European Dividend Stocks To Consider In December 2025

As European markets show signs of steady economic growth and benefit from looser monetary policy, the pan-European STOXX Europe 600 Index has risen by 1.60%. With major stock indexes like Italy’s FTSE MIB and the UK’s FTSE 100 also experiencing gains, investors might look towards dividend stocks as a potential source of stable income in this environment. A good dividend stock typically offers a reliable yield and sustainable payout ratios, making it an attractive option for those seeking consistent returns amidst evolving market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.13% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.62% | ★★★★★★ |

| Swiss Re (SWX:SREN) | 4.47% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 4.02% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.85% | ★★★★★★ |

| Evolution (OM:EVO) | 4.86% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.12% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.33% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.29% | ★★★★★★ |

| Banca Popolare di Sondrio (BIT:BPSO) | 4.89% | ★★★★★☆ |

Click here to see the full list of 205 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

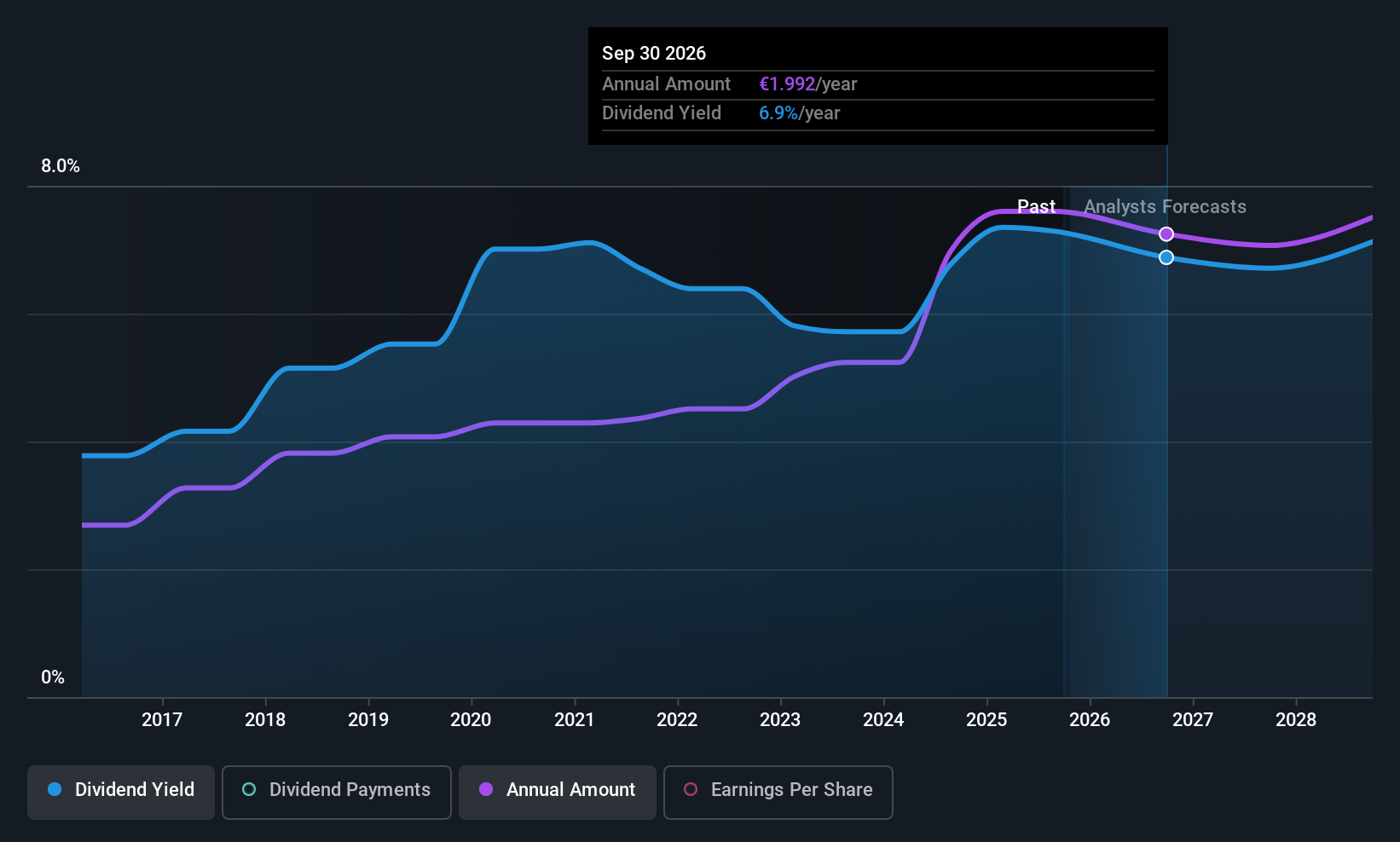

Logista Integral (BME:LOG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Logista Integral, S.A. operates as a distributor and logistics operator in Spain, France, Italy, Portugal, and Poland with a market cap of €3.92 billion.

Operations: Logista Integral, S.A. generates revenue primarily from Tobacco and Related Products (€12.63 billion), Transport Services (€899.96 million), and Pharmaceutical Distribution (€306.32 million).

Dividend Yield: 7.0%

Logista Integral's dividends have been reliably growing with stability over the past decade, offering a yield of 7.05%, which is in the top tier of Spanish market dividend payers. Despite this, its high payout ratio of 98.2% indicates dividends are not well covered by earnings, though they are reasonably supported by cash flows at a 50.5% cash payout ratio. Recent earnings show slight declines in net income and EPS compared to the previous year, suggesting potential challenges ahead for sustaining dividend growth without improved profitability.

- Click here to discover the nuances of Logista Integral with our detailed analytical dividend report.

- The analysis detailed in our Logista Integral valuation report hints at an inflated share price compared to its estimated value.

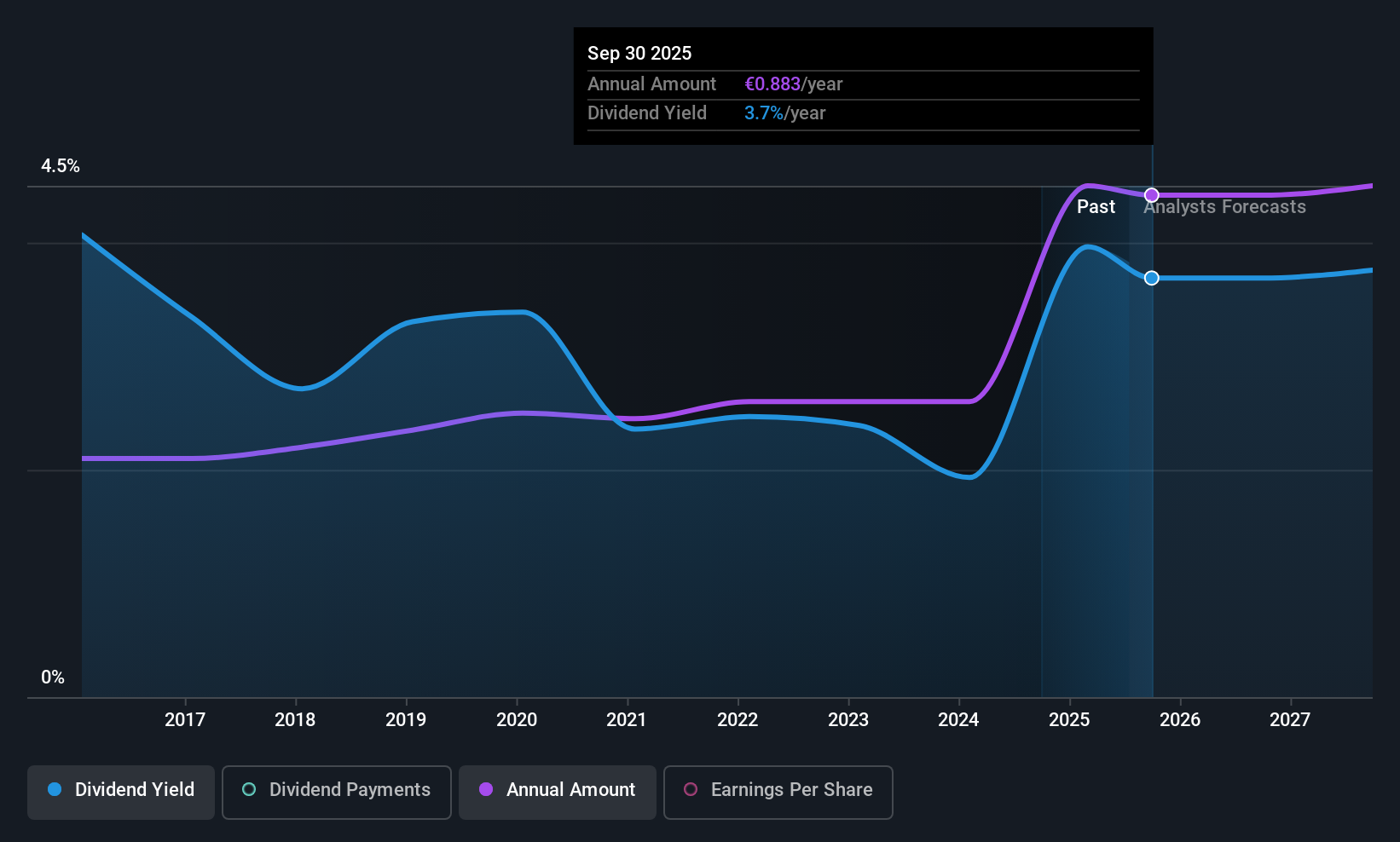

EVN (WBAG:EVN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: EVN AG is an energy and environmental services provider operating in Austria, Bulgaria, North Macedonia, Croatia, Germany, and Albania with a market cap of €5.05 billion.

Operations: EVN AG generates revenue from various segments, including Energy (€684.70 million), Networks (€713.90 million), Generation (€356.60 million), Environment (€421.90 million), and South East Europe (€1.50 billion).

Dividend Yield: 3.2%

EVN's dividends have shown stability and growth over the past decade, though their 3.18% yield is below Austria's top dividend payers. The payout ratio of 35.4% suggests dividends are well covered by earnings, yet a high cash payout ratio of 112.6% indicates insufficient cash flow support, raising sustainability concerns. Trading at a price-to-earnings ratio of 11.1x, EVN is valued attractively compared to the broader Austrian market average of 15.5x.

- Click here and access our complete dividend analysis report to understand the dynamics of EVN.

- Our valuation report here indicates EVN may be undervalued.

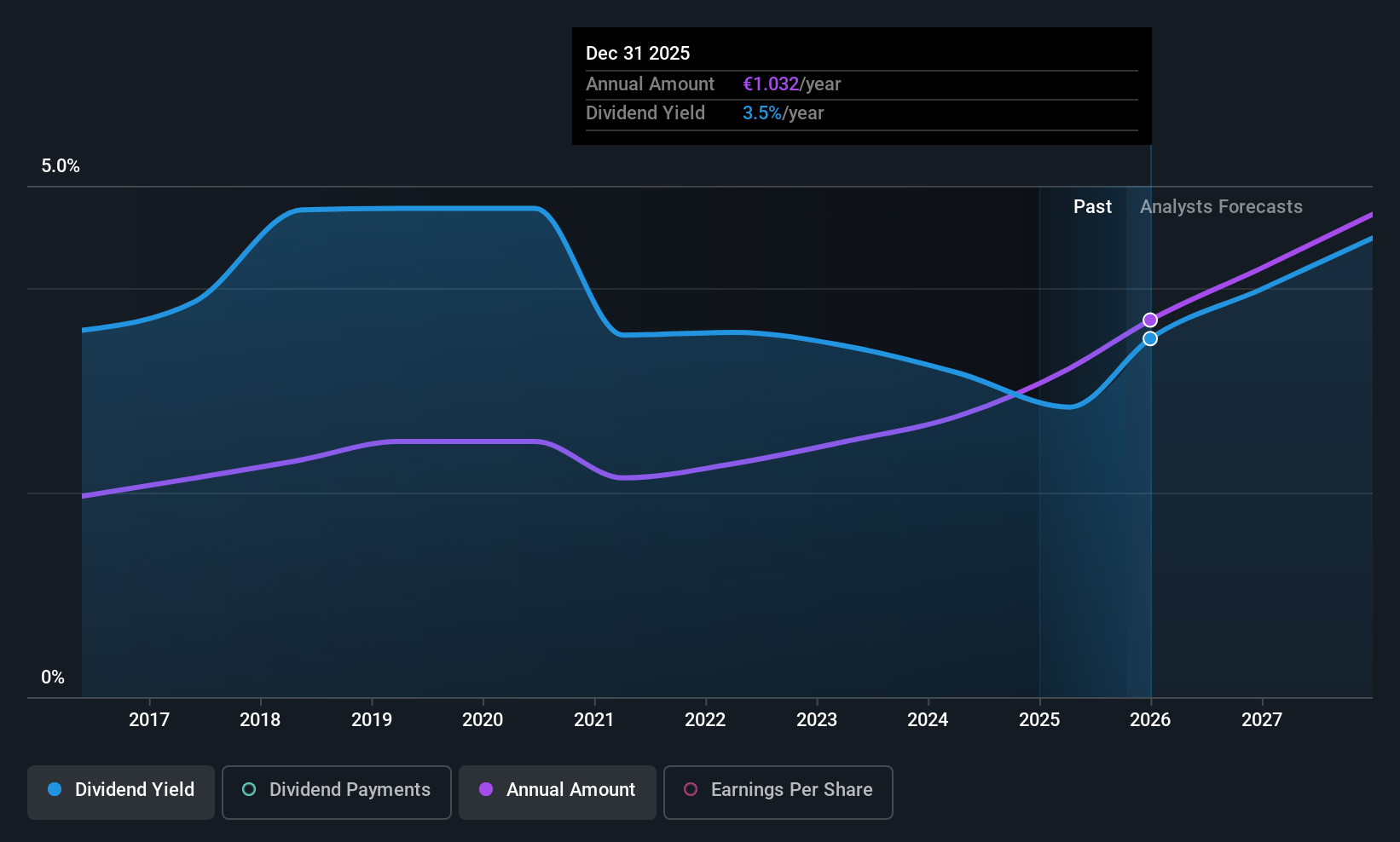

Deutsche Telekom (XTRA:DTE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Deutsche Telekom AG, along with its subsidiaries, offers integrated telecommunication services globally and has a market cap of approximately €130.23 billion.

Operations: Deutsche Telekom AG generates its revenue from various segments, including €12.55 billion from Europe, €25.43 billion from Germany, €77.62 billion from the United States, and €4.08 billion from Systems Solutions.

Dividend Yield: 3.3%

Deutsche Telekom offers a stable dividend with a 3.29% yield, supported by low payout ratios of 36.4% from earnings and 18.3% from cash flow, ensuring sustainability. Despite trading below estimated fair value, the yield is lower than Germany's top dividend payers. Recent strategic alliances with OpenAI and Nvidia enhance its technological capabilities, potentially boosting future growth and innovation without immediate impact on dividends but strengthening long-term operational resilience and market positioning in AI-driven services.

- Delve into the full analysis dividend report here for a deeper understanding of Deutsche Telekom.

- Insights from our recent valuation report point to the potential undervaluation of Deutsche Telekom shares in the market.

Where To Now?

- Get an in-depth perspective on all 205 Top European Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報