Reassessing Cal-Maine Foods (CALM) Valuation as Egg Shortage Concerns Cool and Sentiment Turns Cautious

Investor sentiment around Cal-Maine Foods (CALM) has cooled lately, as commentators argue that fading egg shortages could squeeze future profits, even though the company just delivered unusually strong multi year growth in sales and earnings.

See our latest analysis for Cal-Maine Foods.

That shift in sentiment has been reflected in the numbers, with a 90 day share price return of minus 11.51 percent and a year to date share price return of minus 18.87 percent, even as the five year total shareholder return of 191.28 percent still points to a powerful longer term story.

If Cal Maine’s volatility has you rethinking where you hunt for defensible growth, this might be a good moment to explore fast growing stocks with high insider ownership.

Yet with Cal Maine now trading below analyst targets after years of explosive revenue and earnings growth, investors have to ask: Is this volatility masking an undervalued compounder, or has the market already priced in a sharp earnings reset?

Price-to-Earnings of 3.3x: Is it justified?

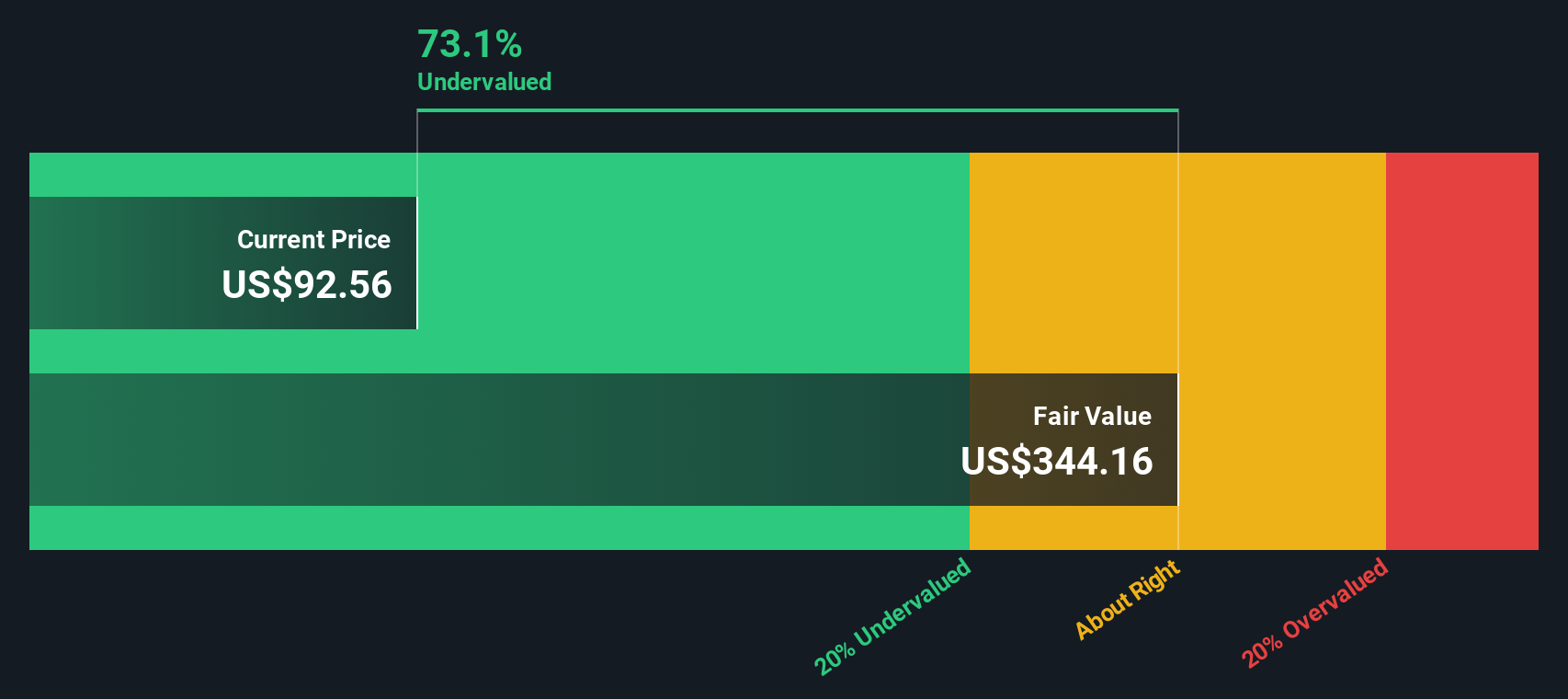

Cal Maine looks deeply discounted on earnings, with its 3.3x price to earnings multiple sitting alongside an SWS DCF fair value of $277.36 versus the last close of $85.7.

The price to earnings ratio compares what investors pay for each dollar of current earnings, and for a profitable, mature food producer like Cal Maine it is a central yardstick for how the market values those earnings. At 3.3x, the market is assigning a very modest value to profits that have grown sharply and currently translate into a return on equity of 46.9 percent.

That low multiple stands out even more against the US Food industry average of 19.9x and a peer average of 19.6x, suggesting the stock trades at an earnings discount relative to similar companies. SWS fair ratio work also indicates a fair price to earnings level of 3.4x, which signals there may be room for the multiple to move closer to that benchmark if sentiment toward Cal Maine normalises.

Explore the SWS fair ratio for Cal-Maine Foods

Result: Price-to-Earnings of 3.3x

However, recent double digit declines in revenue and net income, alongside potential normalization in egg prices, could pressure margins and challenge today’s low valuation.

Find out about the key risks to this Cal-Maine Foods narrative.

Another View on Valuation

Alongside that low price to earnings ratio, our DCF model paints an even more dramatic picture, suggesting Cal Maine could be worth around $277.36 per share versus today’s $85.7. If cash flows normalise rather than collapse, is the market overlooking a sizeable margin of safety?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cal-Maine Foods for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 910 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cal-Maine Foods Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a customised view in minutes. Do it your way.

A great starting point for your Cal-Maine Foods research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before markets move again, use the Simply Wall Street Screener to uncover focused opportunities tailored to your strategy, instead of waiting for the next headline move.

- Target reliable income streams by scanning these 12 dividend stocks with yields > 3% that could strengthen the backbone of a long term portfolio.

- Capitalize on valuation mispricings by zeroing in on these 910 undervalued stocks based on cash flows where cash flows suggest the market may be overly pessimistic.

- Position yourself early in a changing payments landscape by analysing these 79 cryptocurrency and blockchain stocks poised to benefit from blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報