MotorCycle Holdings Leads ASX Penny Stocks Worth Considering

As Australian shares edge up by 0.5% to close out the year, investors are eyeing opportunities that may extend into January, despite a lackluster December. For those interested in exploring beyond well-known names, penny stocks—often representing smaller or newer companies—remain an intriguing area of investment. While the term "penny stock" might seem outdated, these companies can still offer surprising value and potential when backed by solid financials.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Rewards & Risks |

| Alfabs Australia (ASX:AAL) | A$0.39 | A$118.93M | ✅ 4 ⚠️ 4 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.50 | A$68.17M | ✅ 2 ⚠️ 2 View Analysis > |

| Dusk Group (ASX:DSK) | A$0.775 | A$48.57M | ✅ 4 ⚠️ 2 View Analysis > |

| IVE Group (ASX:IGL) | A$2.87 | A$441.09M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$2.85 | A$3.24B | ✅ 4 ⚠️ 2 View Analysis > |

| Service Stream (ASX:SSM) | A$2.22 | A$1.36B | ✅ 3 ⚠️ 2 View Analysis > |

| EDU Holdings (ASX:EDU) | A$0.84 | A$120.9M | ✅ 4 ⚠️ 2 View Analysis > |

| Fleetwood (ASX:FWD) | A$2.48 | A$228.68M | ✅ 4 ⚠️ 2 View Analysis > |

| MaxiPARTS (ASX:MXI) | A$2.21 | A$122.75M | ✅ 4 ⚠️ 2 View Analysis > |

| GWA Group (ASX:GWA) | A$2.45 | A$639.96M | ✅ 5 ⚠️ 1 View Analysis > |

Click here to see the full list of 427 stocks from our ASX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

MotorCycle Holdings (ASX:MTO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: MotorCycle Holdings Limited owns and operates motorcycle dealerships in Australia, with a market cap of A$243.01 million.

Operations: The company generates revenue through two primary segments: Motorcycle Retailing, which accounts for A$454.38 million, and Motorcycle and Accessories Wholesaling, contributing A$243.54 million.

Market Cap: A$243.01M

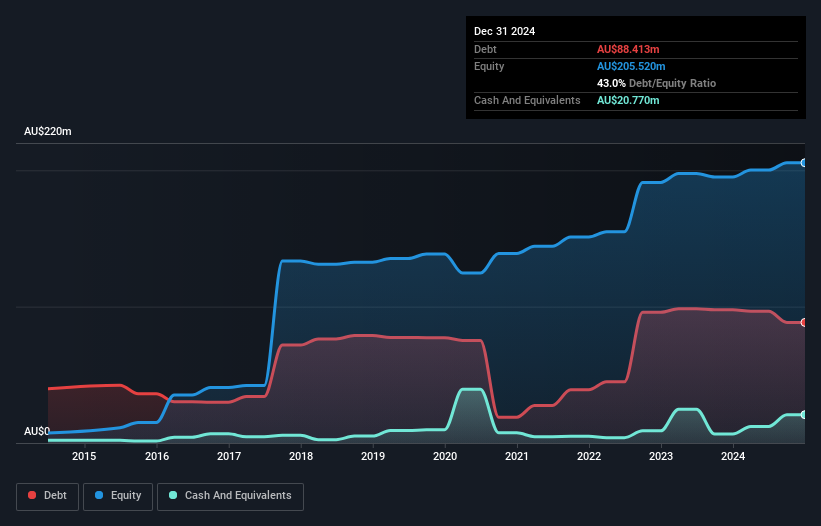

MotorCycle Holdings Limited, with a market cap of A$243.01 million, has shown robust financial health with short-term assets exceeding both its short and long-term liabilities. The company's debt is well covered by operating cash flow and interest payments are comfortably managed by EBIT. Earnings have grown significantly, outpacing the Specialty Retail industry, although the management team lacks experience due to recent changes. Trading below estimated fair value suggests potential upside, though investors should be cautious of its unstable dividend track record. Recent board changes include the resignation of former CEO Dave Ahmet from his Non-Executive Director role for personal reasons.

- Get an in-depth perspective on MotorCycle Holdings' performance by reading our balance sheet health report here.

- Gain insights into MotorCycle Holdings' future direction by reviewing our growth report.

NuEnergy Gas (ASX:NGY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NuEnergy Gas Limited is an independent clean energy company focused on exploring, appraising, and developing coal bed methane gas projects in Indonesia with a market cap of A$67.16 million.

Operations: NuEnergy Gas Limited does not currently report any revenue segments.

Market Cap: A$67.16M

NuEnergy Gas Limited, with a market cap of A$67.16 million, is pre-revenue and focuses on coal bed methane projects in Indonesia. Recently, the company completed drilling for its TE-B01-003 well under the Tanjung Enim PSC Plan of Development 1, marking progress toward initial gas sales. Despite an unprofitable status and auditor concerns about its going concern viability, NuEnergy has raised additional capital through follow-on equity offerings totaling A$8.08 million to support operations. While it maintains a satisfactory net debt to equity ratio at 8.9%, short-term liabilities exceed assets significantly (A$16.9M vs A$3.3M).

- Unlock comprehensive insights into our analysis of NuEnergy Gas stock in this financial health report.

- Explore NuEnergy Gas' analyst forecasts in our growth report.

SRG Global (ASX:SRG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: SRG Global Limited operates as an engineering, mining, maintenance and construction contractor in Australia and New Zealand, with a market cap of A$1.85 billion.

Operations: The company generates revenue from two primary segments: Engineering and Construction, which contributes A$455.93 million, and Maintenance and Industrial Services, which brings in A$867.38 million.

Market Cap: A$1.85B

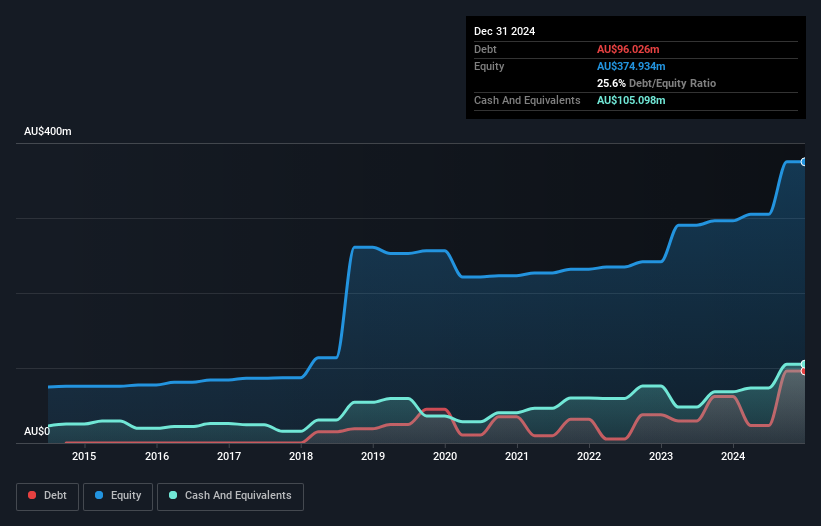

SRG Global, with a market cap of A$1.85 billion, stands out in the engineering and construction sector due to its robust financials and strategic maneuvers. The company has demonstrated strong debt management, as operating cash flow comfortably covers its debt obligations and interest payments are well-covered by EBIT. SRG's earnings have been on an upward trajectory, growing 37.9% over the past year, surpassing industry averages. Despite a low return on equity at 12.1%, the company's valuation appears attractive as it trades below estimated fair value. Recent M&A discussions signal potential growth through strategic acquisitions like TAMS.

- Dive into the specifics of SRG Global here with our thorough balance sheet health report.

- Understand SRG Global's earnings outlook by examining our growth report.

Key Takeaways

- Reveal the 427 hidden gems among our ASX Penny Stocks screener with a single click here.

- Searching for a Fresh Perspective? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報