Taking Another Look at First Hawaiian (FHB) Valuation After Its Recent Share Price Uptick

Recent performance and what is driving interest

First Hawaiian (FHB) has quietly put together a steady run, with the stock up about 7 % over the past month and 4 % in the past 3 months, drawing fresh attention from income focused bank investors.

See our latest analysis for First Hawaiian.

Zooming out, the stock’s roughly mid single digit year to date share price gain, alongside a 1 year total shareholder return of about 7 %, suggests momentum is quietly rebuilding as investors reassess risks around rates and regional banks.

If First Hawaiian has you rethinking where stable returns might come from next, it could be worth scanning the market for fast growing stocks with high insider ownership.

With shares trading just below analyst targets yet at a sizeable discount to some intrinsic value estimates, investors face a key question: is First Hawaiian now a quiet value opportunity, or is it already pricing in its future growth?

Most Popular Narrative Narrative: 3.9% Undervalued

With First Hawaiian last closing at $26.26 against a narrative fair value of about $27.33, the storyline leans toward modest upside rather than extreme mispricing.

The analysts have a consensus price target of $26.125 for First Hawaiian based on their expectations of its future earnings growth, profit margins and other risk factors.

In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $952.3 million, earnings will come to $263.9 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 6.8%.

Curious how steady, mid single digit growth, high margins and a richer future earnings multiple can still add up to an undervalued regional bank story? The narrative explains the specific revenue trajectory, profit profile and share count assumptions that need to line up to support that higher future multiple. It also outlines how those elements combine to produce today’s fair value estimate.

Result: Fair Value of $27.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer loan growth and rising competition for deposits or construction takeouts could still cap earnings momentum and challenge the current undervaluation story.

Find out about the key risks to this First Hawaiian narrative.

Another Lens on Value: Earnings Ratio Check

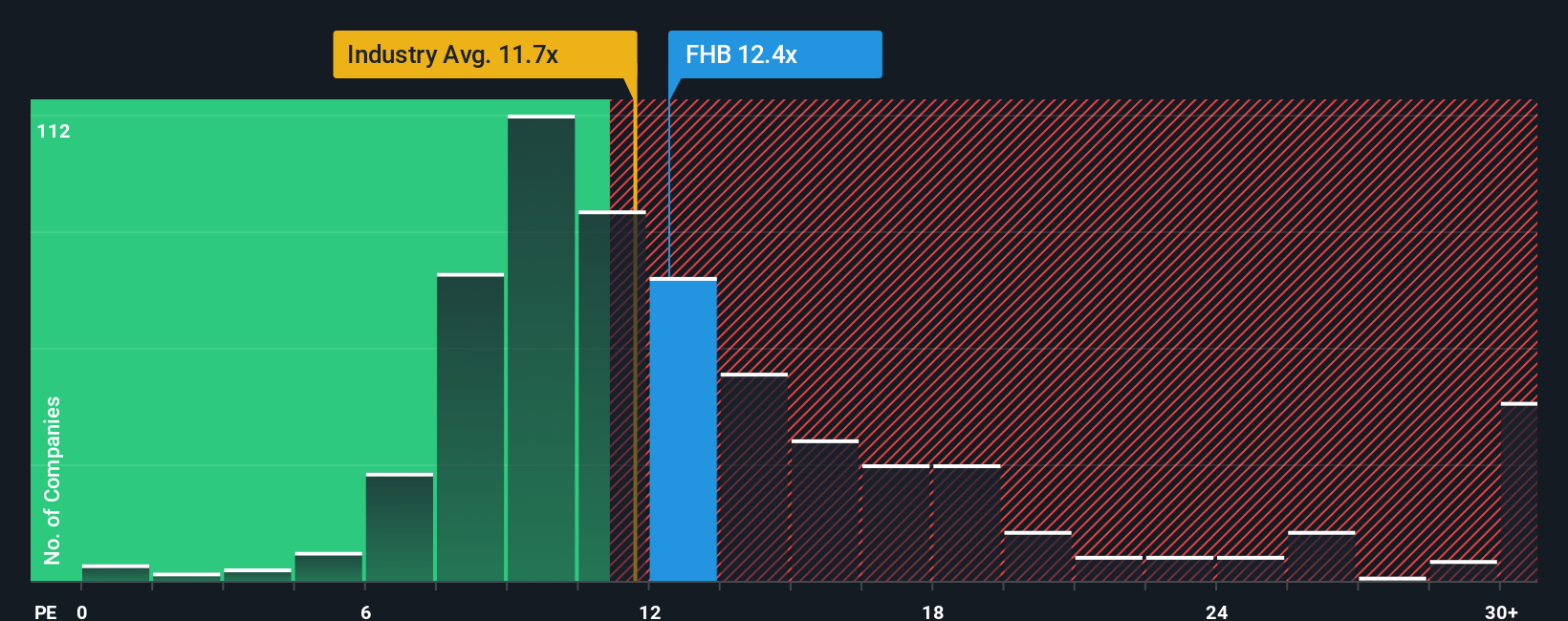

While the narrative fair value suggests upside, the earnings ratio tells a different story. FHB trades on a 12.6x price to earnings multiple, richer than the US banks at 11.9x and above its 11x fair ratio, hinting that sentiment, not fundamentals, may be doing more of the heavy lifting. Could this premium evaporate if growth disappoints?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Hawaiian Narrative

If you want to stress test these assumptions or lean on your own research, you can build a personalized view in minutes: Do it your way.

A great starting point for your First Hawaiian research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in fresh ideas by running targeted screens on Simply Wall Street, so potential winners do not slip past your radar.

- Capture mispriced opportunities early by checking these 914 undervalued stocks based on cash flows that pair solid cash flows with attractive entry points.

- Capitalize on the AI transformation through these 24 AI penny stocks that could reshape entire industries and long term portfolio returns.

- Strengthen your income stream using these 12 dividend stocks with yields > 3% offering reliable yields above 3 % supported by real underlying businesses.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報