Optimism for India Cements (NSE:INDIACEM) has grown this past week, despite five-year decline in earnings

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But on the bright side, you can make far more than 100% on a really good stock. For example, the The India Cements Limited (NSE:INDIACEM) share price has soared 203% in the last half decade. Most would be very happy with that. On top of that, the share price is up 12% in about a quarter.

After a strong gain in the past week, it's worth seeing if longer term returns have been driven by improving fundamentals.

While India Cements made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over the last half decade India Cements' revenue has actually been trending down at about 1.1% per year. On the other hand, the share price done the opposite, gaining 25%, compound, each year. It just goes to show tht the market is forward looking, and it's not always easy to predict the future based on past trends. Still, this situation makes us a little wary of the stock.

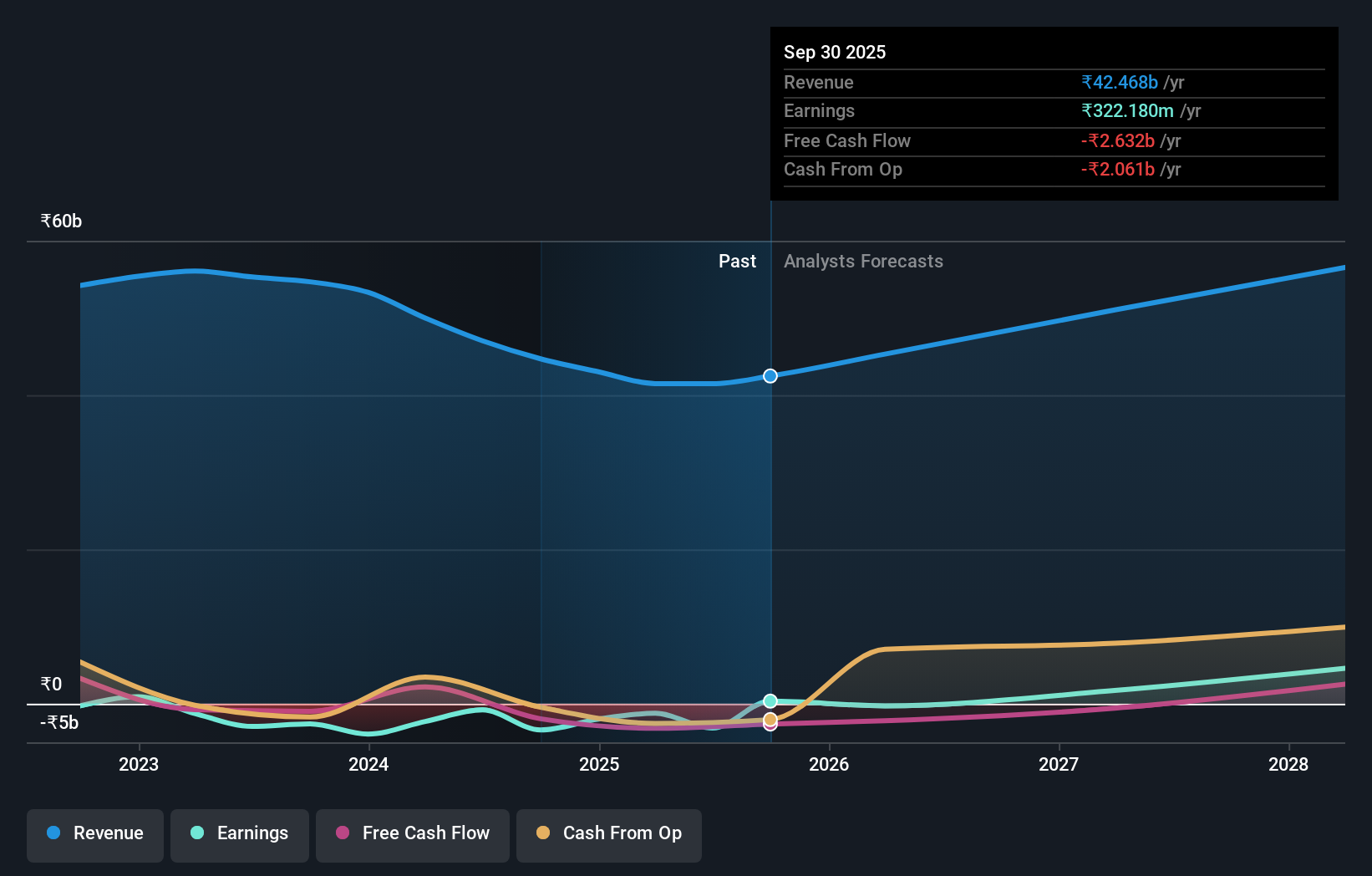

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that India Cements has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think India Cements will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We've already covered India Cements' share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. India Cements' TSR of 206% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's good to see that India Cements has rewarded shareholders with a total shareholder return of 29% in the last twelve months. That gain is better than the annual TSR over five years, which is 25%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that India Cements is showing 1 warning sign in our investment analysis , you should know about...

We will like India Cements better if we see some big insider buys. While we wait, check out this free list of undervalued stocks (mostly small caps) with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報