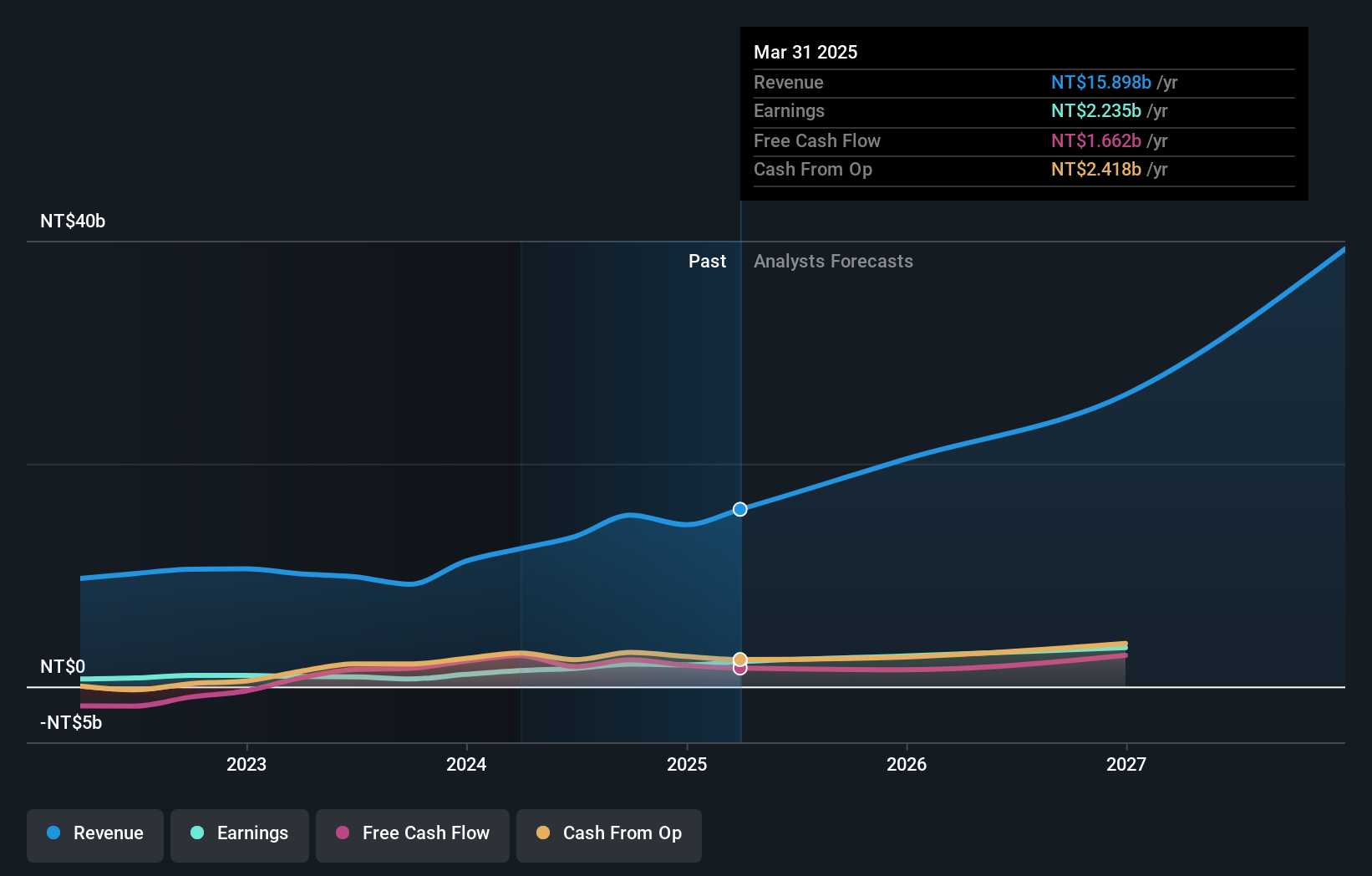

Chenbro Micom (TWSE:8210)

Simply Wall St Growth Rating: ★★★★★★

Overview: Chenbro Micom Co., Ltd. focuses on the research, development, design, manufacture, processing, and trading of computer peripherals and systems globally, with a market cap of NT$114.65 billion.

Operations: The company's revenue from computer peripherals amounts to NT$19.13 billion.

Insider Ownership: 24.6%

Earnings Growth Forecast: 32.2% p.a.

Chenbro Micom's earnings are forecast to grow significantly at 32.2% annually, surpassing Taiwan's market growth rate. Revenue is projected to increase by 30.7% per year, indicating robust expansion potential despite recent share price volatility and no significant insider trading activity in the past three months. The company's Return on Equity is expected to reach a very high level of 41.7%. Recent earnings reports show strong financial performance with substantial increases in sales and net income over the previous year.

- Click here to discover the nuances of Chenbro Micom with our detailed analytical future growth report.

- The analysis detailed in our Chenbro Micom valuation report hints at an inflated share price compared to its estimated value.

Key Takeaways

- Click through to start exploring the rest of the 859 Fast Growing Global Companies With High Insider Ownership now.

- Curious About Other Options? We've found 12 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報