Evaluating China Life Insurance (SEHK:2628)’s Valuation After RMB5 Billion Real Estate Commitment

China Life Insurance (SEHK:2628) has been back on investors’ radar after committing an extra RMB5 billion to its flagship real estate partnership, tightening the link between its investment portfolio and long term insurance liabilities.

See our latest analysis for China Life Insurance.

The extra commitment to its Beijing real estate project comes on top of November’s strong premium update and tighter asset management governance. The market has taken notice, with the share price at HK$28.8 and a year-to-date share price return of around 106%, while the three-year total shareholder return of roughly 163% suggests momentum has been building rather than fading.

If this kind of sustained rerating has you rethinking where insurers sit in your portfolio, it could be a good moment to explore fast growing stocks with high insider ownership.

Yet with the share price now hovering around analyst targets but still trading at a steep discount to some intrinsic estimates, investors have to ask: is China Life still undervalued, or is the market already pricing in years of growth?

Most Popular Narrative: 0.8% Overvalued

With China Life Insurance closing at HK$28.8 against a narrative fair value of about HK$28.57, the spotlight shifts to the earnings path that underpins that slim premium.

The analysts have a consensus price target of HK$23.551 for China Life Insurance based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of HK$31.01, and the most bearish reporting a price target of just HK$14.24.

Want to know why a shrinking profit margin, rising revenues and a richer future earnings multiple still add up to this fair value math? The narrative leans on a bold mix of growth assumptions, profitability compression and a higher valuation bar than many insurers enjoy. Curious how those moving parts combine into a price just shy of today’s market level?

Result: Fair Value of $28.57 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, faster than expected growth in new business value and sustained investment income strength could support higher earnings, challenging the current overvaluation narrative.

Find out about the key risks to this China Life Insurance narrative.

Another Angle on Valuation

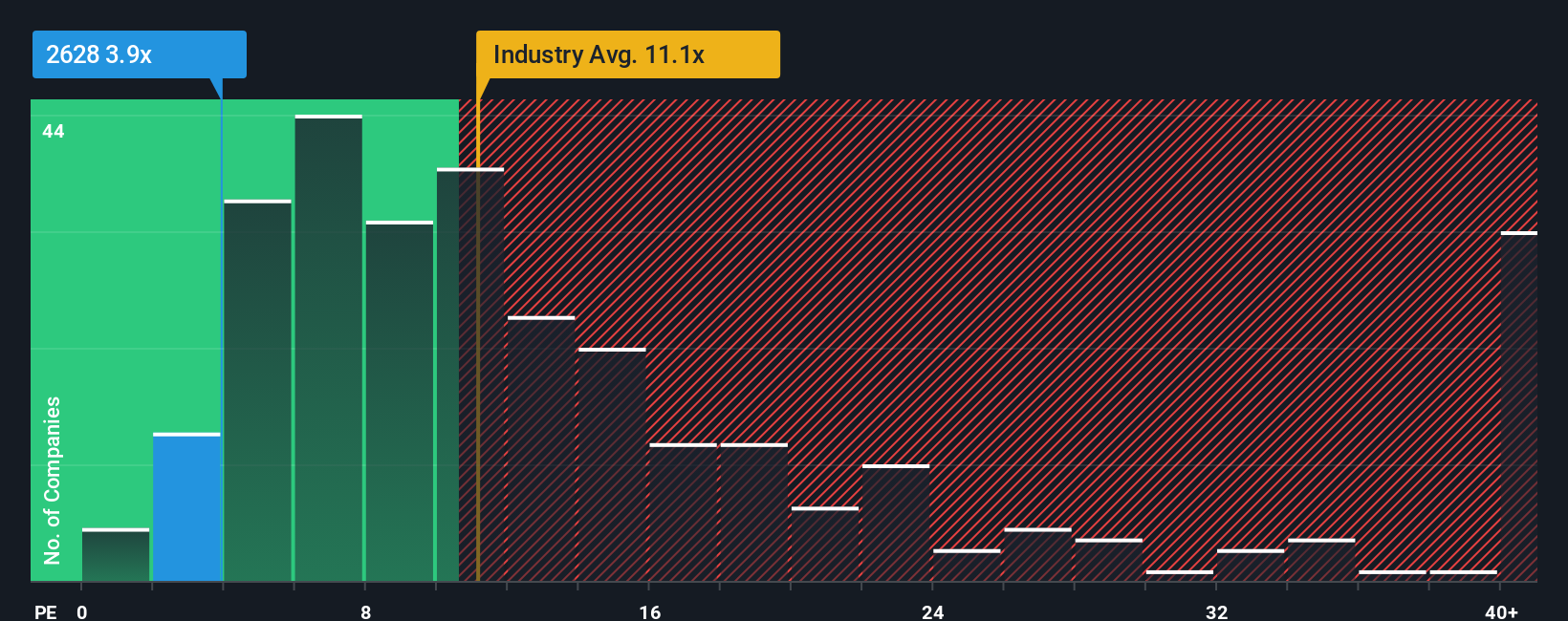

On earnings multiples, China Life looks strikingly cheap, trading on about 4.3 times earnings versus 11.4 times for the Asian insurance industry and 31.5 times for peers. Our fair ratio sits nearer 5 times. Is the market mispricing resilience or bracing for a sharp earnings reset?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own China Life Insurance Narrative

If this view does not quite match your own, or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your China Life Insurance research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider setting up your next opportunities by putting the Simply Wall St Screener to work for you and stay ahead of the crowd.

- Target income-focused opportunities by reviewing steady cash generators through these 12 dividend stocks with yields > 3% and explore building a portfolio that pays out regular income.

- Explore high potential growth themes by scanning these 24 AI penny stocks and focus on areas where AI-driven innovation is developing rapidly.

- Support diversification with forward-looking breakthroughs using these 28 quantum computing stocks to identify companies working at the frontier of computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報