Grand Pharmaceutical Group (SEHK:512) Valuation After Phase II Success for Innovative TCM Depression Treatment

Grand Pharmaceutical Group (SEHK:512) just cleared a key hurdle. Its TCM antidepressant candidate GPN01360 hit the primary endpoint in a Phase II trial in China, reinforcing the company’s push into broader chronic disease markets.

See our latest analysis for Grand Pharmaceutical Group.

The market seems to be taking notice, with the latest 1 day share price return of 2.63 percent lifting Grand Pharmaceutical Group to HK$8.19. Its year to date share price return of 78.04 percent and three year total shareholder return of 120.73 percent point to momentum that is still very much intact.

If this kind of pipeline driven story appeals to you, it could be worth exploring other healthcare names using our curated screen of healthcare stocks to spot similar opportunities.

Against that backdrop, Grand Pharmaceutical still trades at a sizeable discount to analyst targets and our intrinsic estimates. This raises the key question: is this momentum name still a buy, or is the market already pricing in its future growth?

Price to Earnings of 13.8x: Is it justified?

On a price to earnings basis, Grand Pharmaceutical Group trades at 13.8x, putting its HK$8.19 share price slightly above the wider Hong Kong pharmaceuticals average.

The price to earnings ratio compares the current share price to the company’s earnings, offering a quick read on how much investors are paying for each unit of profit. For a diversified pharma and medical device group with established products and a growing R&D pipeline, this is often the primary yardstick investors use to judge whether profits are being priced aggressively or conservatively.

While Grand Pharmaceutical screens as slightly more expensive than the broader Hong Kong pharmaceuticals industry on this metric, it still appears attractively positioned when set against its own assessed fair ratio and selected peers. The stock trades below an estimated fair price to earnings ratio of 20.8x and below a peer average of 17.3x, indicating that the market may not have fully reflected its projected profit growth and margin profile in the current valuation.

Compared with the Hong Kong pharmaceuticals industry average of 13.4x, Grand Pharmaceutical’s 13.8x multiple represents only a mild premium. This can be viewed as a modest recognition of its earnings outlook rather than as a sign of excessive optimism.

Explore the SWS fair ratio for Grand Pharmaceutical Group

Result: Price to Earnings of 13.8x (UNDERVALUED)

However, there are still clear risks, including clinical or regulatory setbacks for key pipeline assets and any slowdown in revenue or earnings growth from current levels.

Find out about the key risks to this Grand Pharmaceutical Group narrative.

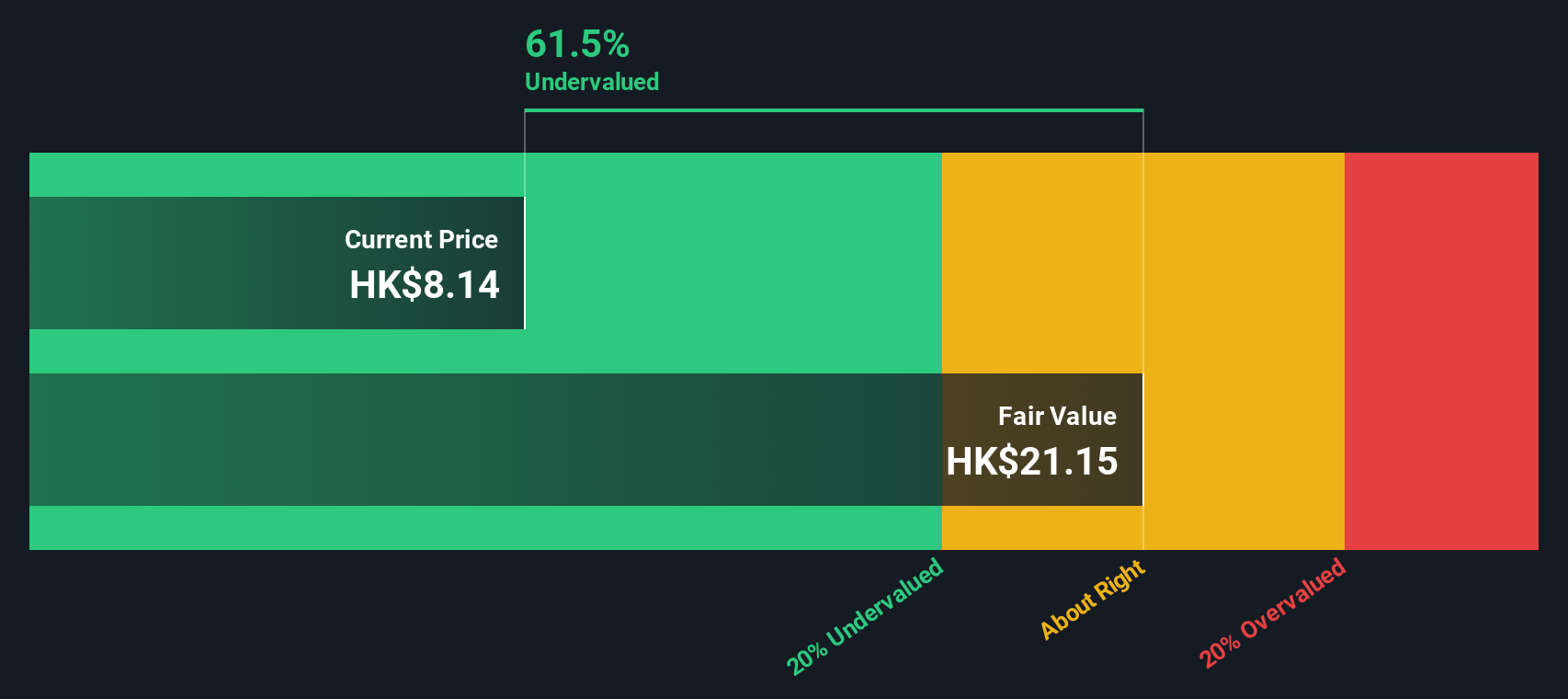

Another View: What Our DCF Model Says

Our DCF model suggests a much stronger upside than the 13.8x earnings multiple. With an estimated fair value of around HK$21.03 per share, Grand Pharmaceutical appears to be trading at about a 61 percent discount, implying a deeper margin of safety than the P E alone indicates.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Grand Pharmaceutical Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Grand Pharmaceutical Group Narrative

If you see the numbers differently or prefer to run your own checks, you can quickly build a personalised view in under three minutes: Do it your way.

A great starting point for your Grand Pharmaceutical Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, lock in your next potential winner using data backed stock screens that surface opportunities most investors overlook, often before momentum kicks in.

- Capture early stage growth potential with these 3633 penny stocks with strong financials that pair compelling stories with improving fundamentals and financial resilience.

- Position ahead of the next technology wave by targeting these 24 AI penny stocks benefiting from real world AI adoption across industries and business models.

- Secure value orientated opportunities through these 913 undervalued stocks based on cash flows that highlight strong cash flow generators trading at meaningful discounts to intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報