The Market Lifts PlaySide Studios Limited (ASX:PLY) Shares 31% But It Can Do More

PlaySide Studios Limited (ASX:PLY) shareholders would be excited to see that the share price has had a great month, posting a 31% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 41% in the last twelve months.

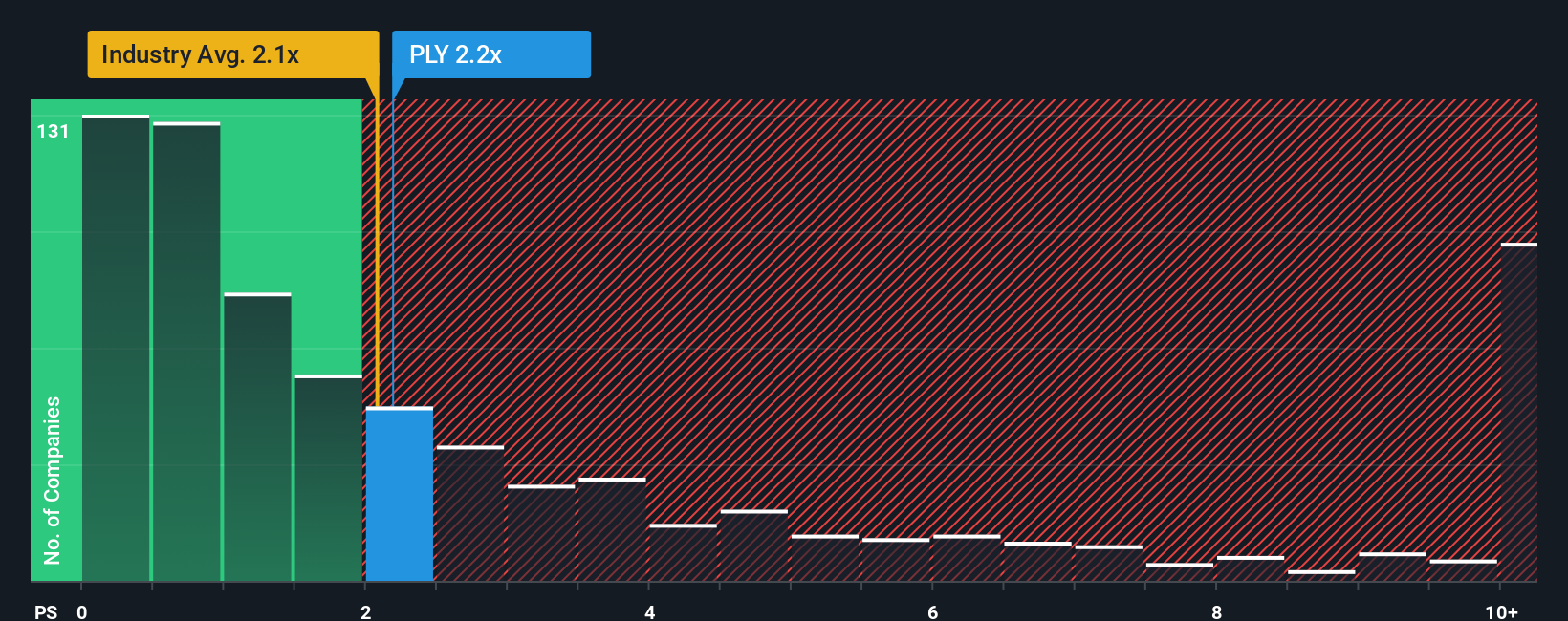

Even after such a large jump in price, there still wouldn't be many who think PlaySide Studios' price-to-sales (or "P/S") ratio of 2.2x is worth a mention when it essentially matches the median P/S in Australia's Entertainment industry. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for PlaySide Studios

How PlaySide Studios Has Been Performing

While the industry has experienced revenue growth lately, PlaySide Studios' revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on PlaySide Studios will help you uncover what's on the horizon.How Is PlaySide Studios' Revenue Growth Trending?

PlaySide Studios' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. Even so, admirably revenue has lifted 67% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 16% each year during the coming three years according to the two analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 12% per annum, which is noticeably less attractive.

In light of this, it's curious that PlaySide Studios' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From PlaySide Studios' P/S?

PlaySide Studios' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that PlaySide Studios currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for PlaySide Studios that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報