Norfolk Southern (NSC): Reassessing Valuation After a Strong Year-to-Date Share Price Rally

Norfolk Southern (NSC) has quietly outpaced many peers this year, with the stock up about 24% year to date, even after slipping slightly over the past week.

See our latest analysis for Norfolk Southern.

That 24.2% year to date share price return, alongside a 27.1% total shareholder return over the past year, suggests momentum is still broadly intact as investors reassess rail demand, efficiency gains, and operational risk following recent network and safety initiatives.

If Norfolk Southern’s run has you rethinking where the next opportunity might be, it could be worth scanning fast growing stocks with high insider ownership as a fresh hunting ground for potential leaders.

Yet with shares hovering near 52 week highs and trading only modestly below analyst targets, investors now face a key question: is Norfolk Southern still undervalued or is the market already pricing in its future growth?

Most Popular Narrative: 5.5% Undervalued

With Norfolk Southern last closing at 291.41 dollars against a narrative fair value of about 308 dollars, the storyline leans toward modest upside potential based on steady execution rather than explosive growth.

The analysts have a consensus price target of 298.158 dollars for Norfolk Southern based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of 339.0 dollars, and the most bearish reporting a price target of just 235.0 dollars.

Curious how relatively low revenue growth, firm but easing margins, and a higher future earnings multiple still add up to upside potential? Unlock the full valuation playbook behind this narrative and see which assumptions are quietly doing the heavy lifting.

Result: Fair Value of $308.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could be knocked off track by weaker industrial demand or intensifying price competition across freight and intermodal corridors.

Find out about the key risks to this Norfolk Southern narrative.

Another Angle on Value

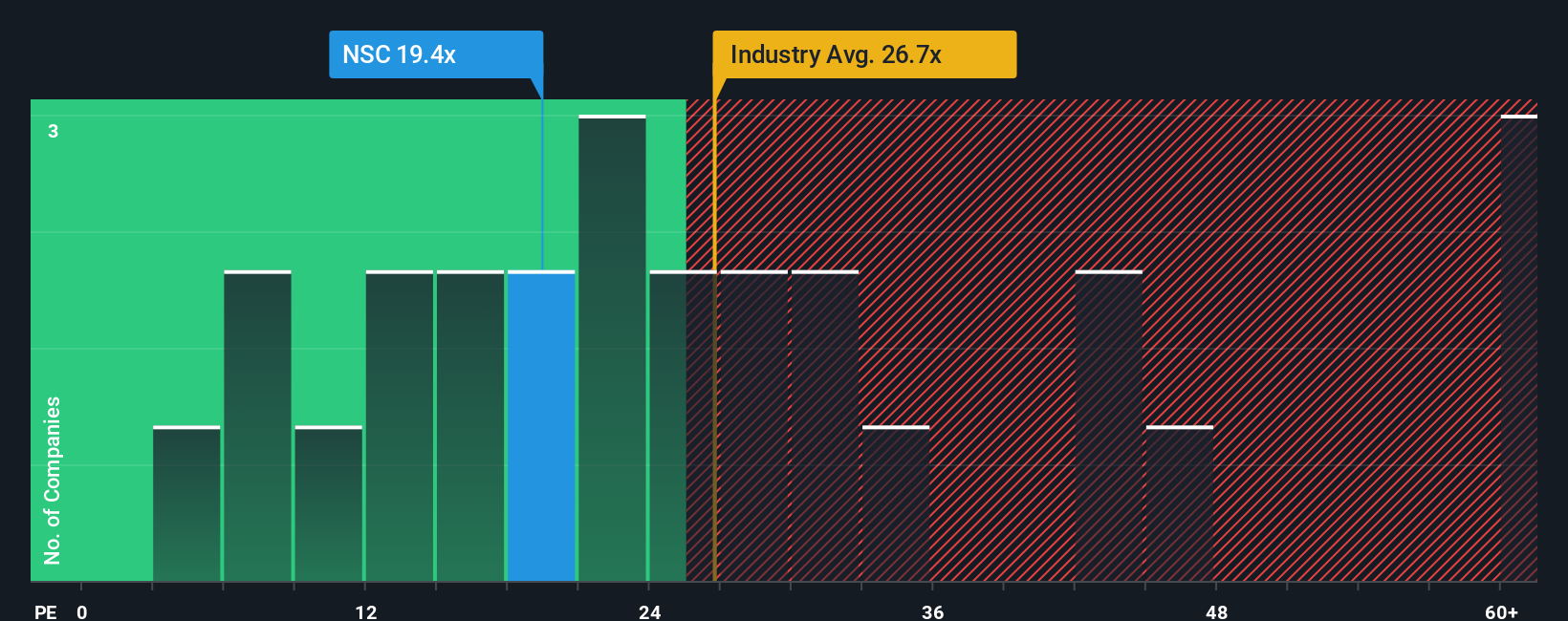

On earnings based valuation, Norfolk Southern looks less generous. The stock trades around 22.1 times earnings versus a fair ratio of roughly 18.1 times, and above its own intrinsic estimate of 218.24 dollars per share, hinting at downside risk if sentiment cools. Which story do you believe?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Norfolk Southern Narrative

If you are not fully convinced by this perspective or prefer to dig into the numbers yourself, you can build a personalised view in minutes: Do it your way.

A great starting point for your Norfolk Southern research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, put your research momentum to work and explore a few fresh opportunities using targeted screeners that surface quality ideas in seconds.

- Uncover potential mispricings by scanning these 912 undervalued stocks based on cash flows that could offer upside if the market catches up to their cash flow strength.

- Capitalize on sector shifts by zeroing in on these 29 healthcare AI stocks at the intersection of medicine and machine learning.

- Position ahead of speculative waves by reviewing these 79 cryptocurrency and blockchain stocks that are building real businesses around blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報