Assessing BlackSky Technology (BKSY) Valuation After Rapid Deployment of Its Third Gen‑3 Satellite

BlackSky Technology (BKSY) just brought its third Gen 3 satellite into commercial service only three weeks after launch, a speed upgrade that meaningfully boosts its imaging capacity and strengthens the underlying case for the stock.

See our latest analysis for BlackSky Technology.

That rapid Gen 3 rollout lands at a time when the share price has climbed to about $19.25, with strong recent momentum evident in its 1 month share price return of 25.57 percent and an 80.07 percent year to date share price return. The 1 year total shareholder return of 80.41 percent hints that investors are steadily warming to the growth story despite a more mixed multi year track record.

If this kind of space based data play has your attention, it is worth exploring other potential opportunities across high growth tech and AI stocks that are also riding structural demand for advanced analytics.

Yet with revenues growing, losses narrowing and the share price already up sharply this year, the real debate now is simple: is BlackSky still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 29.5% Undervalued

With BlackSky Technology last closing at $19.25 against a narrative fair value of $27.29, the valuation debate pivots on ambitious growth and margin assumptions.

The ramp-up of the Gen-3 satellite constellation, coupled with demonstrated high performance and lower costs, is creating strong demand and contract expansion (especially once general availability launches in Q4) and is likely to drive a step-function increase in recurring imagery and analytics revenues in 2025 and beyond.

Want to see what kind of revenue surge and margin reset could justify that gap, and how far out the payoff is meant to be? The narrative hinges on aggressive top line growth, a sharp swing toward positive profitability and a valuation multiple usually reserved for market darlings. Curious how those moving parts combine into that fair value line? Read on to unpack the full story behind the numbers.

Result: Fair Value of $27.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering dependence on government and early access contracts means that slower Gen 3 adoption or contract delays could quickly puncture those upbeat growth assumptions.

Find out about the key risks to this BlackSky Technology narrative.

Another Angle on Valuation

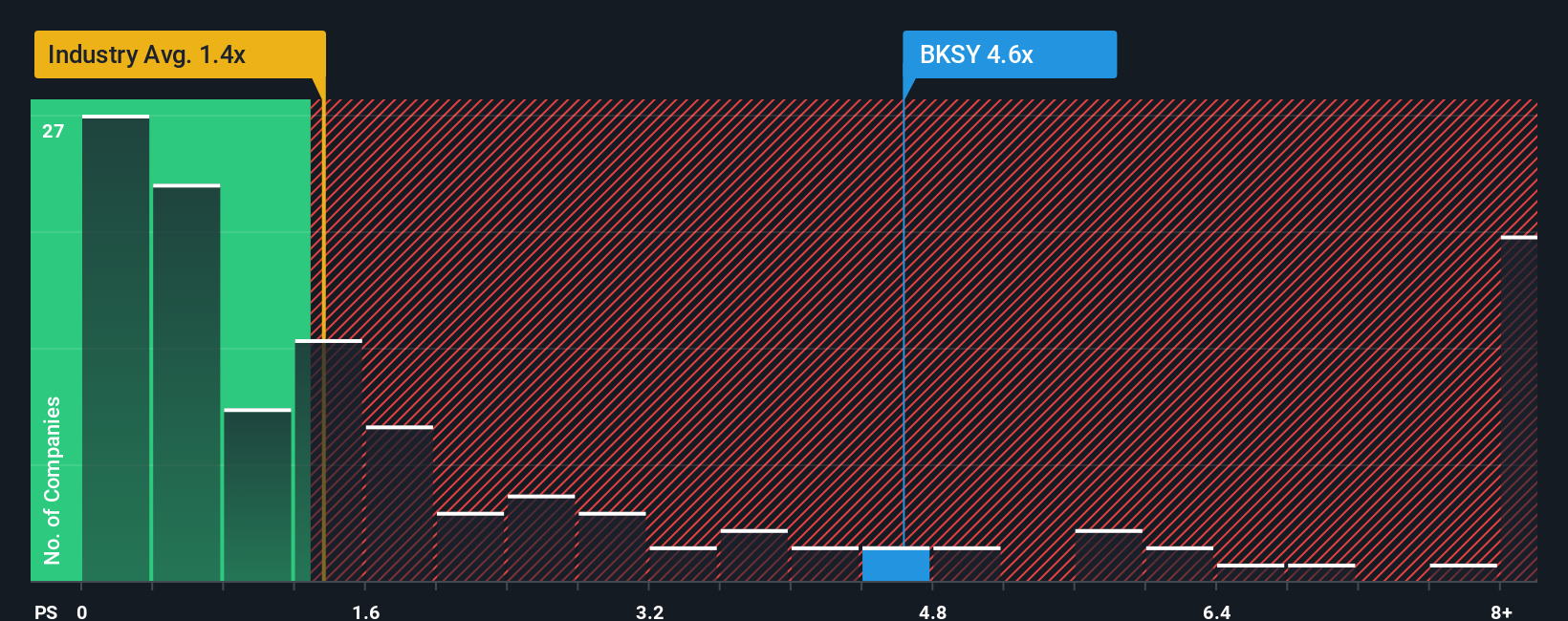

On simple price to sales math, the story looks less generous. BlackSky trades around 6.8 times sales, far richer than both peers at 2.1 times and a fair ratio of 3.2 times. That premium suggests the market already bakes in big execution, leaving limited room for missteps.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BlackSky Technology Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes: Do it your way.

A great starting point for your BlackSky Technology research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential move by scanning targeted stock ideas from the Simply Wall Street Screener that match your strategy.

- Consider early high-upside opportunities by tracking these 3632 penny stocks with strong financials that combine low share prices with relatively robust financial fundamentals.

- Explore potential future tech leaders by focusing on these 24 AI penny stocks that use artificial intelligence innovations to support real, scalable revenue.

- Seek to strengthen your portfolio’s long-term return profile with these 912 undervalued stocks based on cash flows that trade below what their future cash flows may justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報