Does BILL (BILL) Leadership Turnover Quietly Recast Its Long‑Term Fintech Growth Narrative?

- BILL Holdings, Inc. recently announced that Senior Vice President, Finance & Accounting and Principal Accounting Officer Germaine Cota intends to resign effective January 16, 2026, and that shareholders approved the appointment of Natalie Derse to the board at the December 11, 2025 annual meeting.

- While these leadership changes adjust oversight of BILL’s financial and governance functions, recent investor attention has centered more on macroeconomic shifts that influence growth-oriented fintech companies.

- Next, we’ll consider how Germaine Cota’s planned departure and broader macro tailwinds might influence BILL’s existing investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

BILL Holdings Investment Narrative Recap

To own BILL, you need to believe that small and midsize businesses will keep shifting their financial workflows onto its automation platform, and that BILL can convert that usage into durable, profitable growth. The planned 2026 departure of Principal Accounting Officer Germaine Cota and the addition of new directors do not appear to materially change the near term focus on macro conditions, which remain the key catalyst for payment volumes and the main risk to transaction driven revenue.

The most relevant update here is the shareholder approval of CFO Natalie Derse’s appointment to the board, which further ties financial oversight to BILL’s broader governance refresh following the Starboard Value cooperation agreement. For investors watching how BILL executes on AI enabled automation, embedded finance and mid market expansion while operating in a macro sensitive, transaction heavy model, this expanded board level financial expertise may help support execution, but it does not remove the core risks around SMB spending and rate driven float income.

Yet behind BILL’s automation opportunity, investors should be aware that its reliance on transaction and float driven revenue means...

Read the full narrative on BILL Holdings (it's free!)

BILL Holdings’ narrative projects $2.1 billion in revenue and $94.8 million in earnings by 2028.

Uncover how BILL Holdings' forecasts yield a $60.86 fair value, a 9% upside to its current price.

Exploring Other Perspectives

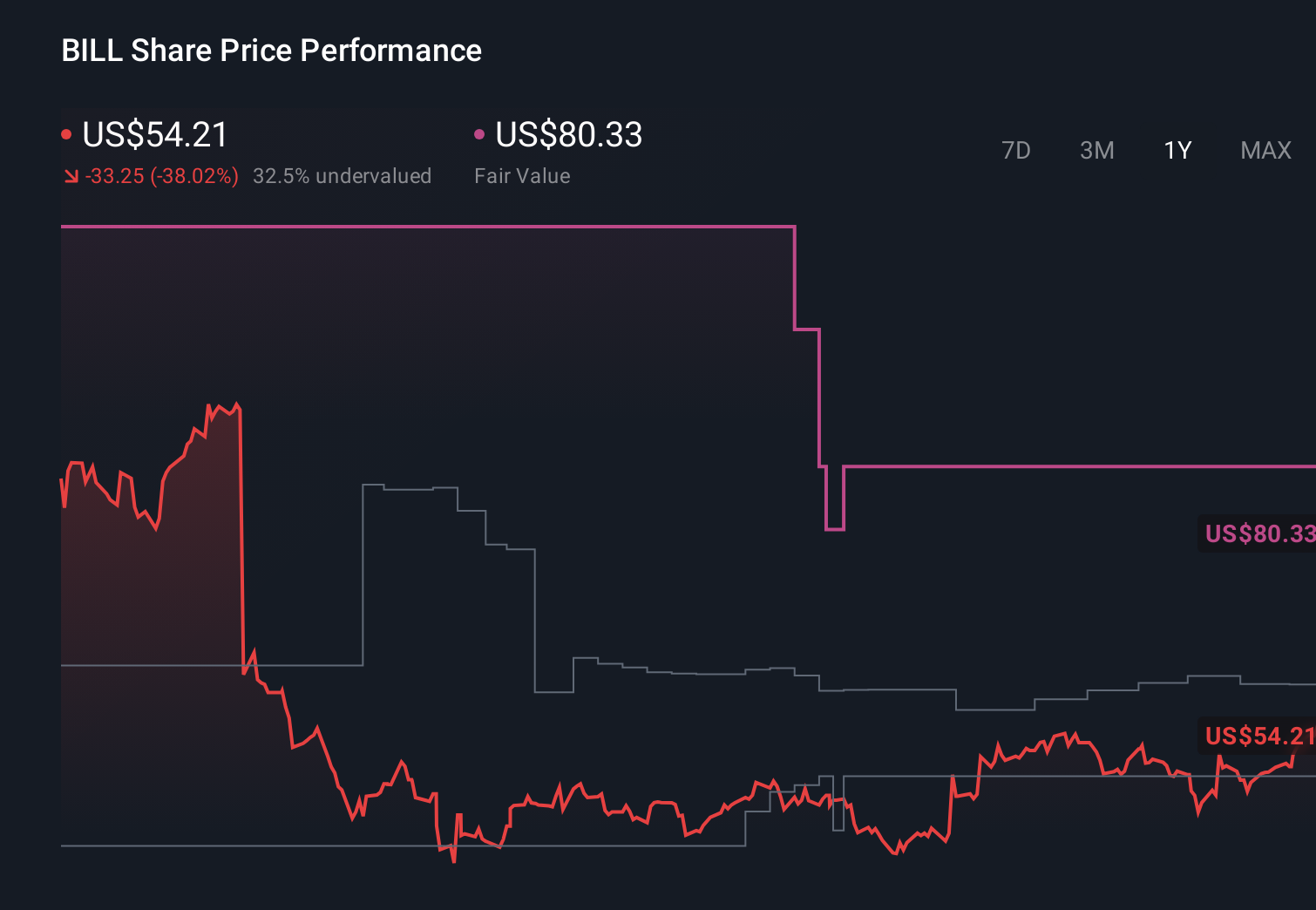

Six members of the Simply Wall St Community currently see BILL’s fair value between US$42 and about US$92, reflecting wide dispersion in expectations. When you set that against the company’s exposure to macro driven SMB transaction volumes, it underlines why performance could diverge sharply from any single forecast and why it helps to compare several viewpoints.

Explore 6 other fair value estimates on BILL Holdings - why the stock might be worth as much as 65% more than the current price!

Build Your Own BILL Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BILL Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BILL Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BILL Holdings' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報