Should DRMTLGY’s Exclusive Ulta Rollout Reshape Ulta Beauty’s (ULTA) Science‑Led Skincare Positioning?

- Earlier this month, DRMTLGY announced that its clinical skincare line had launched exclusively at Ulta Beauty, rolling out across more than 1,400 stores nationwide and Ulta.com with 13 curated products highlighted through prominent in‑store displays and digital promotion.

- This exclusive partnership deepens Ulta Beauty’s emphasis on science‑focused, results‑oriented skincare, potentially reinforcing its appeal among ingredient‑conscious shoppers seeking medical‑grade options at more accessible price points.

- We’ll now explore how DRMTLGY’s exclusive, science-focused rollout across Ulta’s 1,400-plus stores could influence Ulta Beauty’s broader investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ulta Beauty Investment Narrative Recap

To own Ulta Beauty, you need to believe its large store base, loyalty program and differentiated brand mix can offset rising costs, online competition and the eventual loss of Target shop‑in‑shops. DRMTLGY’s exclusive launch supports Ulta’s focus on higher value, science-led skincare, but does not materially change the near term earnings catalyst of improving margins or the key risk that physical store and SG&A costs grow faster than sales.

Among recent developments, Ulta’s December 15 Executive Severance Plan stands out, as it formalizes protections for top leaders while the company leans into new brands like DRMTLGY and Herbivore. For investors watching catalysts tied to merchandising and digital execution, this move adds context on how Ulta is structuring leadership stability at a time when it is investing heavily in omnichannel capability and exclusive partnerships.

Yet investors should also weigh how rising store expenses and wage inflation could pressure profitability over time, especially as...

Read the full narrative on Ulta Beauty (it's free!)

Ulta Beauty's narrative projects $13.8 billion revenue and $1.3 billion earnings by 2028. This requires 5.9% yearly revenue growth and roughly a $0.1 billion earnings increase from $1.2 billion today.

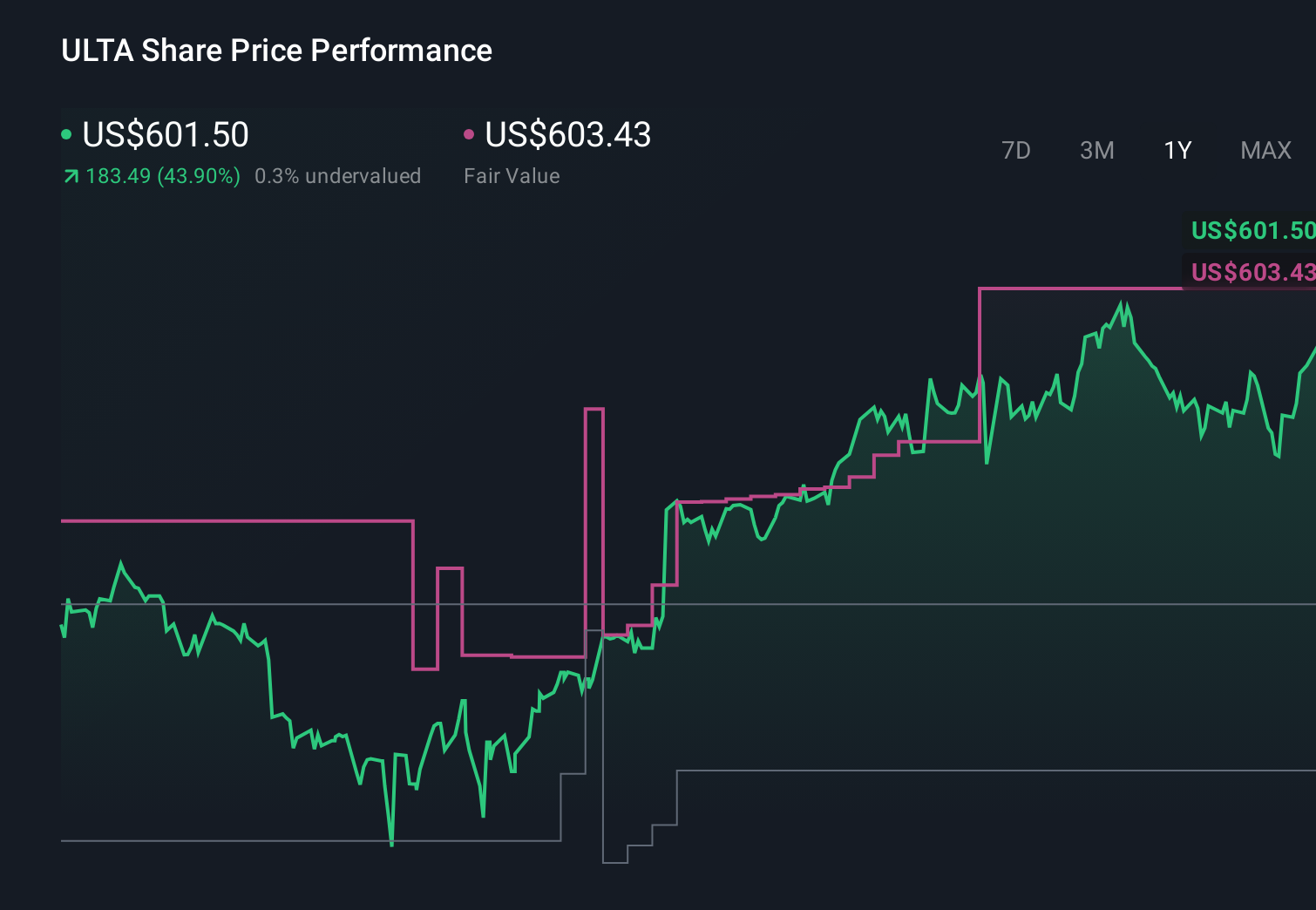

Uncover how Ulta Beauty's forecasts yield a $603.43 fair value, in line with its current price.

Exploring Other Perspectives

Nine fair value estimates from the Simply Wall St Community span roughly US$380 to US$603 per share, showing how differently people view Ulta’s potential. As you compare those viewpoints, keep in mind that Ulta’s growing roster of exclusive, science focused brands like DRMTLGY could be an important driver of customer loyalty and long term revenue quality.

Explore 9 other fair value estimates on Ulta Beauty - why the stock might be worth 36% less than the current price!

Build Your Own Ulta Beauty Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ulta Beauty research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Ulta Beauty research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ulta Beauty's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報