The horror of tariffs, AI fanaticism, and “drastic roller coaster fluctuations”! Six pictures review the “wild 2025” of US stocks

2025 is a year of extreme pricing for the US stock market and the global stock market. The benchmark stock index for US stocks, the S&P 500 index, once plummeted to the edge of a bear market triggered by Trump's tariff policy. After that, the global stock market, including US stocks, quickly rebounded after Trump's aggressive tariff policy made obvious concessions, and after late June, the “Everything Is AI” stock began, driven by AI fervent investment sentiment from Nvidia, Broadcom, TSMC, and Micron. As of now, the S&P 500 Index and the Nasdaq 100 Index have repeatedly reached record highs. The trend has not stopped.

Previously, the US tariff policy storm led by the Trump administration caused huge waves; later, as the wave of AI data center construction led by tech giants such as Google, Microsoft, and Meta is in full swing, spawning an unprecedented AI computing power infrastructure investment frenzy. Coupled with multiple variables such as the market's ongoing game over the Federal Reserve's monetary policy and the escalation of geopolitical risks, and in addition, recently, the increasingly exaggerated “AI circular investment” led by OpenAI and giants such as Oracle jeopardized financial fundamentals by unprecedented large-scale borrowing to drive AI data center construction, causing the market to worry more and more about the “bursting of the AI bubble”. This year, the US stock market had an “investment feast” and a “frightening horror” moment.

From US President Trump's waving the tariff stick, which triggered a rare sharp decline in the US and the Nasdaq index once fell into a technical bear market area, to the AI investment heatwave surrounding AI computing power infrastructure combined with the Federal Reserve's interest rate cuts driving the total US stock market value to $70 trillion; from Nvidia's market capitalization historically reaching the 5 trillion US dollar super mark, to Oracle's trillion-dollar market capitalization dream; and from “big bears” calling for the risk of an AI bubble in 2025, to Wall Street financial giants repeatedly adjusting index points in 2025 and the “AI bubble theory”” At a time when the market is sweeping the market, they are collectively singing the 2026 S&P 500 Index. For stock market investors, 2025 will definitely be a “super year” of extreme volatility.

This dizzying fluctuation can also be clearly seen in the Cboe Volatility Index (Cboe Volatility Index, also known as the VIX Panic Index), which measures the market's expectations for sharp stock price fluctuations. On April 8, when the Trump administration's comprehensive tariff plan caused extreme market panic, the VIX Index soared above 50 points. This was the first time since the COVID-19 pandemic and the second time since the financial crisis. Subsequently, when Trump delayed the imposition of tariffs for three months, VIX quickly fell back. By the time Trump began cutting aggressive tariffs to the world in May, it had already fallen below 20, and is currently close to this level.

“It's like Trump 1.0 version with 'steroids' added.” Keith Lerner (Keith Lerner), chief investment officer and chief market strategist from Truist Advisory Services Inc., said. He added that he no longer can remember when the last time US policy-level decisions caused such a degree of fluctuation in the stock market.

Ultimately, Trump's tariff stance became rational, and strong corporate profit prospects (partly due to huge expenses related to AI infrastructure) and expectations of the Federal Reserve's interest rate cuts saved investors. According to statistics from the Zhitong Finance App, the S&P 500 index has risen 16% since this year, but in April it once fell by about 15%, and is on its way to achieving strong double-digit gains for three consecutive years.

The following six charts can be described as showing the sharp fluctuations and challenges faced by US stocks during this wild year in 2025.

Outflow of funds

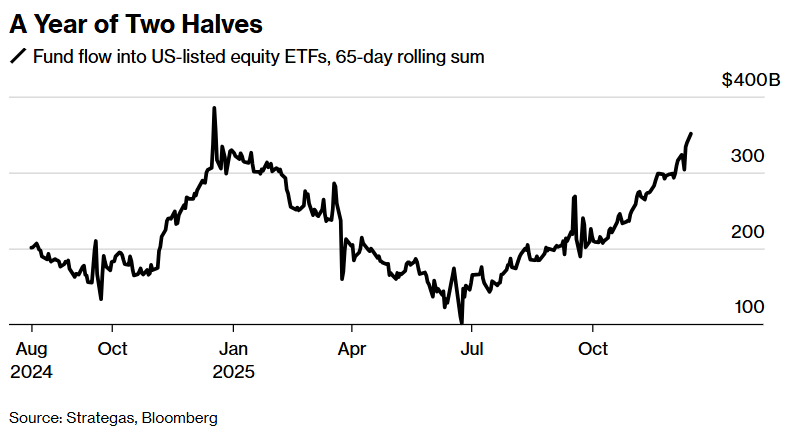

US stock market transactions in 2025 can be categorized as “April crash” and “everything since.” The tariff policy led by Trump almost ended the long-standing bull market in US stocks and the MSCI global stock index because many tradable open index funds (ETFs) experienced significant large-scale net outflows in a single month of April.

“From about March to summer, as investors thought about the impact of tariffs on the market environment, the speed and intensity of ETF capital flows in the stock market really slowed down.” Todd Sohn (Todd Sohn), senior ETF and technology strategist at Strategas Securities, said. “The outflow of capital from the cyclical sector during that period was almost consistent with the decline in market risk appetite,” Thorne added.

Judging from the money flow statistics in the chart above, the year 2025 was clearly split in half.

The Invesco QQQ Trust Series 1 ETF, which tracks the Nasdaq 100 index, saw its first net outflow in seven months in April, when traders withdrew their capital at the fastest pace in more than two years. However, as the tariff plan was reversed by the Trump administration and selling pressure subsided, Invesco QQQ's ETF inflow resumed and surged in May.

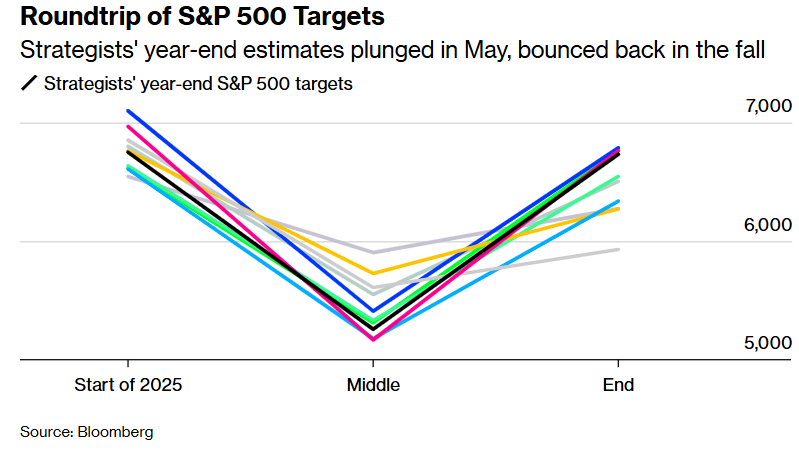

Wall Street quickly adjusted its year-end target for the S&P 500 index back and forth

It is very difficult to predict where the benchmark stock index of the US stock market, the S&P 500 index, or the MSCI global stock index will close at the end of any year. But 2025 is even more difficult. Almost all major Wall Street banks lowered their outlook for the S&P 500 index in April due to the Trump administration's comprehensive tariff plan. Subsequently, as tariff policies were clearly relaxed, corporate profit expectations picked up, and stock prices took off one after another, they had to raise their target level again.

The picture above shows a round-trip trip to the S&P 500 target point on Wall Street — Wall Street's top strategists' predictions for year-end points fell sharply in May, then rebounded again in the fall.

“We did cut our year-end target level drastically because we know that historically it would take at least four months for the market to go from a pullback to the break-even point.” Sam Stovall (Sam Stovall), chief investment strategist at CFRA, said.

Stovall stressed that the last time market strategists had to collectively drastically lower the S&P 500 forecast points as in April was at the beginning of the COVID-19 outbreak in 2020. But he added that an additional challenge came in 2025: a drastic shift in trade policy to reduce the market's historical timeline from pullback to recovery to just two months instead of the usual four months, which almost no strategist anticipated.

Bubble concerns

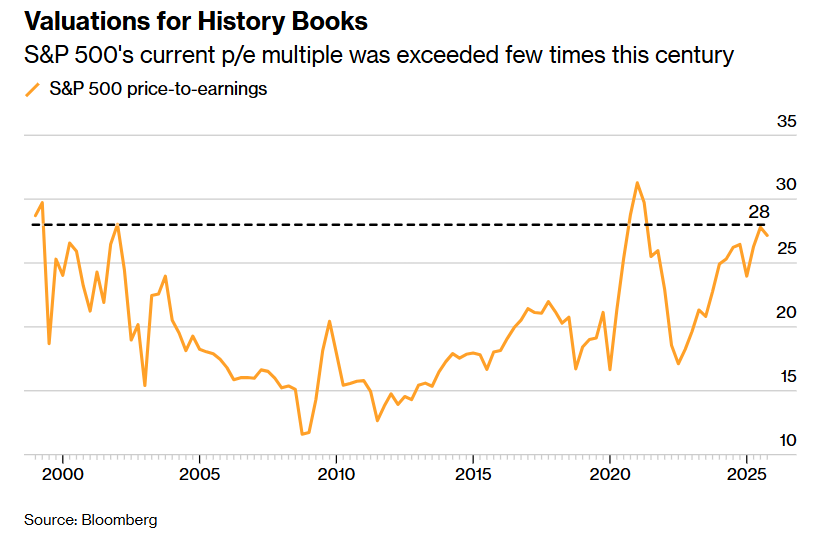

At the beginning of 2025 — before the world-famous DeepSeek AI chatbot launched by a Chinese AI startup with extremely low AI training costs once ignited market concerns about valuations of tech stocks benefiting from AI and heightened competitive fears about Chinese rivals, legendary investor Howard Marks (Howard Marks) warned that he was in a “bubble watching” state. The reason this opinion is remarkable is that the co-founder of Oak Capital Management was one of those investors who accurately predicted the moment the internet bubble burst in 2000.

Valuation levels written into historical books — the current price-earnings ratio multiples of the S&P 500 have only been surpassed in a few periods since this century.

Since Max issued a memorandum of a warning nature on January 7, some Wall Street strategists have also issued similar warnings as the S&P 500 valuation climbed to its highest level since the pandemic. Last week, Ned Davis Research strategists said that semiconductor stocks in the US stock market fit the definition of a “stock bubble” established by a Harvard Business School professor in a 2017 research paper.

However, this is clearly not a Wall Street consensus view. Bank of America Global Research (BofA Global Research) strategists wrote in a Wednesday report that they “haven't seen an AI bubble to any extent.” According to data compiled by Jefferies (Jefferies), another Wall Street financial giant, Wall Street analysts generally expect the overall profit growth of S&P 500 companies to accelerate year by year, and is expected to continue until 2027.

Market capitalization concentration risk has risen sharply

In the S&P 500 index, the 10 largest stocks by market capitalization account for almost 40% of the US stock benchmark index. This is a seriously high proportion in US stock history. The same is true for stock markets including Japan, Europe, South Korea, and China. In other words, market capitalization leaders in these stock markets hold too much weight in the stock market benchmark index, making investors uneasy about the risk of market capitalization concentration. The market capitalization concentration in the Korean stock market is even more exaggerated. The world's two largest memory chip giants, Samsung Electronics and SK Hynix, once occupied 40% of the Korea Composite Stock Index.

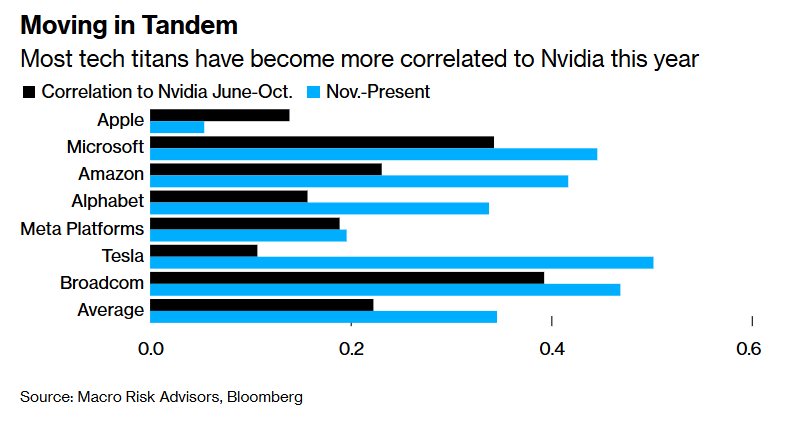

Dean Curnutt (Dean Curnutt), founder and CEO of Macro Risk Advisors, said that in an increasingly concentrated market, “countervailing risk” is rising, especially when few market capitalization dominates the correlation between companies. He sees the “Big Seven Tech Giants” (the Magnificent Seven) in the US stock market as a potential “circular takeover team” where “free cash flow or the scale of profit is only being recycled, thus creating room for larger market capitalization growth.”

The “super bull market” where the S&P 500 index has accumulated a cumulative increase of about 30 trillion US dollars over the past three years is largely driven by the world's largest tech giants (such as the seven major US tech giants), and also by companies that promote large-scale investment in AI computing power infrastructure (such as Micron, TSMC, Broadcom, etc.) and power system suppliers (such as Constellation Energy).

The so-called “seven tech giants”, or “Magnificent Seven,” which account for the high weight of the S&P 500 index (about 35%), include Apple, Microsoft, Google, Tesla, Nvidia, Amazon, and Facebook's parent company Meta Platforms. They are the core driving force behind the S&P 500 Index's record highs, and are also regarded by top Wall Street investment institutions as the combination most capable of bringing huge returns to investors in the context of the biggest technological changes since the Internet era.

The chart above shows this kind of “rising and falling” — the correlation between most technology stocks and Nvidia's stock prices has become stronger this year.

“As a benchmark index, S&P did a poor job of providing a set of diversified exposures,” Connett said. “The index you see is simply ridiculous in that its head weight is too high.”

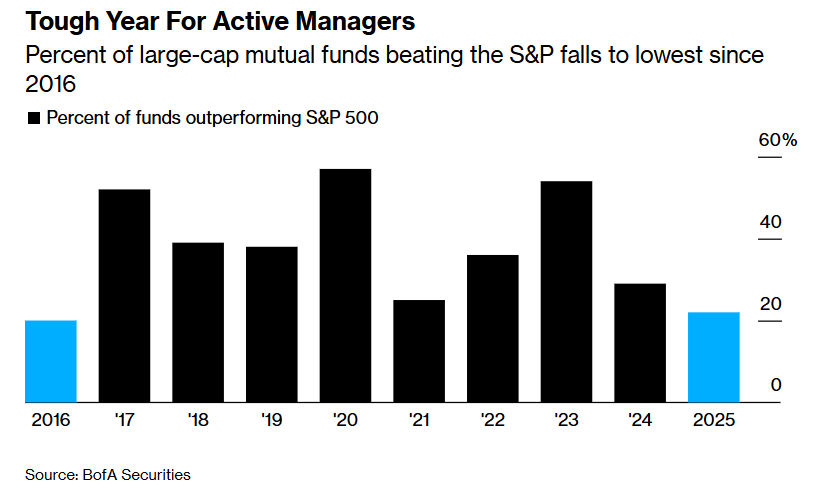

The difficulty of active management

About 45% of the increase in the S&P 500 index in 2025 came from the “seven big tech giants” mentioned above. Investors with tracking index ETFs continue to benefit, but actively managed fund managers who reduce the risk of concentration in a certain sector by selecting stocks and constructing diverse portfolios are struggling.

According to statistics from Bank of America's global research team, only 22% of actively managed large-cap ETF funds outperformed the S&P 500 index this year, the lowest ratio since 2016, and far below the 40% average.

As a result, 2025 is a difficult year for actively managed fund managers — the chart above shows that the proportion of active large-cap mutual funds that outperformed the S&P 500 index fell to its lowest level since 2016

Seaport Research Partners said in October that active fund managers are selling technology stocks so hard that they have reduced their allocation to the sector to the most “low allocation” level in five years, which has also led to the poor performance of active funds.

However, as the upward trend is expected to become more widespread next year, this situation is likely to change significantly, said Steven DeSanctis (Steven DeSanctis), a senior analyst from Jefferies. Obviously, his opinion is not an exception. Goldman Sachs's capital flow expert team said last Thursday that as stocks become more independent, Wall Street's most professional stock selectors may cheer in 2026. J.P. Morgan strategists believe that investors are “on the doorstep of the best stock selection era we have seen in our lives.”

As for 2026, as the market's fear of the AI bubble storm that blew up in November intensifies, and they begin to doubt that this irrational AI bubble is forming and getting closer to bursting, top Wall Street institutions, including Goldman Sachs and Morgan Stanley, are predicting that large stock market rotation covering styles such as old-school value stocks, small to medium capitals, and cyclical stocks, and different industry sectors other than technology will continue to unfold. This means that stocks other than popular AI technology stocks are likely to reap far better annual returns than the “AI bull market” in 2025 A much broader, broad-spectrum bull market has swept through.

Morgan Stanley defines 2026 as a “broad-spectrum stock market bull market under rolling recovery,” betting that the S&P 500 index is expected to hit 9,000 points, and argues that the return of “point-to-point” market risk appetite resonates upward with many cyclical industries.

Goldman Sachs said that in 2025, the global stock market has begun to show a clear trend of broadening sector growth and rotation. This trend will continue to strengthen in 2026, breaking the previous pattern where the market was highly concentrated on AI technology stocks, so the non-US and non-tech sectors will continue to perform strongly under rotation in 2026.

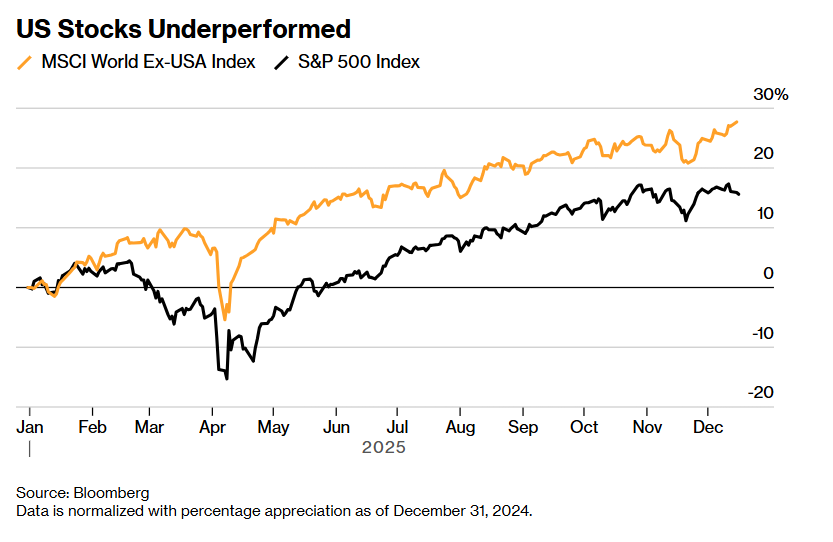

“American exceptionalism” fades

Although the US stock market has rebounded strongly since its lowest point in April, its performance still lags behind the “benchmark stock index for international stock markets other than the US.” The S&P 500 index outperformed the MSCI Global Stock Index for the first time since 2017 and significantly outperformed the MSCI World Ex-US Index (excluding the US) Benchmark Index (MSCI World Ex-US Index) in this round of rising bull markets, highlighting a clear rift in the market's narrative logic of “American exceptionalism” after Trump fully upgraded the global tariff policy after returning to the White House and threatening the independence of the Federal Reserve's monetary policy many times.

American exceptionalism generally means that no matter how the global economy evolves, the US economic data, the US stock market, and the US bond market will show resilience and stability far beyond other countries, thereby continuously attracting incremental capital from all over the world to the US dollar and US equity markets. In other words, “American exceptionalism” means that even when the global economy is turbulent, capital often chooses US assets as “safe havens” (safe havens) or is a priority choice for long-term allocation. As a result, the US economy, stock market, and bond market can continue to receive incremental injections of international capital.

Over the past 10 years, “American exceptionalism” has taken the world by storm, and investors in the US market have enjoyed the best returns in the world for a long time, but the current “American exceptionalism” can be described as having major rift, a series of aggressive external tariff policies recently initiated by the Trump administration or proposed to implement in the future, as well as wording that jeopardizes the independence of the Federal Reserve, causing more and more investors to worry about the risk of the US economy falling into “stagflation” or even a “deep recession”. This is also the core logic of the recent continuous weakening of US dollar assets.

Since 2025, the benchmark stock indexes of Canada, the United Kingdom, Germany, Spain, Italy, Japan, and Hong Kong, China have all significantly outperformed the US benchmark index. Wall Street strategists generally say that this is due to the uncertainty of the US government's policies since this year and the “self-imposed punishment” brought about by the increasingly high US deficit.

“I think the international market is benefiting from the ongoing turmoil in the US, combined with the fall in the value of the dollar,” said Stovall from CFRA. Furthermore, he stressed that after losing out on the S&P 500 index for many years, the international stock market had reached a relatively strong year. “It is only a matter of time before the international market continues to surpass the US.”

Nasdaq

Nasdaq 華爾街日報

華爾街日報