IPO News | Zejing Pharmaceutical (688266.SH) reports that the Hong Kong Stock Exchange owns three marketed drugs

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 19, Suzhou Zejing Biopharmaceutical Co., Ltd. (688266.SH) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CICC is its sole sponsor.

Company profile

According to the prospectus, Zejing Pharmaceutical is a comprehensive biopharmaceutical company focusing on the discovery, development and commercialization of innovative small molecule and biologic therapeutics. The strategy focuses on the fields of oncology, autoimmune diseases, and hemostasis/hematologic diseases. Since its establishment in 2009, the company has established comprehensive end-to-end capabilities covering drug discovery, R&D, production and commercialization, thereby building a diversified and multi-level pipeline and successfully commercializing it.

As of the last practical date, Zejing Pharmaceutical has three marketed drugs: Zepsen® (donafinil toluene sulfonate tablets), the first locally developed small-molecule multi-target drug for first-line treatment of advanced liver cancer in China; zeppine® (dicaxitinib hydrochloride tablets), the first locally developed innovative JAK inhibitor for the treatment of myelofibrosis; and Zeptinin® (recombinant human thrombin), the only recombinant human thrombin developed and successfully commercialized in China using recombinant DNA technology.

According to reports, Zejing Pharmaceutical's drug candidate pipeline includes 11 drug candidates for 28 major clinical projects (including Zepupin® and clinical projects related to autoimmune diseases). Among them, 7 indications for 3 drug candidates have entered the BLA/NDA or critical/phase III registration clinical trial stage.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the nine months ended September 30, the company recorded revenue of RMB 302 million, 384 million yuan, $532 million and 593 million yuan respectively.

Annual/period loss

In 2022, 2023, 2024, and the nine months ended September 30, 2025, the company recorded losses of RMB486 million, RMB295 million, RMB150 million and RMB95.96 million respectively.

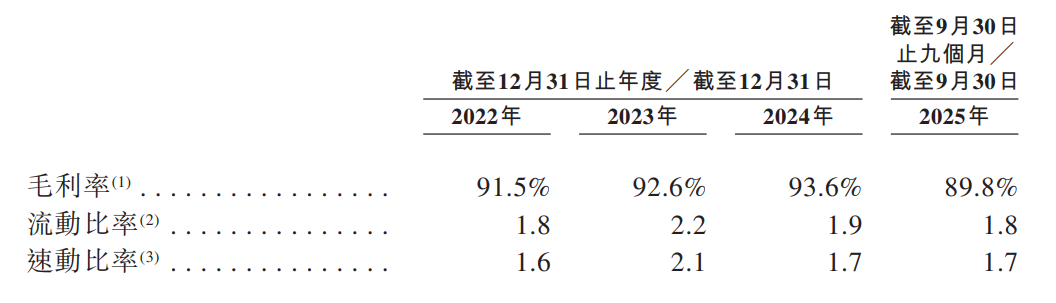

gross profit margin

For the nine months ended September 30 in 2022, 2023, 2024, and 2025, the company's corresponding gross profit margins were 91.5%, 92.6%, 93.6%, and 89.8%.

Industry Overview

The global pharmaceutical market, which includes chemical drugs and biologics, is expected to reach US$2,6493 billion by 2035, with a compound annual growth rate of 5.1% from 2030 to 2035. In China, driven by strong economic growth and increased demand for healthcare, the market is expected to grow faster than the global growth rate, reaching RMB 3103.4 billion by 2035, with a compound annual growth rate of 7.8%.

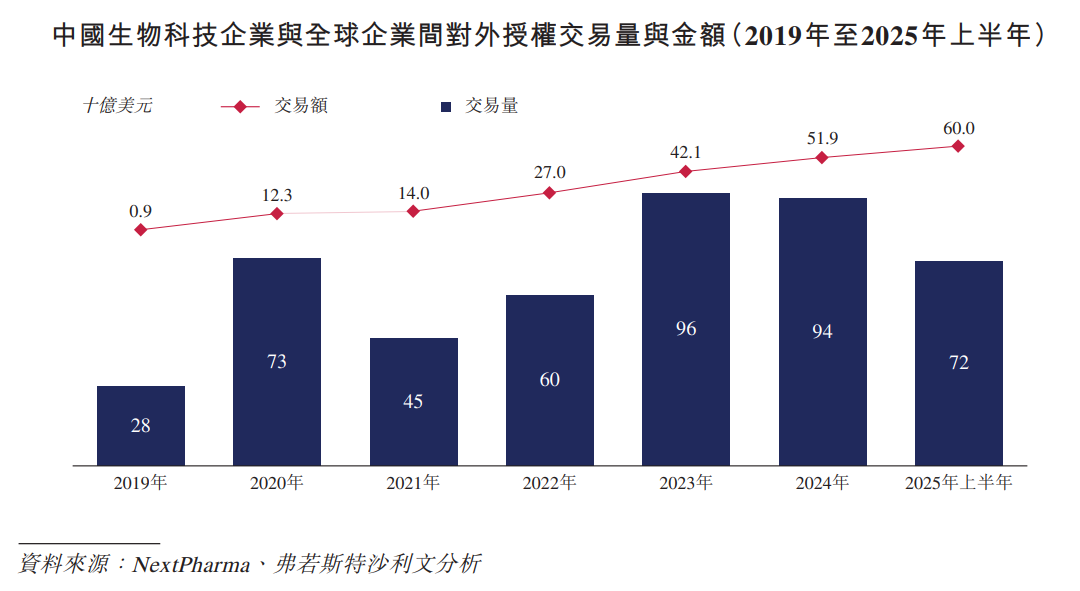

In recent years, China's foreign licensing activities have grown rapidly. In 2024 alone, China completed 94 foreign authorized transactions, with a total disclosed transaction amount of US$51.9 billion. In the first half of 2025, China completed a total of 72 foreign licensing transactions, with a total disclosed amount of 60 billion US dollars. The momentum is strong.

From a global perspective, pharmaceutical transactions showed a decline in transaction volume, but the total transaction amount continued to grow, from US$177.5 billion in 2021 to US$187.4 billion in 2024, reaching US$130.4 billion in the first half of 2025. This shift indicates that the industry is strategically shifting to value enhancement and quality-oriented investment, driving a sharp increase in average transaction amount. China plays an important role in global licensing transactions, accounting for about 25% of global transactions worth more than 500 million US dollars.

Board Information

The board of directors will be composed of nine directors, including three executive directors, three non-executive directors and three independent non-executive directors.

Shareholding structure

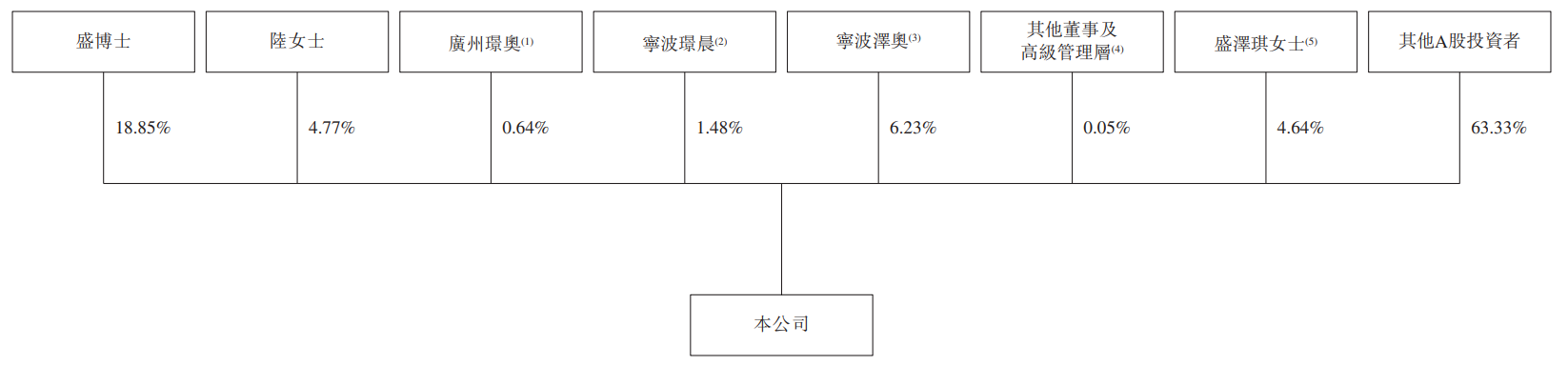

According to the unanimous action agreement dated April 12, 2019 and the updated concerted action agreement dated January 23, 2025, Ms. Lu has acted and will continue to act in concert with Dr. Sheng on matters relating to the company's shareholders' meeting and board of directors meetings. According to the Concerted Action Agreement and the updated Concerted Action Agreement, Dr. Sheng and Ms. Lu directly controlled a total of 62,542,171 shares, accounting for about 23.63% of the Company's voting rights on the last practical date.

Intermediary team

Sole sponsor: China International Finance Hong Kong Securities Limited

Company Legal Advisors: Clu Hong Kong Law Firm, Jun He Law Firm

Sole sponsor legal advisors: Beck McKenzie International Law Firm, Jia Yuan Law Firm

Reporting Accountant: Xinyong Zhonghe (Hong Kong) Certified Public Accountants Limited

Industry Advisor: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch

Nasdaq

Nasdaq 華爾街日報

華爾街日報