Fintel Leads These 3 UK Penny Stocks To Watch

The United Kingdom's market has recently faced challenges, with the FTSE 100 index closing lower due to weak trade data from China, highlighting global economic uncertainties. In such fluctuating conditions, identifying stocks with solid fundamentals becomes crucial for investors seeking potential growth opportunities. Penny stocks, though an outdated term, continue to represent smaller or newer companies that can offer significant value when backed by strong financials and a clear growth trajectory.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.155 | £476.67M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £1.925 | £155.52M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.29 | £331.83M | ✅ 5 ⚠️ 1 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.75 | £133.18M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.845 | £12.76M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.6875 | $399.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.454 | £176.1M | ✅ 3 ⚠️ 2 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.445 | £38.36M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £183.46M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Fintel (AIM:FNTL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £218.81 million.

Operations: The company's revenue is derived entirely from its operations in the United Kingdom, amounting to £85 million.

Market Cap: £218.81M

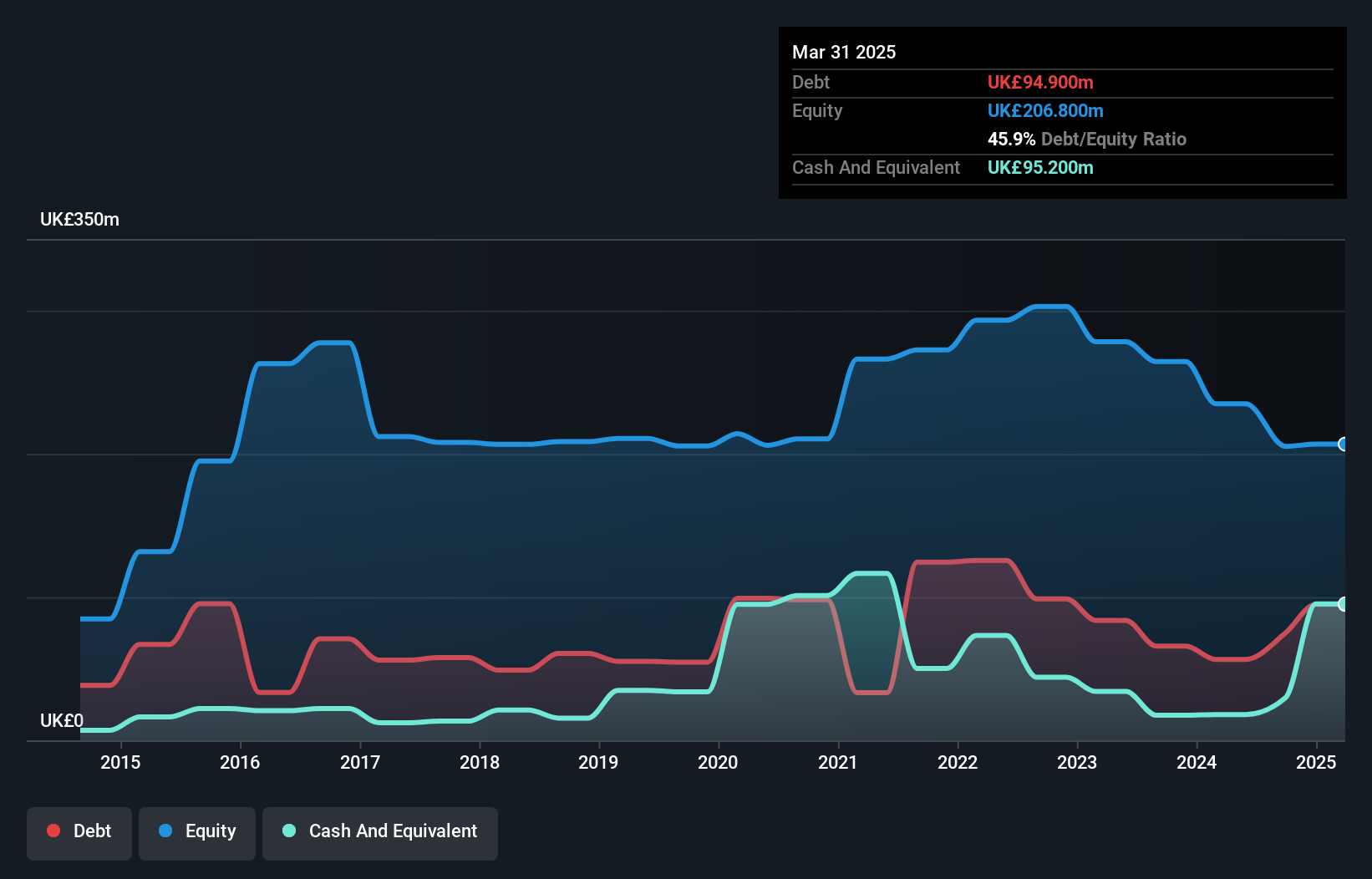

Fintel Plc, with a market cap of £218.81 million and revenue of £85 million, shows potential within the penny stock category due to its recent earnings growth of 5.1%, surpassing the industry average. Despite this growth, challenges persist as short-term assets (£24.8M) fall short of covering both short-term (£28.7M) and long-term liabilities (£51.1M). Nevertheless, debt management appears satisfactory with a net debt to equity ratio at 29.4% and interest payments well covered by EBIT (6.4x). While trading below estimated fair value by 44.8%, Fintel's management team lacks experience but benefits from an experienced board.

- Navigate through the intricacies of Fintel with our comprehensive balance sheet health report here.

- Gain insights into Fintel's outlook and expected performance with our report on the company's earnings estimates.

McBride (LSE:MCB)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: McBride plc manufactures and sells private label household and personal care products to retailers and brand owners across various regions including the United Kingdom, Europe, and the Asia-Pacific, with a market cap of £255.80 million.

Operations: The company generates revenue from several segments, including Liquids (£529.6 million), Powders (£85.5 million), Aerosols (£58.9 million), Unit Dosing (£228.9 million), and the Asia Pacific region (£23.6 million).

Market Cap: £255.8M

McBride plc, with a market cap of £255.80 million, operates in the household and personal care sector, showing mixed signals as a penny stock. The company trades at 39.3% below its estimated fair value and has experienced significant earnings growth over five years at 33.2% annually, though recent performance shows negative earnings growth of -0.3%. Management is experienced with an average tenure of 4.9 years; however, McBride faces challenges such as high net debt to equity ratio (102.9%) and short-term liabilities exceeding short-term assets (£311.8M vs £300.5M). Recent share buybacks may influence future stock dynamics positively or negatively depending on execution strategy and market conditions.

- Unlock comprehensive insights into our analysis of McBride stock in this financial health report.

- Examine McBride's earnings growth report to understand how analysts expect it to perform.

NCC Group (LSE:NCC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe, with a market capitalization of £440.05 million.

Operations: The company generates revenue of £238.9 million from its Cyber Security segment.

Market Cap: £440.05M

NCC Group plc, with a market cap of £440.05 million, presents a complex picture for penny stock investors. Despite trading at 23.9% below estimated fair value and having an experienced board, the company remains unprofitable with losses increasing over five years. However, its financial health is supported by short-term assets exceeding both short and long-term liabilities (£268.1M vs £113.8M and £23M respectively), and debt being well-covered by operating cash flow (1015.2%). Recent earnings showed sales of £238.9 million but net income was only £17.1 million, highlighting ongoing profitability challenges amidst potential growth opportunities in cyber security revenues.

- Click to explore a detailed breakdown of our findings in NCC Group's financial health report.

- Evaluate NCC Group's prospects by accessing our earnings growth report.

Next Steps

- Discover the full array of 306 UK Penny Stocks right here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報