Investors Interested In Meidensha Corporation's (TSE:6508) Earnings

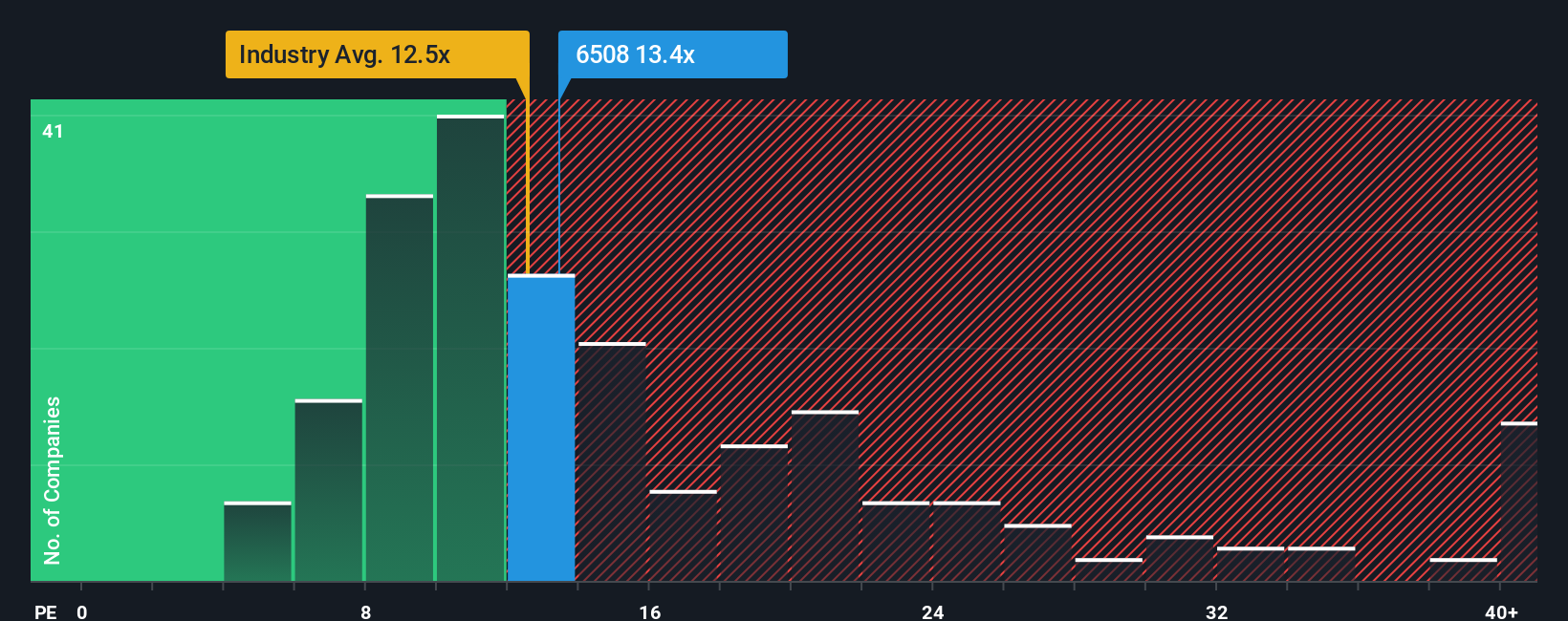

There wouldn't be many who think Meidensha Corporation's (TSE:6508) price-to-earnings (or "P/E") ratio of 13.4x is worth a mention when the median P/E in Japan is similar at about 14x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Meidensha certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is moderate because investors think this strong earnings performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Meidensha

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like Meidensha's is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 23% gain to the company's bottom line. The latest three year period has also seen an excellent 199% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 7.1% per annum as estimated by the six analysts watching the company. That's shaping up to be similar to the 9.0% per year growth forecast for the broader market.

In light of this, it's understandable that Meidensha's P/E sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Meidensha's analyst forecasts revealed that its market-matching earnings outlook is contributing to its current P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Meidensha (of which 1 can't be ignored!) you should know about.

If you're unsure about the strength of Meidensha's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報