Is Activist Pressure After Carbon6 Forcing a Rethink of SPS Commerce’s (SPSC) Capital Allocation Discipline?

- SPS Commerce, a long-time provider of cloud-based supply chain management software, has recently faced pressure after its early‑2025 Carbon6 acquisition was undermined by Amazon marketplace rule changes and activist investor Anson began pushing for a potential sale of the company.

- This combination of a misjudged move into the Amazon seller ecosystem and escalating activist involvement has raised fresh questions about SPS Commerce's capital allocation discipline and boardroom decision-making.

- We’ll now examine how activist pressure following the Carbon6 setback may reshape SPS Commerce’s previously consensus-backed investment narrative.

The latest GPUs need a type of rare earth metal called Terbium and there are only 34 companies in the world exploring or producing it. Find the list for free.

SPS Commerce Investment Narrative Recap

To own SPS Commerce today, you need to believe its core retail EDI network, high retention and clean balance sheet can outlast the Carbon6 setback and any boardroom turbulence. The key near term catalyst is whether activist pressure around a potential sale or broader “strategic alternatives” process unlocks value without disrupting operations, while the biggest risk has become capital allocation discipline and further missteps in adjacent markets rather than macro demand alone.

The most relevant recent announcement here is the ongoing US$100,000,000 share buyback program, with roughly US$89,990,000 already deployed by late 2025. That capital return is now being judged against the Carbon6 outcome and activist scrutiny, and it frames an important question about how SPS balances repurchases with reinvestment and M&A as it seeks to restore confidence in its growth story.

Yet behind the resilient core business, investors should also weigh the risk that future acquisitions could again misfire and...

Read the full narrative on SPS Commerce (it's free!)

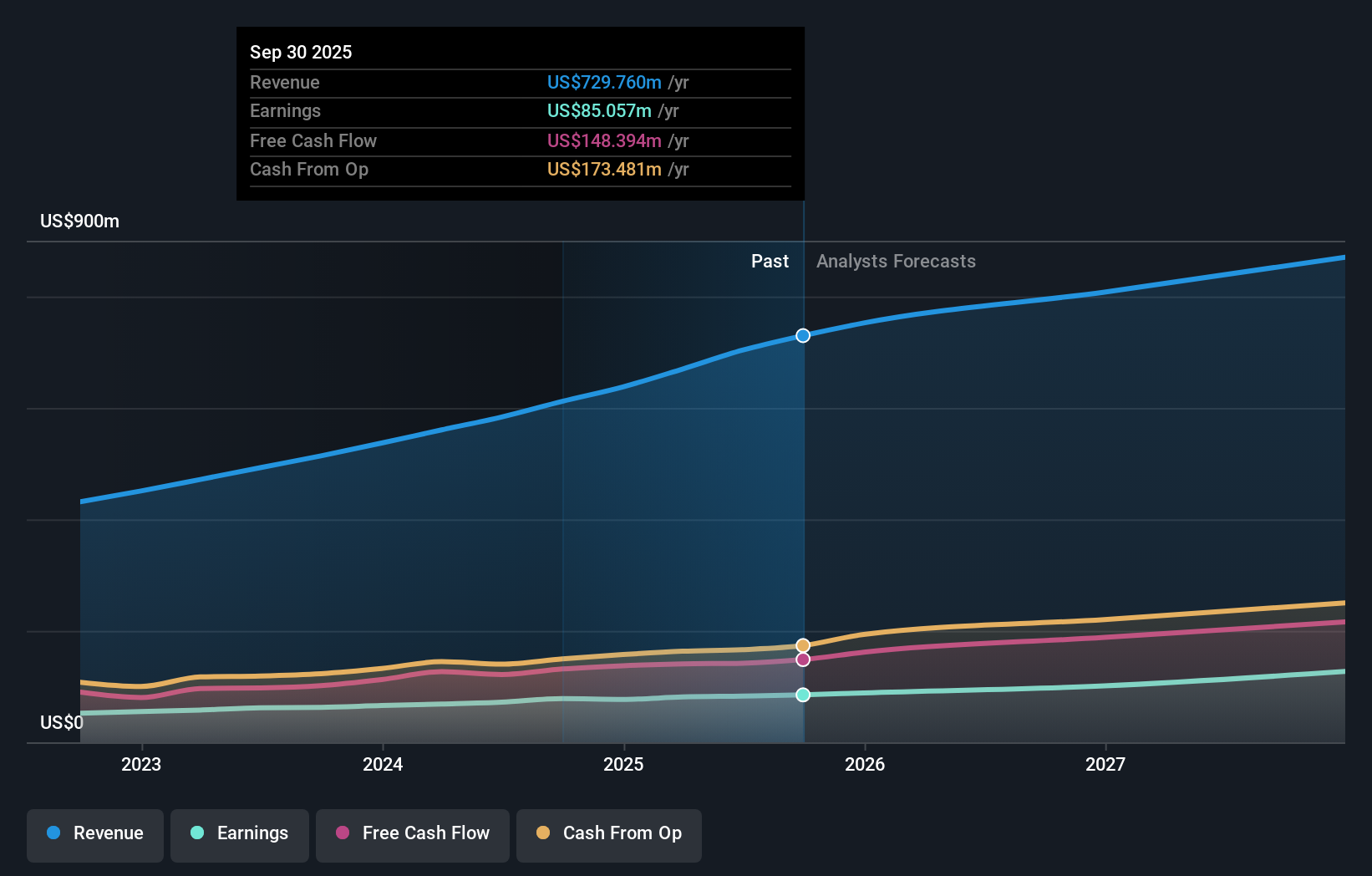

SPS Commerce's narrative projects $966.0 million revenue and $139.1 million earnings by 2028. This requires 11.1% yearly revenue growth and about a $56 million earnings increase from $82.9 million today.

Uncover how SPS Commerce's forecasts yield a $98.00 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Three Simply Wall St Community valuations for SPS Commerce span roughly US$98 to US$182 per share, underlining how far opinions can stretch. You are weighing those against a business whose biggest near term swing factor may now be activist driven strategic change, which could have real implications for growth consistency and execution risk.

Explore 3 other fair value estimates on SPS Commerce - why the stock might be worth just $98.00!

Build Your Own SPS Commerce Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SPS Commerce research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free SPS Commerce research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SPS Commerce's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報