Greatland Resources (ASX:GGP): Valuation Check After New Rincon Farm-In and Paterson Exploration Expansion

Greatland Resources (ASX:GGP) has caught fresh attention after striking a multi stage farm in and joint venture deal with Rincon Resources, expanding its exploration reach around the Telfer gold copper hub in Western Australia.

See our latest analysis for Greatland Resources.

That backdrop has coincided with a sharp re-rating, with the share price closing at A$10.55 and a 30 day share price return of 33.21%, building on a 44.52% year to date share price return that suggests momentum is clearly picking up as investors reassess Greatland’s growth runway and risk profile.

If this kind of exploration driven story has your attention, it might be a good moment to scan for other resource names with strong management alignment using fast growing stocks with high insider ownership.

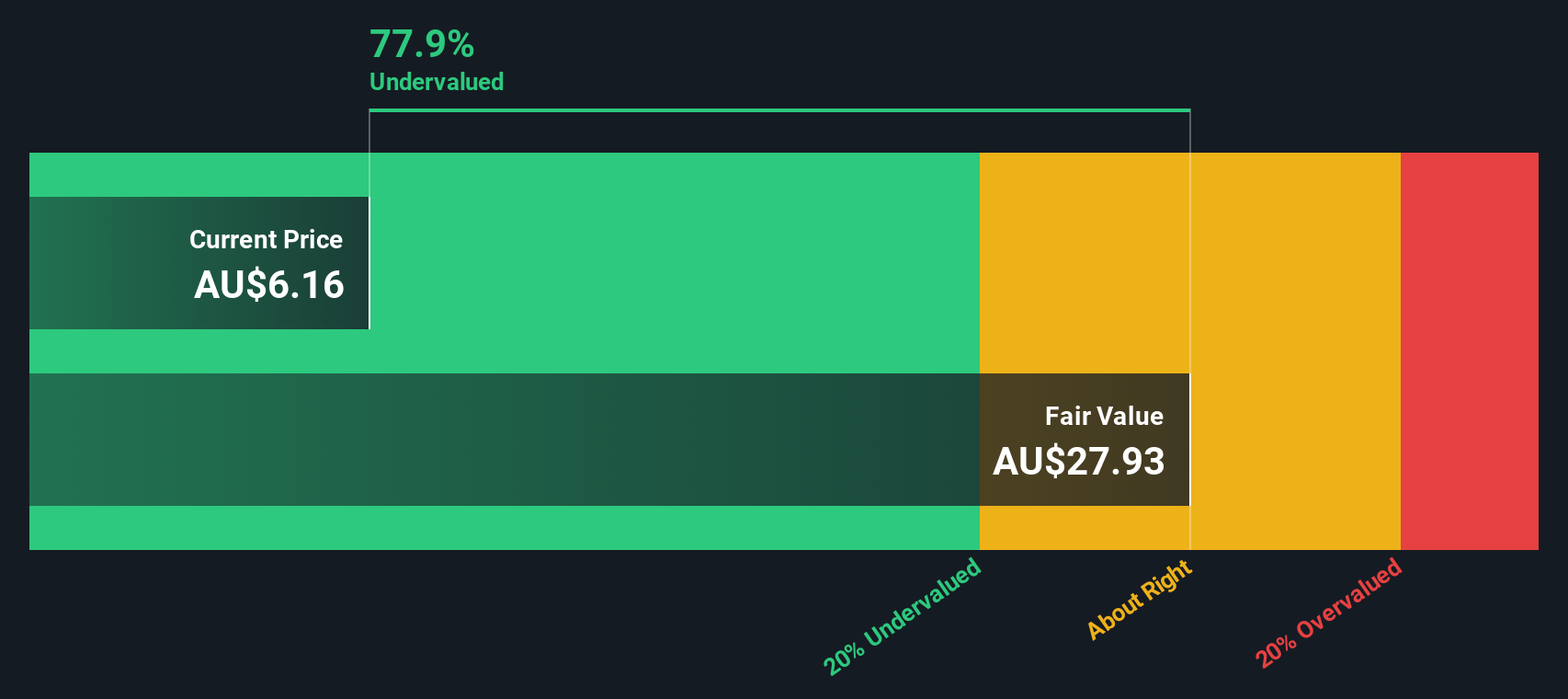

Yet with the share price now sitting above consensus targets and recent gains looking stretched, investors face a key question: does Greatland still trade at a meaningful discount to its intrinsic value, or is future growth already priced in?

Price-to-Earnings of 21x: Is it justified?

On a price-to-earnings ratio of 21x, Greatland Resources looks modestly valued relative to the sector and peers, even after the recent share price surge to A$10.55.

The price-to-earnings multiple compares the company’s current share price with its earnings per share. It is a common way to benchmark how much investors are paying for today’s profits in metals and mining.

For Greatland, the 21x multiple sits below both the wider Australian Metals and Mining industry average of 23x and a much richer peer group average of 53.9x. This suggests the market is not aggressively pricing in its earnings power. However, this sits above our estimated fair price-to-earnings ratio of 18.1x, indicating investors may already be paying a premium relative to where our fair ratio model suggests the multiple could settle.

Compared with the industry, Greatland trades at a discount to typical metals and mining valuations and at a far steeper discount to its immediate peers. This reinforces the idea that the stock is not being priced like the higher multiple names in its space, even if it screens as expensive versus our fair ratio benchmark.

Explore the SWS fair ratio for Greatland Resources

Result: Price-to-Earnings of 21x (ABOUT RIGHT)

However, investors should weigh risks such as execution challenges at Telfer and Havieron, and weaker commodity prices that could quickly stall current momentum.

Find out about the key risks to this Greatland Resources narrative.

Another View, Big DCF Upside

While a 21x earnings multiple suggests Greatland is fairly priced, our DCF model presents a more optimistic picture, with fair value at A$34.41 versus the current A$10.55. That implies the shares trade about 69% below intrinsic value. The key question is whether the cash flows can realistically support that level of optimism.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Greatland Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Greatland Resources Narrative

If you see the numbers differently, or simply want to dive into the details yourself, you can craft a personalised viewpoint in minutes: Do it your way.

A great starting point for your Greatland Resources research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Do not stop with just one stock. Use the Simply Wall Street Screener to uncover fresh, data backed opportunities that others will only notice much later.

- Capture early stage growth potential by targeting these 3633 penny stocks with strong financials that pair small market caps with balance sheets and trends strong enough to support a real rerating.

- Ride powerful structural trends as you focus on these 29 healthcare AI stocks transforming diagnostics, treatment outcomes and hospital efficiency with scalable, defensible technology.

- Lock in income focused opportunities by filtering for these 12 dividend stocks with yields > 3% that combine robust payout histories with yields that can meaningfully move your portfolio returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報