Weak Results and Analyst Downgrades Could Be A Game Changer For LyondellBasell Industries (LYB)

- In recent months, LyondellBasell Industries has reported weaker quarterly results, with double-digit year-over-year declines across all five operating segments and sizable impairment charges, prompting concerns about rising leverage and the resilience of its high dividend yield.

- At the same time, a series of cautious analyst updates has shifted sentiment, as major firms reassess LyondellBasell’s risk profile in light of pressure on earnings quality and balance sheet strength.

- Next, we’ll consider how the string of analyst downgrades and worries about dividend sustainability may reshape LyondellBasell’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

LyondellBasell Industries Investment Narrative Recap

To own LyondellBasell today, you need to be comfortable with a cyclical petrochemicals business that is currently unprofitable and carrying high leverage, while offering a very high dividend yield that may be under pressure. The latest weak quarter and analyst downgrades primarily reinforce the near term risk that cash flows and the balance sheet may struggle to support both the dividend and future investment, which is now the key issue to watch.

Against this backdrop, the company’s decision in November 2025 to affirm a US$1.37 per share dividend stands out, because it directly touches the central short term catalyst and risk: whether that payout can be maintained given recent losses and rising leverage. For investors, that announcement, combined with a near 13% yield and cautious analyst revisions, puts the sustainability of shareholder returns at the heart of the LyondellBasell story.

Yet behind the headline yield, there is a separate balance sheet concern that investors should be aware of, especially if earnings remain under pressure...

Read the full narrative on LyondellBasell Industries (it's free!)

LyondellBasell Industries' narrative projects $29.2 billion revenue and $2.2 billion earnings by 2028. This requires a 9.0% yearly revenue decline and about a $2.1 billion earnings increase from $150.0 million today.

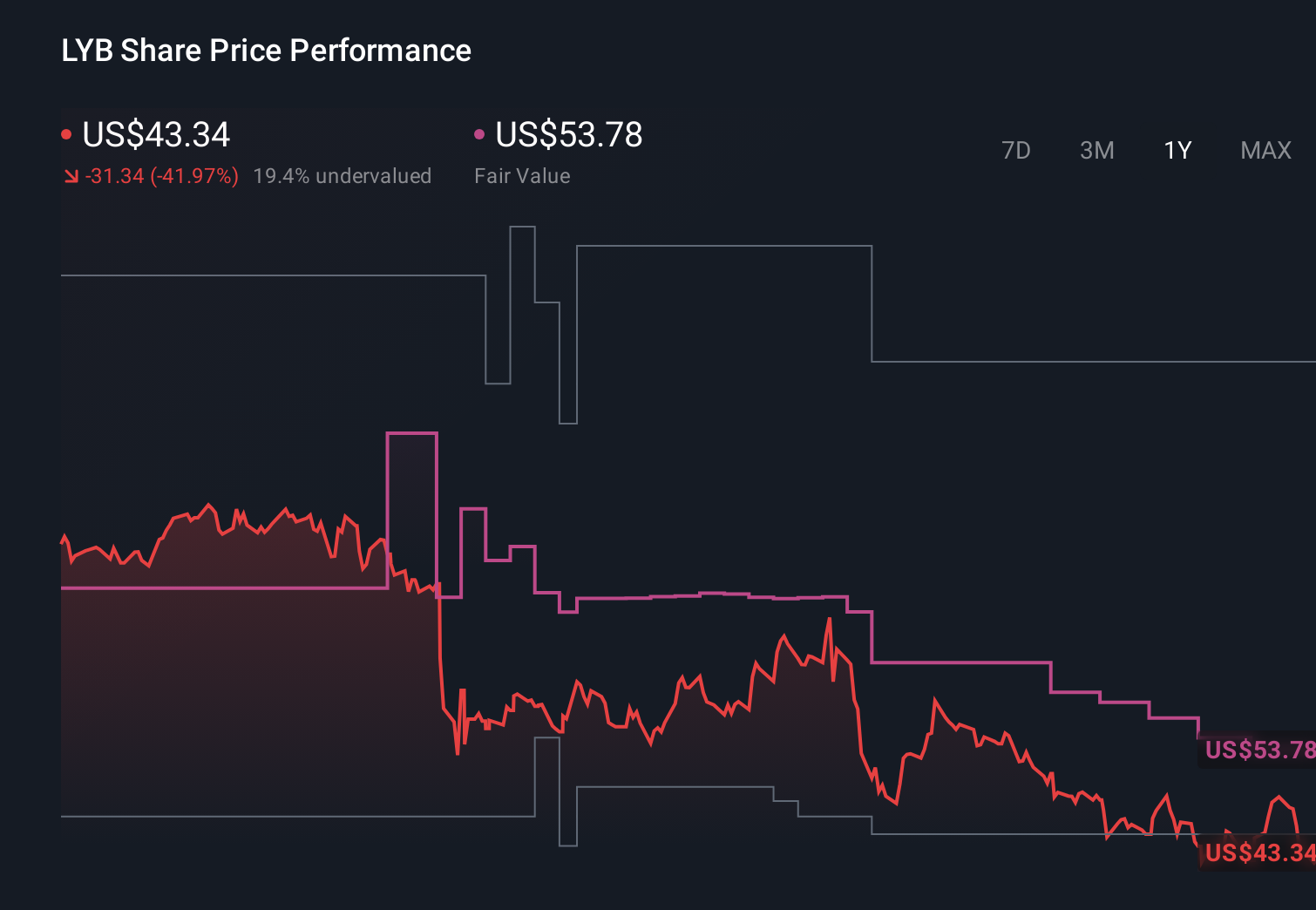

Uncover how LyondellBasell Industries' forecasts yield a $51.61 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Eleven fair value estimates from the Simply Wall St Community span roughly US$38 to US$87 per share, showing how far apart individual views can be. Set against worries about dividend coverage and rising leverage, this spread underlines why it can help to weigh several different scenarios for LyondellBasell’s future performance.

Explore 11 other fair value estimates on LyondellBasell Industries - why the stock might be worth over 2x more than the current price!

Build Your Own LyondellBasell Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LyondellBasell Industries research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free LyondellBasell Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LyondellBasell Industries' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報