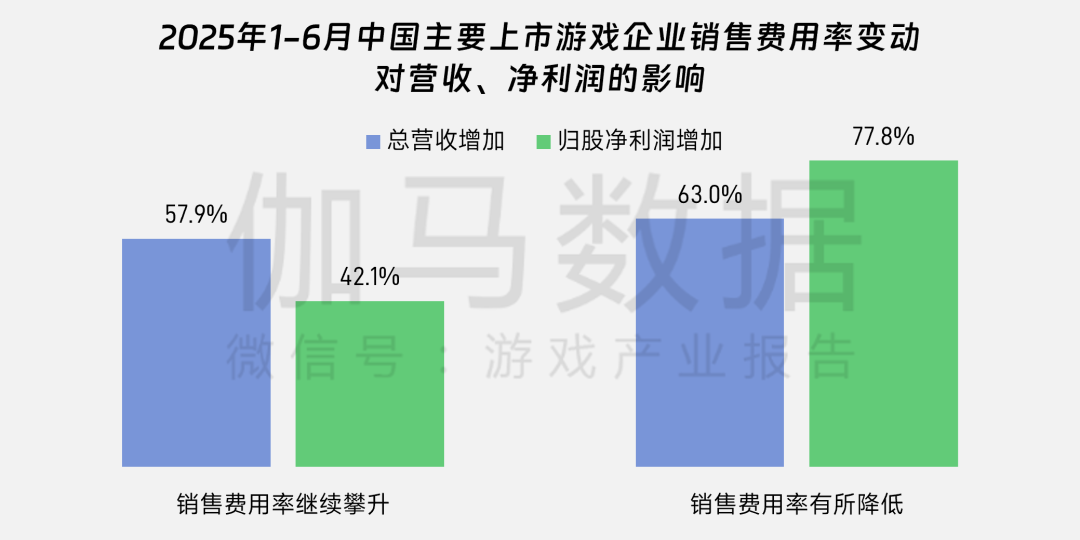

Gamma data: The average sales expense ratio of major listed game companies in China from January to June was 21.8%, the first significant decline in the past 5 years

Zhitong Finance App learned that Ao Ran, executive vice chairman and secretary general of the China Audiovisual and Digital Publishing Association, released the “2025 China Mobile Game Advertising and Marketing Report”. This report was written by Gamma Data. The report shows that from January to June 2025, the average sales expense ratio of major listed game companies in China was 21.8%, down 2.9 percentage points from the same period last year. This is the first significant decline in nearly 5 years.

The overall state of mobile marketing

Status 1: The average sales expense ratio is 21.8%, the first significant decline in the past 5 years

Data Source: Gamma Data (CNG)

Focusing on in-depth marketing indicators is the core cause of these changes. In-depth marketing indicators can further strengthen the link between marketing investment and revenue generation, thereby increasing marketing returns. This is reflected in the data: Among the companies whose sales expense ratio decreased from January to June 2025, net profit increased by 77.8%, and the proportion of companies that increased revenue also reached 63%. The performance of most companies was not impacted by the decline in sales expenses; on the contrary, it increased, and the performance was better than that of companies whose sales expense ratio increased.

Data Source: Gamma Data (CNG)

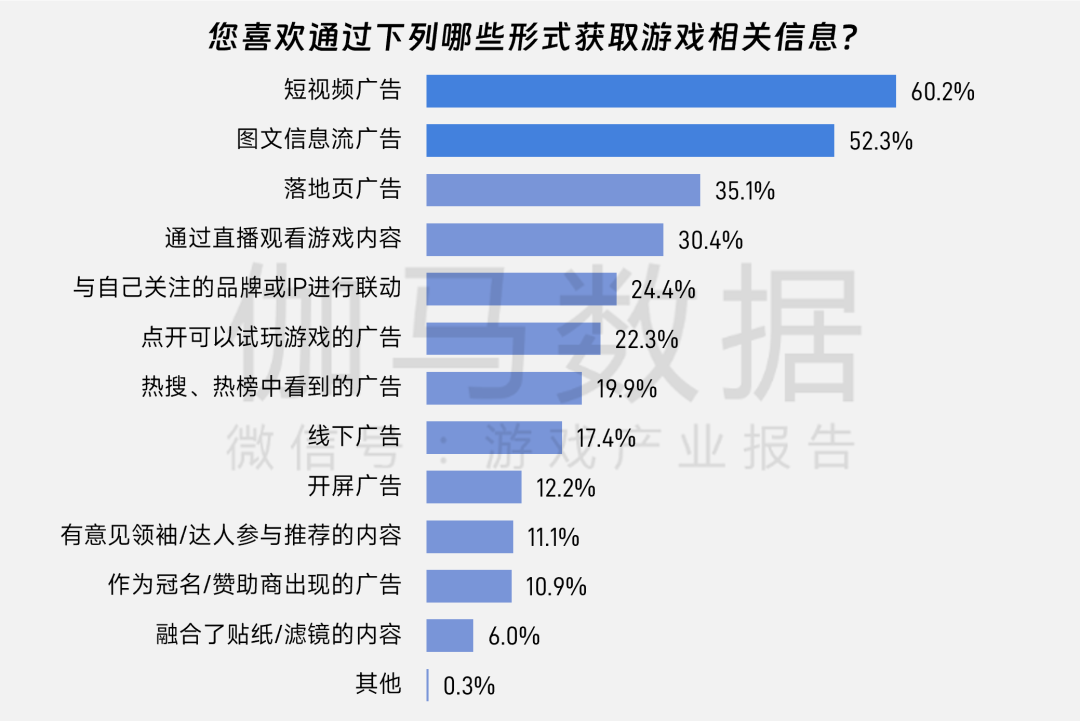

Status 2:60% of users like to obtain information through short video ads, and content marketing focuses on the role of attracting new and returning content

Short video ads and graphic information stream ads are the most preferred forms for users to obtain game information, and they are also the main players in the current industrial layout. However, in addition to this, more than 20% of users have clearly expressed their likes in various forms such as landing page ads, live broadcasts, IP links, and trial ads. Various advertising formats are further stimulating users' interest in gaming.

Data Source: Gamma Data (CNG)

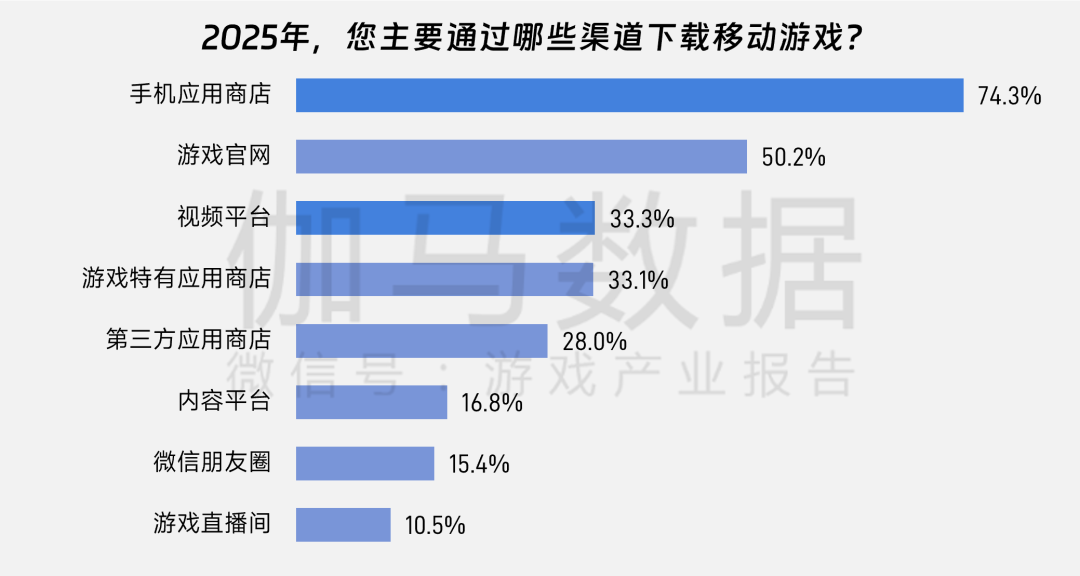

On the advertising channel side, mobile app stores are the channel where users most often download mobile games, accounting for 74.3%; at the same time, 33.3% of respondents mainly download games through video platforms, 16.8% mainly through content platforms, and 10.5% mainly download games through game live streaming rooms. Content marketing with the core purpose of revitalizing and optimizing the game ecosystem plays a greater role in attracting new and returning games.

Data Source: Gamma Data (CNG)

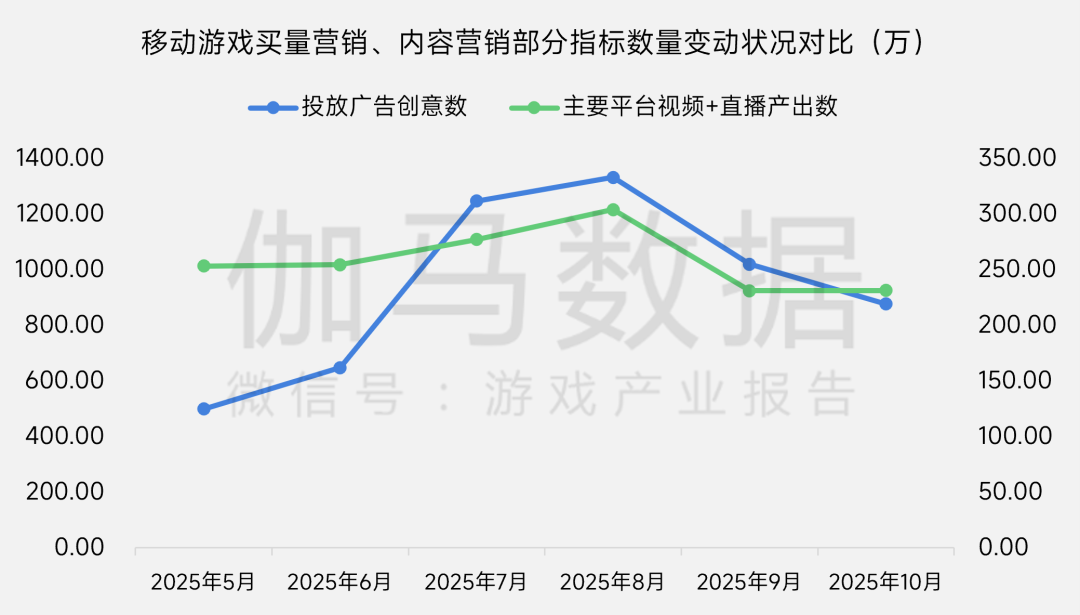

Status 3: Buying volume marketing is changing from quantity to quality, and content marketing is gradually becoming another pillar

Purchase volume marketing and content marketing are the two major directions of mobile game marketing, and the production of marketing materials has reached a high level. Purchase volume marketing started early and is mature. Currently, it is shifting from “quantity” to “quality”. The number of advertising ideas is no longer growing, but the amount of high-quality materials is increasing; content marketing is developing relatively late, but its cost-effective marketing potential has attracted many corporate layouts. At this stage, the average monthly content output of the main forms of content marketing (video, live streaming) has stabilized at more than 2 million pieces, gradually becoming another pillar of mobile game marketing.

Data Source: Gamma Data (CNG)

App game purchase marketing status

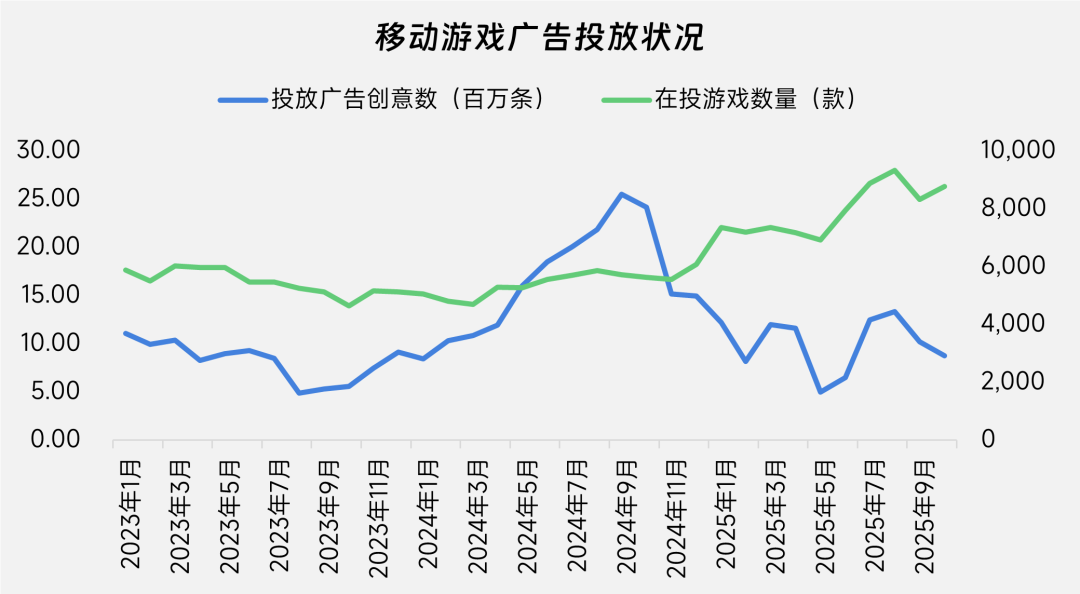

Status 1: App game advertisements have fallen to the level of 2023 several times, affected by in-depth marketing goals and cost-effective marketing methods

“Focus on deep marketing goals” is an important characteristic of app game advertising in 2025. Judging from the data, there was a significant decrease in the number of ads for app games in 2025 compared to 2024, but the amount of advertising for app games continued to grow, which meant that companies concentrated their purchasing capital on fewer but higher quality advertising materials.

Data source: Source is AppGrowing, gamma data (CNG) collated

The changes are mainly affected by two factors. On the one hand, as mentioned earlier, more and more companies realise that simply increasing the number of advertisements is difficult to bring ideal returns, so they are focusing on deep goals such as payment and retention, leading to a decline in the number of advertisements; on the other hand, IAA products are an important source of game purchases, but in recent years, more IAA products have switched to a mixed monetization model, and the new business model has reduced the degree of dependence on advertising, reducing the amount of advertising materials. In the future, how to tap deeper goals more effectively and how to achieve more cost-effective marketing will still be an important factor driving changes in app game advertising.

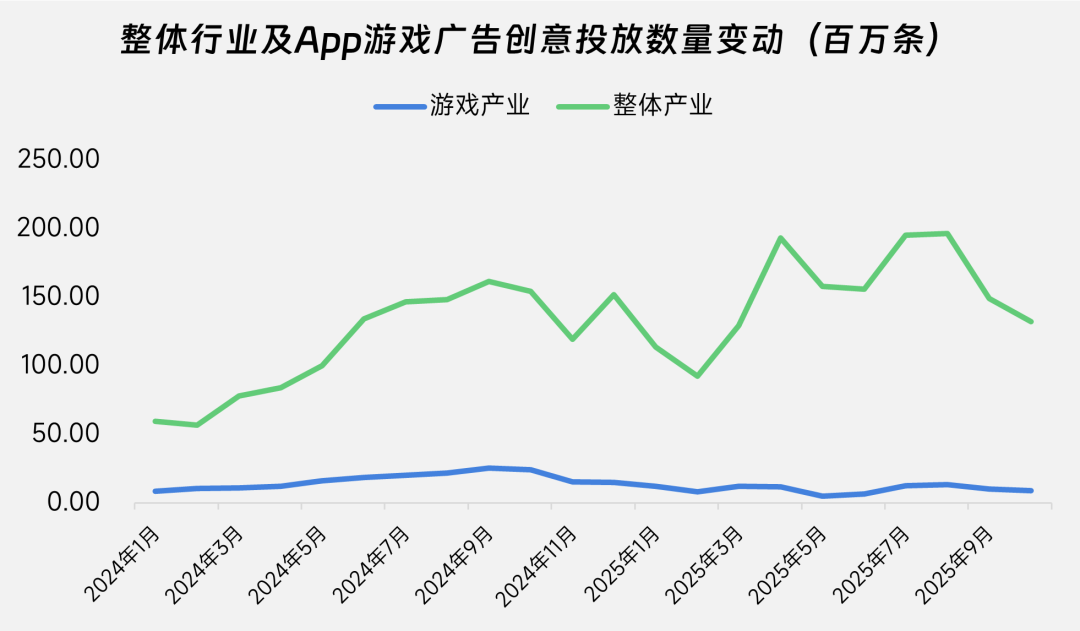

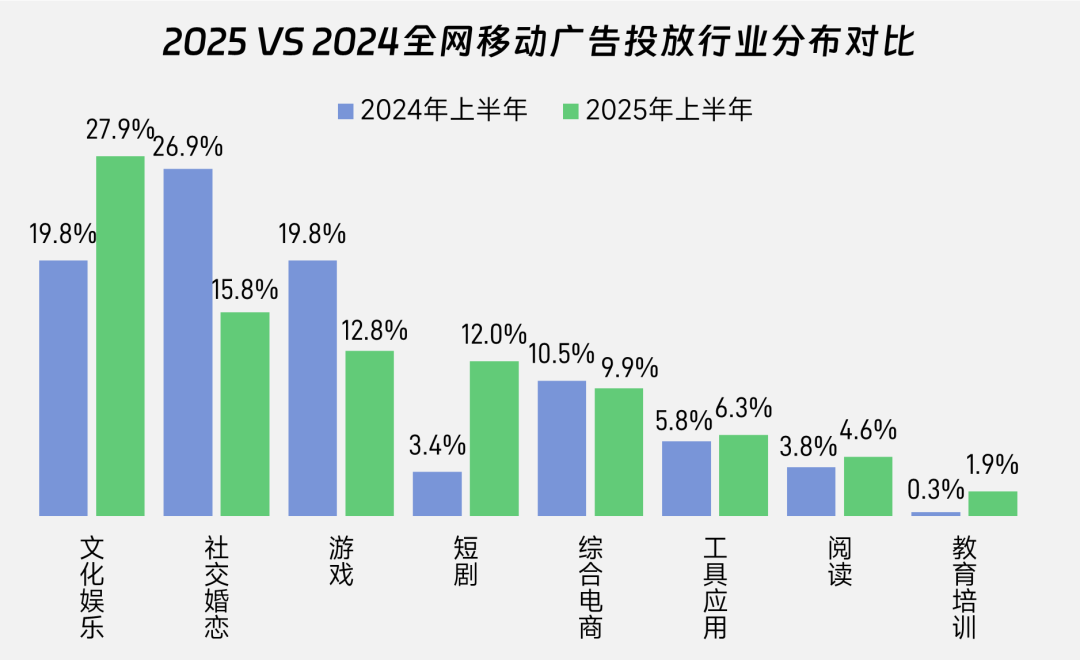

Status 2: Cross-industry competition is intensifying, and competition in the same industry is stable

The game industry faces increased competition from different industries: on the one hand, in 2025, the number of creative advertising for apps in the game industry decreased compared to the same period, but the total number of advertisements placed on various traffic platforms continued to grow; on the other hand, the game industry occupied 12.8% of advertising in the first half of 2025, a decrease of 7 percentage points over the previous year. Although the aforementioned factors such as focusing on in-depth marketing goals and IAA game transformation also had an impact, the scale of the industry represented by skits is growing rapidly, and the increase in advertising investment due to competitive market share has led to a decline in the share of games, increasing the competitive pressure on the game industry in different industries.

Data source: Source is AppGrowing, gamma data (CNG) collated

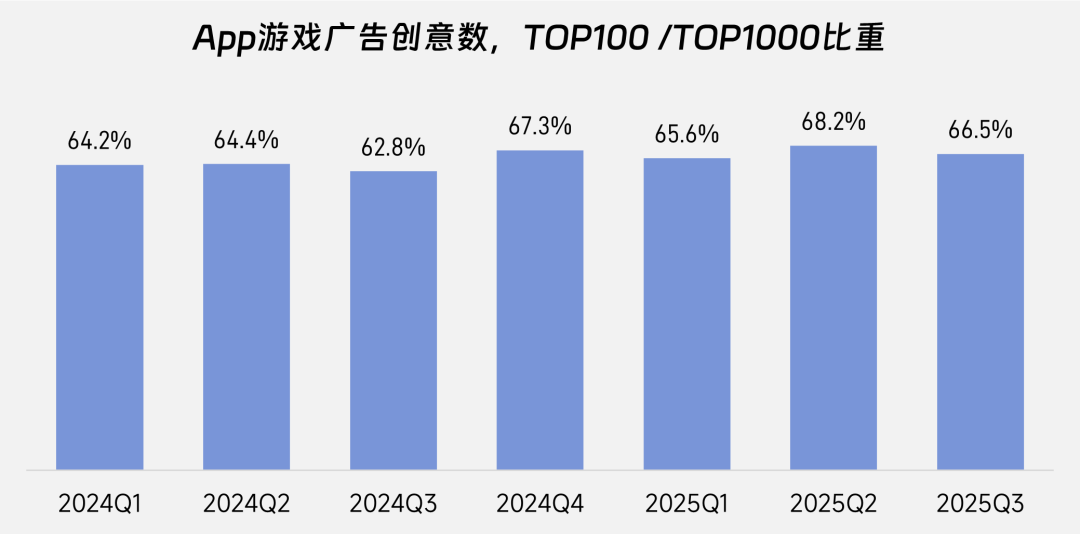

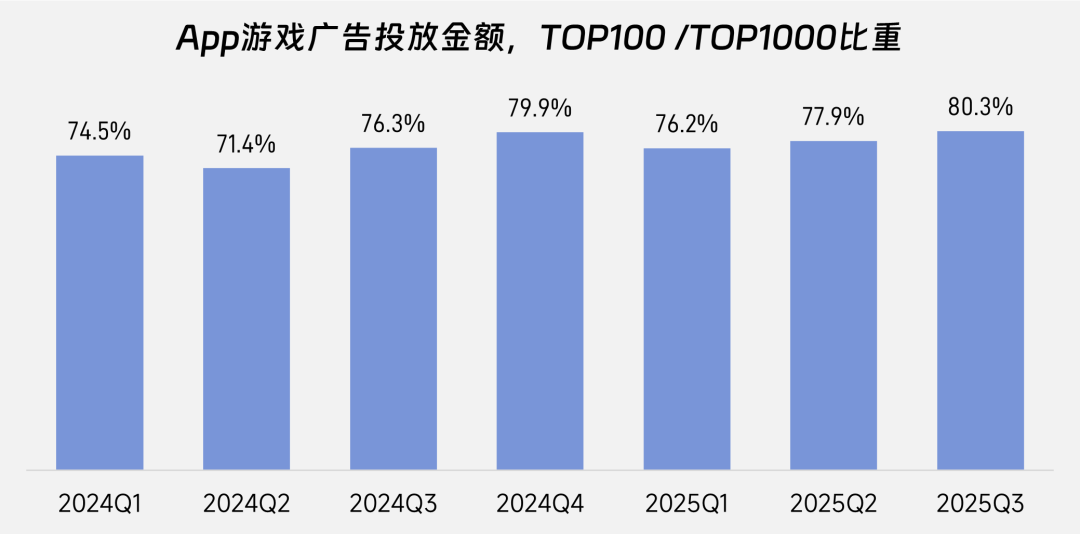

Competition in the industry has intensified slightly, but overall it has remained stable: both in terms of the number of advertising ideas and the amount of advertising, the share of the top 100 app games corresponding to the list in 2025 increased compared to 2024, but the increase was limited.

Data source: Source is AppGrowing, gamma data (CNG) collated

On the one hand, increased competition is influenced by users. The siphon effect of leading products boosts the customer acquisition costs of mid-tail products, reducing the number of advertisements that can be placed under the same marketing budget; on the other hand, it is currently a mainstream practice for companies to plan marketing budgets in more detail and concentrate resources on main and high-potential products in order to obtain better returns, but it also makes products with limited revenue generation capacity receive less resource investment, thereby speeding up marketing concentration on leading products. However, due to changes in marketing priorities, leading products already occupy a high market share, etc., competition in the industry has intensified to a limited extent, and the overall level of competition has remained stable.

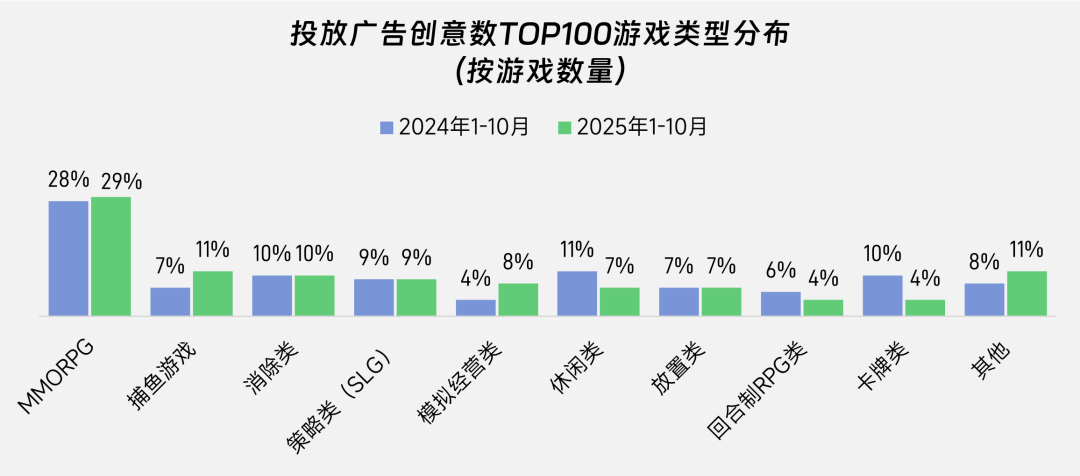

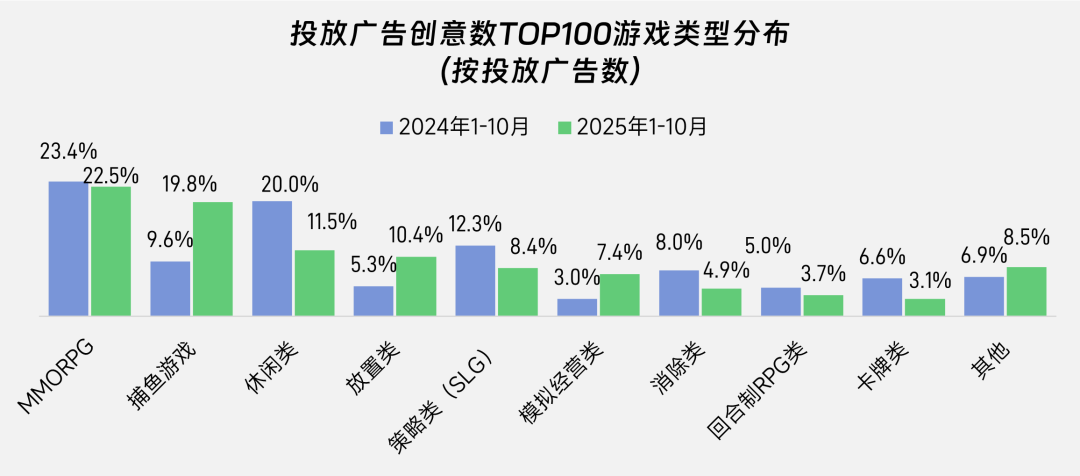

Status 3: MMORPGs rank first with 29%, and the potential for placement and simulation management is being released at an accelerated pace

At the product level, MMORPGs and fishing are still the categories with the most amount of advertising, accounting for 40% of the number of products and 42.3% of the number of ads. Among them, MMORPGs still maintain the top position among the leading products. This is related to the release of game nostalgia potential and the business results of MMORPG classic IPs. More genuine authorized products have been launched, and they have entered the top of the list under the double guarantee of product quality and corporate distribution capacity, so that the category still ranks first.

Data source: Source is AppGrowing, gamma data (CNG) collated

Judging from the number of advertisements placed, there is a marked increase in the fishing, placement, and simulated business categories. Among them, the placement category and simulated business category are all categories that “have high-flow aquatic products, but the number of high-flow aquatic products is small” in recent years, and there are market opportunities. However, with the production of more well-known new products, these opportunities are being realized at an accelerated pace, which in turn is driving up the share of advertising.

Data source: Source is AppGrowing, gamma data (CNG) collated

The current state of applet game marketing

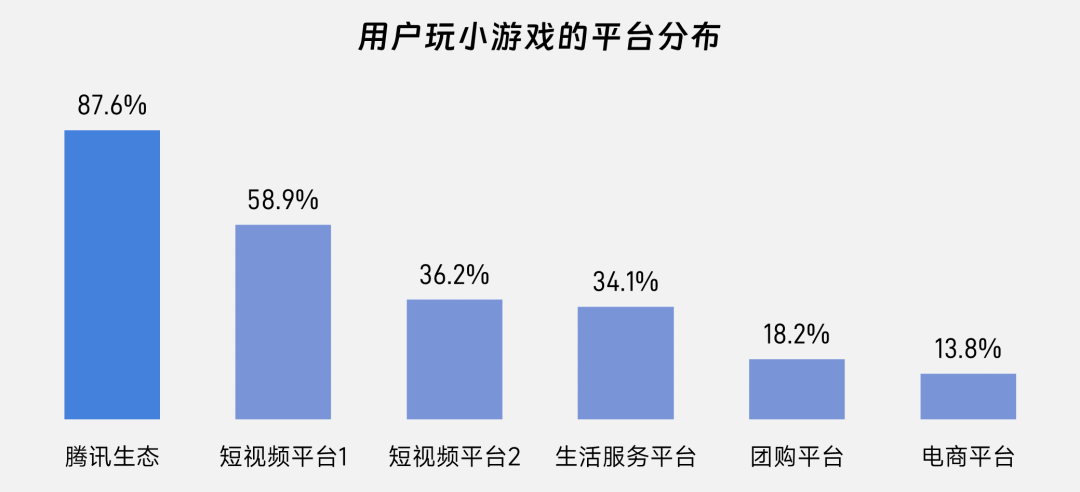

Status 1: Applet games continue to develop, and Tencent's ecological penetration rate ranks first

Applet games have continued to develop in recent years, and their distribution channels have continued to be enriched. Many channels such as social platforms, content platforms, payment platforms, and app stores have arranged applet game distribution. At this stage, the Tencent ecosystem, represented by WeChat, is still the platform most preferred by applet game users. According to “Tencent IAA Insights on Eliminating Mini Game User Behavior Trends (2025 Edition)”, this type of user accounts for 87.6%, ranking first among all platforms. The platform's high penetration rate and high usage rate among users, and Tencent's support for applet games at the technical and policy levels are the reasons why users prefer this ecosystem the most.

Data source: Tencent Marketing Insights (TMI) “Tencent IAA's Insights on Eliminating User Behavior Trends in Mini Games (2025 Edition)”

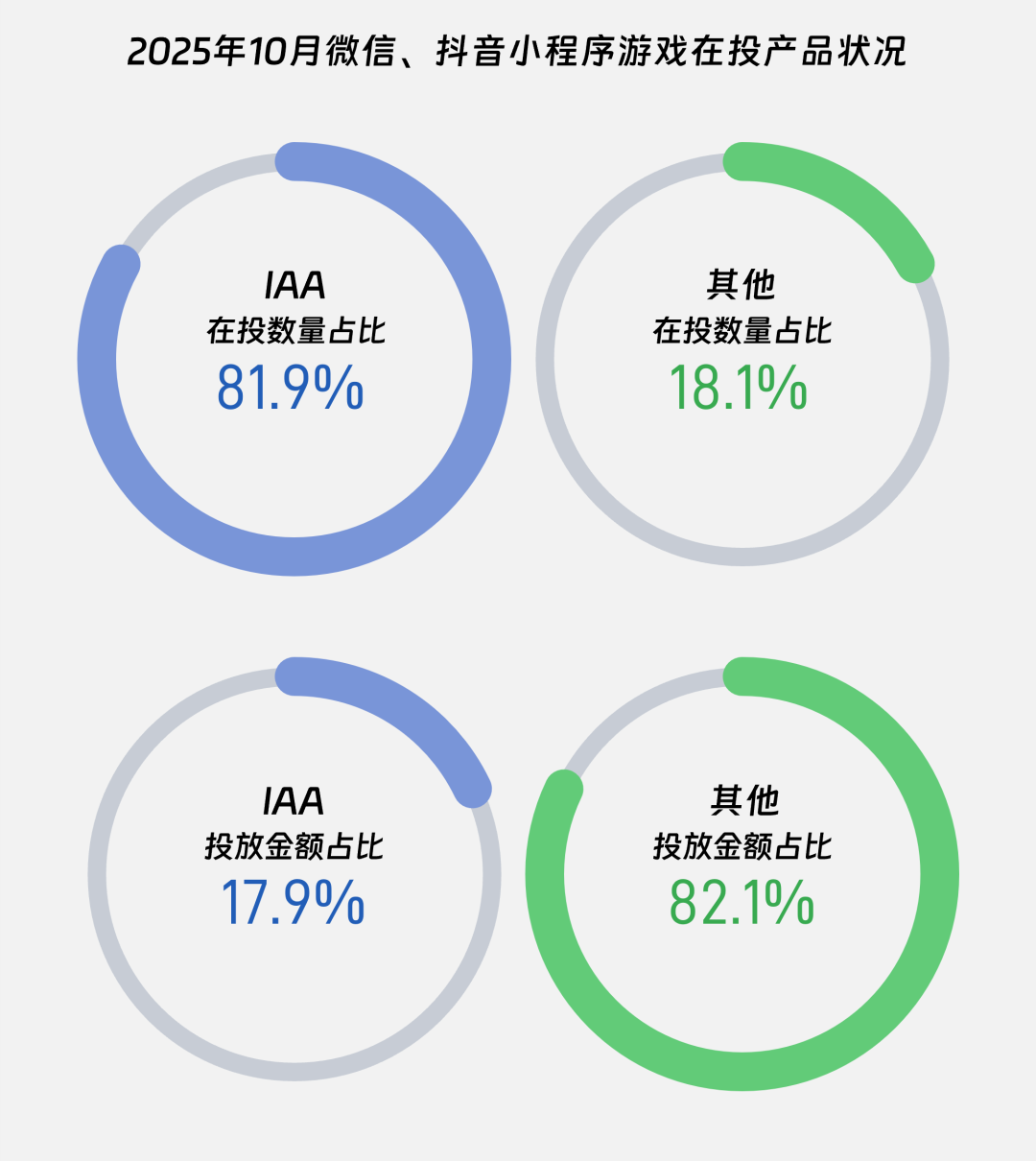

Status 2: IAA mini games account for 80% of the number of products invested, and IAP and hybrid monetization account for more than 80% of the investment amount

Judging from the advertising situation, IAA games are dominated by applet games, accounting for 81.9% of the number of games submitted. Compared to app products, users are more accepting of the applet game advertising monetization business model, which is the core reason that supports the output of such games. However, judging from the amount of advertising, IAP games and hybrid monetization games account for more than 80% of the total share of advertising. The deeper payment and content system has greatly increased the product's revenue generation limit, enabling the product to bear larger user acquisition costs, which in turn accounts for more than 80% of the advertising amount with less than 20% of the number of games being sold.

Data source: Source is AppGrowing, gamma data (CNG) collated

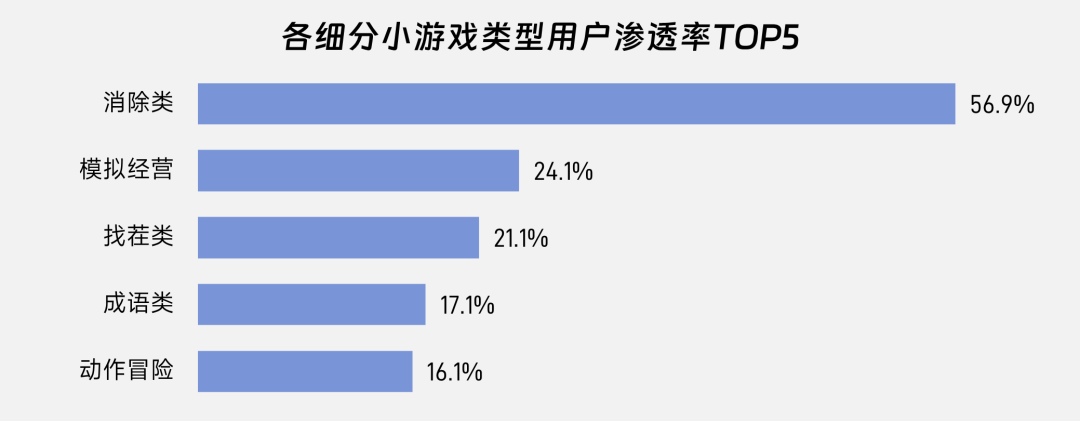

Status 3: Elimination classes are the focus of applet games

The elimination category is the focus of applet games, and has the characteristics of “wide audience and strong willingness to monetize ads”: on the one hand, the elimination category has a user penetration rate of 56.9% in IAA games, ranking first among all genres;

Data source: Tencent Marketing Insights (TMI) “Tencent IAA's Insights on Eliminating User Behavior Trends in Mini Games (2025 Edition)”

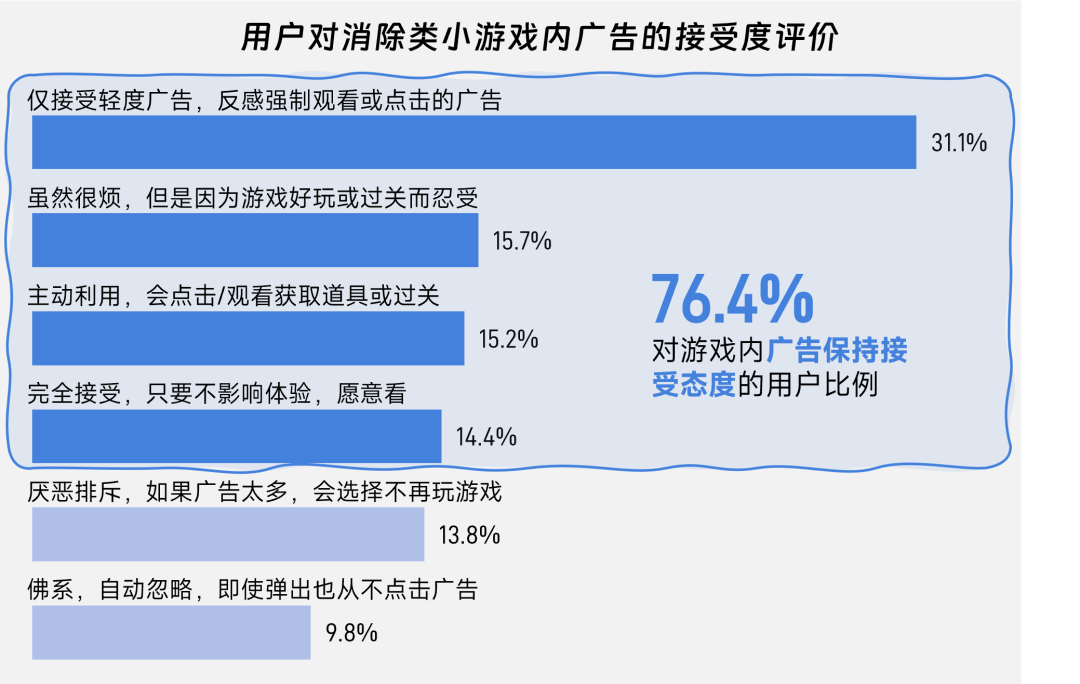

On the other hand, 76.4% of eliminated users can accept in-game ads, and the category has a monetization advantage. Looking at the categories themselves, the changes in the elimination category are more diverse. In addition to the traditional elimination category, by adding new elements and creating a sense of freshness on the basis of retaining the core pleasure of “elimination,” various subcategories with “elimination” as the core, such as water sorting and stacking elimination, have also gained high popularity, and maintain a high penetration rate of the elimination category as a whole.

Data source: Tencent Marketing Insights (TMI) “Tencent IAA's Insights on Eliminating User Behavior Trends in Mini Games (2025 Edition)”

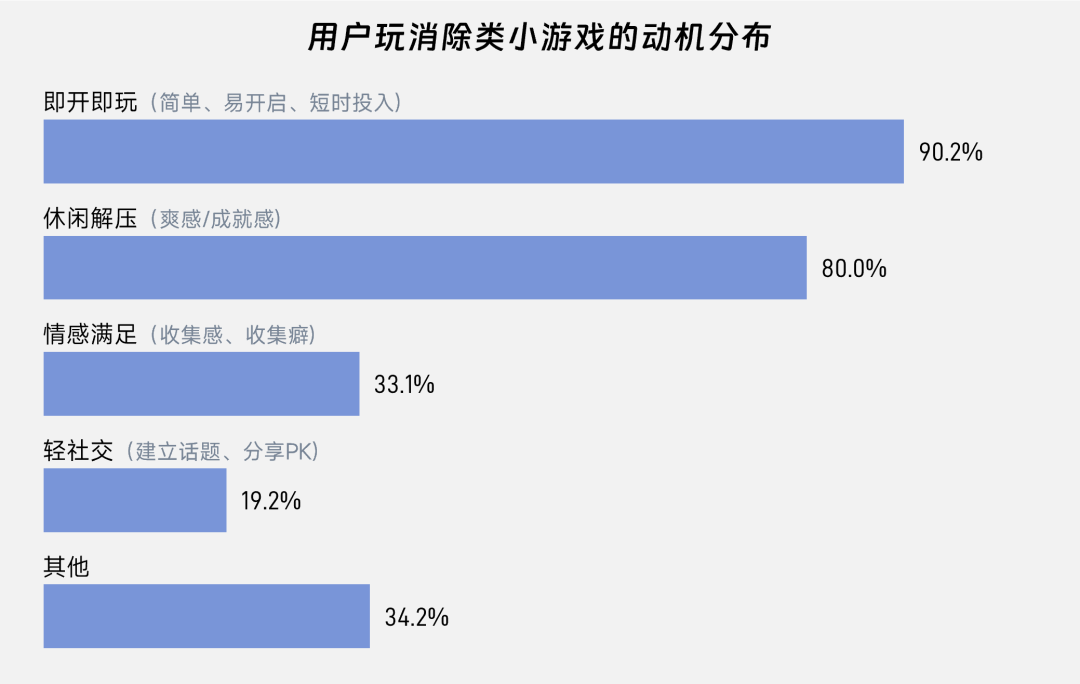

From a user perspective, instant play, low investment, and a sense of excitement are the core factors in users' preferences for such games. For example, elimination gameplay is simple and easy to play, and the overall play threshold is low. However, the sense of exhilaration and order brought by elimination, the sense of accomplishment when passing levels, and the achievement system of some product designs can still provide sufficient positive feedback and enhance user retention.

Data source: Tencent Marketing Insights (TMI) “Tencent IAA's Insights on Eliminating User Behavior Trends in Mini Games (2025 Edition)”

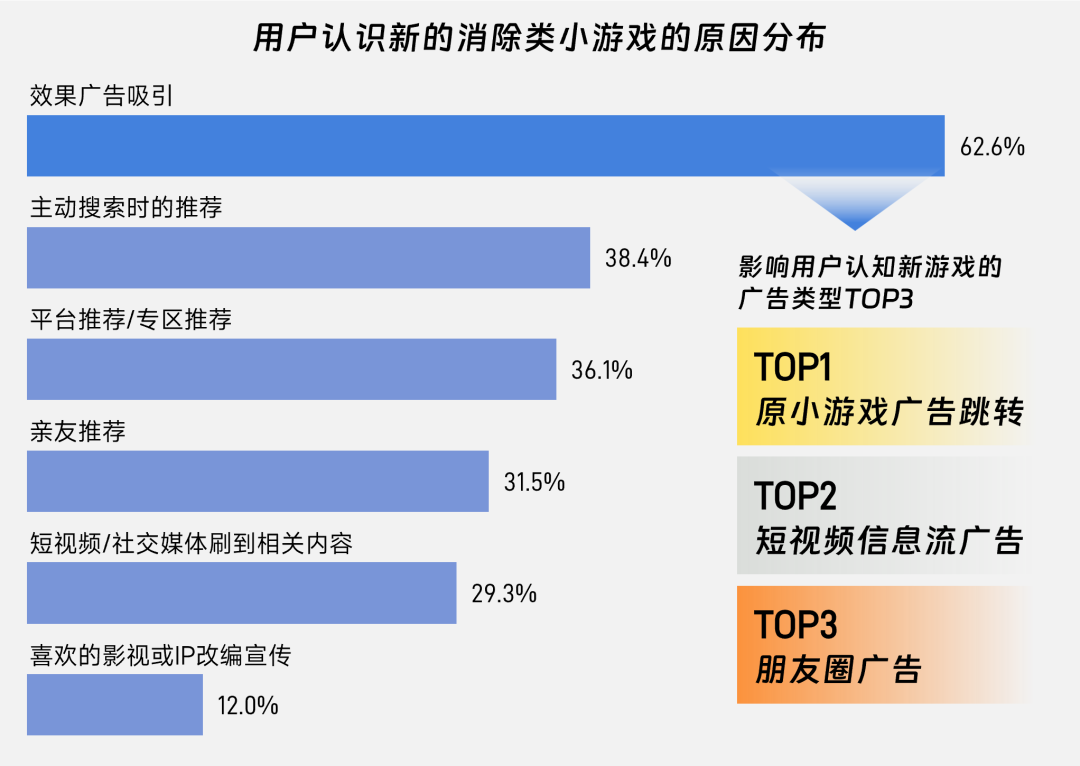

When marketing games that eliminate applets, customers need to focus on performance advertisements. 62.6% of users learned about new products as a result, which is the main way to acquire customers. Among them, the conversion efficiency of ad redirects within the original mini game, short video streaming ads, and friend zone ads was the most efficient.

Data source: Tencent Marketing Insights (TMI) “Tencent IAA's Insights on Eliminating User Behavior Trends in Mini Games (2025 Edition)”

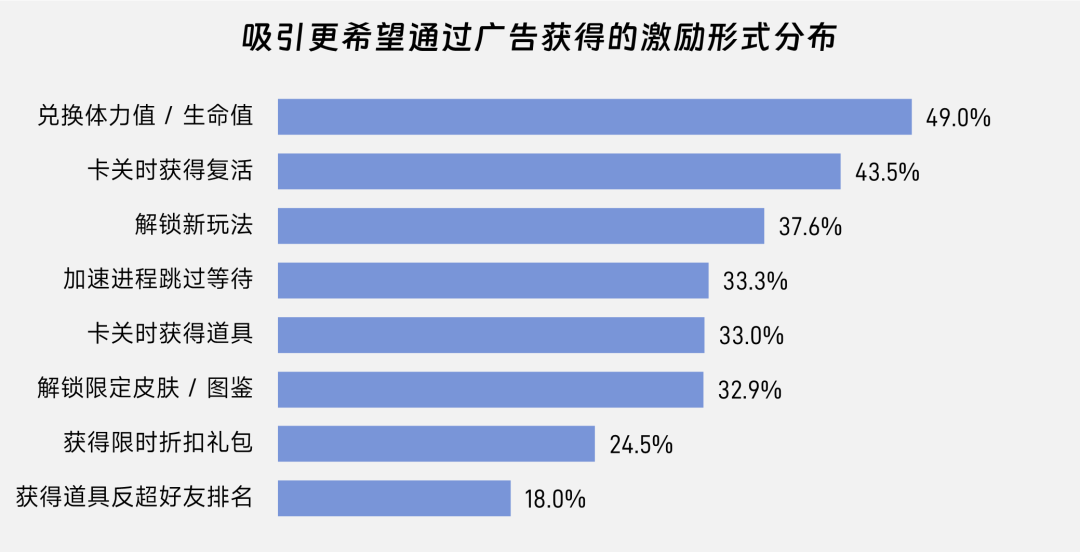

When monetizing by eliminating ads, exchanging stamina value/health, getting revived when stuck, and unlocking new gameplay are attractive points for TOP3 users. These contents are not only the focus of tuning the model, but also the key to influencing users' game progress. Because of this, over 7 categories of users can accept watching ads, thereby obtaining a smoother gaming experience.

Data source: Tencent Marketing Insights (TMI) “Tencent IAA's Insights on Eliminating User Behavior Trends in Mini Games (2025 Edition)”

Nasdaq

Nasdaq 華爾街日報

華爾街日報