Ryan Specialty (RYAN): Reassessing Valuation After CEO Share Sale and Board Changes Linked to Major Investor Exit

Ryan Specialty Holdings (RYAN) is back in focus after CEO Timothy Turner sold a sizable block of shares, just as a long time board member prepares to step down following Onex’s full exit.

See our latest analysis for Ryan Specialty Holdings.

Those leadership changes are landing against a softer patch for the stock, with a 1 month share price return of minus 7.75 percent and year to date share price return of minus 15.58 percent, even though the 3 year total shareholder return of 32.9 percent still points to longer term momentum rather than a broken story.

If this mix of insider moves and shifting momentum has you rethinking your playbook, it might be worth exploring fast growing stocks with high insider ownership as a fresh hunting ground for ideas.

With revenue still growing double digits, earnings expanding faster, and the stock trading below consensus targets, investors face a key question: is Ryan Specialty now a mispriced growth compounder or is the market already discounting its future?

Most Popular Narrative: 20.5% Undervalued

With Ryan Specialty shares last closing at $52.87 and the narrative fair value sitting at about $66.53, followers see meaningful upside from here.

The company's continued expansion into higher margin specialty lines, especially through innovative product launches in alternative and complex risks, and acquisition of niche MGUs, is expected to increase the contribution from diverse, less commoditized business. This may help stabilize and grow earnings even when traditional property pricing cycles are volatile.

Want to see what powers that upside view? The narrative leans on aggressive earnings growth, rising margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $66.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case leans heavily on continued double digit growth, which leaves the narrative vulnerable if softening P&C pricing deepens or M&A integration disappoints.

Find out about the key risks to this Ryan Specialty Holdings narrative.

Another Angle On Valuation

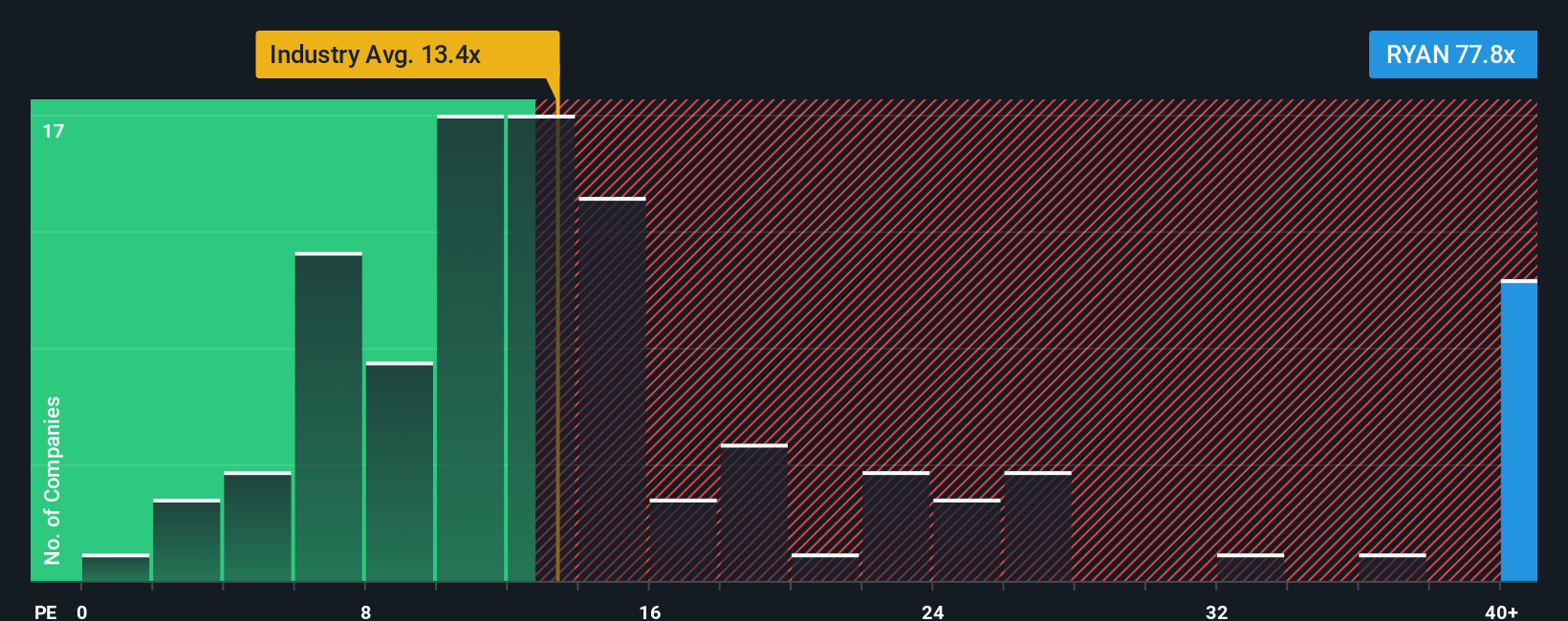

Step away from fair values and narratives, and the current price tag looks far less forgiving. Ryan Specialty trades on a P E ratio of 96.6 times, versus 30.7 times for peers and a fair ratio of about 29 times, which points to real multiple compression risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ryan Specialty Holdings Narrative

If this view does not match your own, or you would rather dig into the numbers yourself, you can build a tailored thesis in just a few minutes: Do it your way.

A great starting point for your Ryan Specialty Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Do not stop at a single stock when high conviction opportunities are just a few clicks away. Use these targeted screeners to sharpen your next move.

- Explore potential market mispricing by targeting quality companies trading at compelling valuations through these 912 undervalued stocks based on cash flows that highlight strong cash flow support.

- Follow structural trends by focusing on innovation leaders uncovered in these 24 AI penny stocks that are positioned at the front of the AI adoption curve.

- Review income-oriented opportunities by considering reliable payers selected via these 12 dividend stocks with yields > 3% that combine solid yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報