LendingClub (LC) valuation check after strong quarter and rising institutional demand for loan products

LendingClub (LC) just delivered a stronger quarter, with revenue and net income up solidly from last year, and that combination of earnings momentum and heavy loan demand is starting to reshape how investors view the stock.

See our latest analysis for LendingClub.

The upbeat quarter lands on top of an already strong run, with a roughly 21.8% year to date share price return and a powerful three year total shareholder return of about 126.6% suggesting momentum is firmly building.

If LendingClub’s rebound has your attention, this could be a good moment to see what else is leading the charge in financials and discover fast growing stocks with high insider ownership.

With revenue and earnings accelerating, a 28% intrinsic discount, and analysts still seeing upside to their targets, investors face a pivotal question: Is LendingClub still undervalued, or is the market already pricing in its next leg of growth?

Most Popular Narrative: 11.4% Undervalued

With LendingClub last closing at 19.65 dollars against a narrative fair value of roughly 22.18 dollars, the story focuses on how its hybrid model and profitability ramp justify that gap.

The hybrid digital marketplace/bank model continues to scale. Marketplace originations and balance sheet loans are growing in tandem, with the former providing high-margin, capital-light revenue, and the latter building durable recurring net interest income. This dual engine offers operating leverage for sustained growth in earnings and tangible book value.

Want to see the engine behind that valuation gap? The narrative leans on a sharp profit step up and a future multiple more typical of mature compounders. Curious how modest top line expectations still support that higher fair value? Dive in to see which earnings and margin assumptions make the math work.

Result: Fair Value of $22.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising competition in personal lending and higher marketing costs could squeeze margins and slow growth, which may challenge the optimistic valuation narrative around LendingClub.

Find out about the key risks to this LendingClub narrative.

Another Angle on Valuation

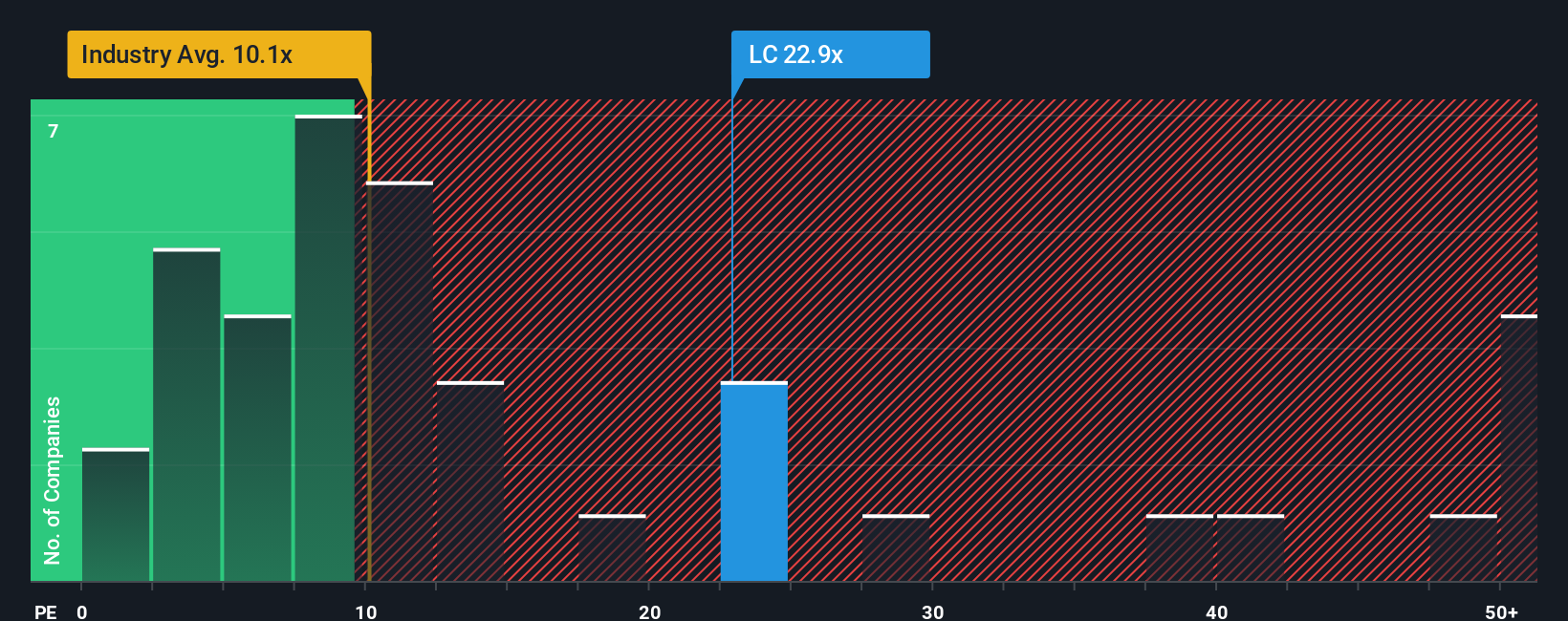

While the narrative points to a double digit discount to fair value, LendingClub actually looks expensive on earnings, trading at about 21.8 times versus 10 times for the US consumer finance industry and 6.3 times for peers, even if a fair ratio of 23.2 times suggests some upside. Which signal do you trust more?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LendingClub Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a personalized view in just minutes: Do it your way.

A great starting point for your LendingClub research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more compelling ideas?

Before you move on, lock in your next potential win by using our screeners to uncover stocks that fit your exact strategy and risk profile.

- Target steady cash flow from companies prioritizing income, starting with these 12 dividend stocks with yields > 3% that can strengthen the foundation of your portfolio.

- Capture cutting edge innovation by reviewing these 24 AI penny stocks positioned to benefit from accelerating adoption of artificial intelligence across industries.

- Capitalize on mispriced opportunities by scanning these 913 undervalued stocks based on cash flows that markets may be overlooking today but could rerate sharply tomorrow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報