Undervalued European Small Caps With Insider Buying To Watch In December 2025

As the European markets close out the year on a high note, with the STOXX Europe 600 Index climbing 1.60% amid signs of steady economic growth and favorable monetary policies, investors are increasingly turning their attention to small-cap stocks that may offer unique opportunities in this dynamic environment. With major indices like Italy’s FTSE MIB and the UK’s FTSE 100 showing robust gains, identifying small-cap stocks with strong fundamentals and potential insider confidence could be key in navigating these promising yet volatile market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

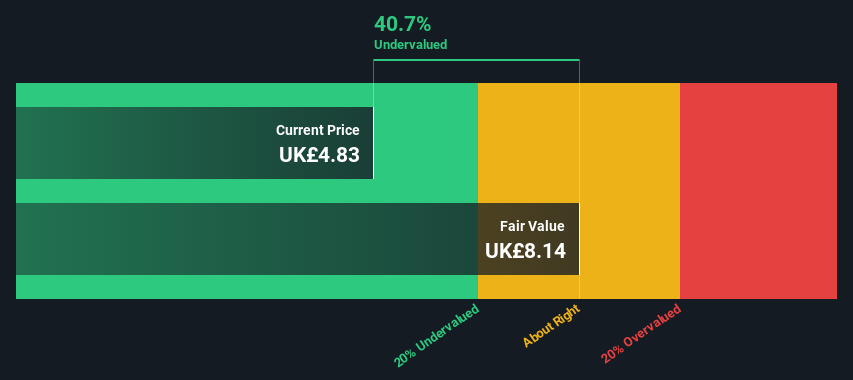

| Norcros | 13.7x | 0.7x | 41.20% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 42.22% | ★★★★★☆ |

| Tokmanni Group Oyj | 12.4x | 0.3x | 41.17% | ★★★★★☆ |

| Eastnine | 12.0x | 7.6x | 48.90% | ★★★★★☆ |

| A.G. BARR | 14.8x | 1.7x | 47.00% | ★★★★☆☆ |

| Eurocell | 17.0x | 0.3x | 38.40% | ★★★★☆☆ |

| Senior | 25.2x | 0.8x | 25.24% | ★★★★☆☆ |

| Gooch & Housego | 46.2x | 1.1x | 23.08% | ★★★☆☆☆ |

| Kendrion | 29.3x | 0.7x | 41.48% | ★★★☆☆☆ |

| CVS Group | 47.2x | 1.3x | 24.36% | ★★★☆☆☆ |

Let's explore several standout options from the results in the screener.

Property Franchise Group (AIM:TPFG)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Property Franchise Group is a company that operates in the property franchising sector, offering licensing and financial services, with a market cap of £1.01 billion.

Operations: The company generates revenue primarily from property franchising, financial services, and licensing. Notably, the net income margin has shown a varied trend over recent periods, with the most recent quarter recording a net income margin of 19.66%. Operating expenses are a significant part of the cost structure and have been increasing alongside revenue growth.

PE: 20.8x

Property Franchise Group, a small player in Europe's market, is currently on investors' radar due to its potential for growth. With earnings projected to grow by 12% annually, the company shows promise despite relying entirely on external borrowing for funding—a riskier approach without customer deposits. Insider confidence is evident as key figures have increased their stakes over recent months. Recent board changes could signal strategic shifts, potentially impacting future value and direction positively or negatively.

Citycon Oyj (HLSE:CTY1S)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Citycon Oyj is a real estate company that specializes in owning, managing, and developing urban grocery-anchored shopping centers in the Nordic and Baltic regions with a market capitalization of approximately €1.41 billion.

Operations: The company's revenue primarily comes from its operations, with a notable gross profit margin trend, which was 72.94% in December 2014 and decreased to 64.17% by December 2023. Operating expenses include significant allocations for general and administrative costs, which were €31.1 million at the end of 2023. Non-operating expenses also play a substantial role in financial outcomes, impacting net income significantly over time.

PE: -7.6x

Citycon Oyj, a European property company, has recently attracted attention due to insider confidence reflected in Chaim Katzman's purchase of 310,937 shares worth approximately €1.24 million. Despite facing volatility and high-risk funding through external borrowing, the company reported a significant turnaround with a net income of €24 million for Q3 2025 compared to a loss last year. G City Ltd's acquisition proposal for an additional stake further underscores potential interest in its assets. With earnings forecasted to grow by nearly 67% annually, Citycon presents intriguing potential amidst its challenges.

Card Factory (LSE:CARD)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Card Factory is a UK-based retailer specializing in greeting cards and related products, with a market cap of approximately £0.92 billion.

Operations: Card Factory generates revenue primarily through its Cardfactory Stores and Partnerships, with the stores being the dominant contributor. The company has experienced fluctuations in its net income margin, which was 10.67% as of July 2023 but decreased to 7.71% by July 2025. Operating expenses and cost of goods sold (COGS) are significant components impacting profitability, with COGS reaching £362.9 million in July 2025.

PE: 5.7x

Card Factory, a smaller player in Europe's market, is attracting attention due to its share repurchase program announced on October 30, 2025. Despite recent earnings showing a dip in net income to £5.6 million from £10.5 million last year, sales rose to £247.6 million. The company has also increased its interim dividend by 4.9%, reflecting confidence despite funding risks from external borrowing and volatile share prices over the past three months.

- Unlock comprehensive insights into our analysis of Card Factory stock in this valuation report.

Explore historical data to track Card Factory's performance over time in our Past section.

Summing It All Up

- Unlock more gems! Our Undervalued European Small Caps With Insider Buying screener has unearthed 70 more companies for you to explore.Click here to unveil our expertly curated list of 73 Undervalued European Small Caps With Insider Buying.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報