Reassessing Sea (NYSE:SE) Valuation After Strong Quarterly Results and New Share Buyback Program

Sea (NYSE:SE) just dropped a quarterly update that checked two big boxes for investors: healthier profits and cash flow, plus a sizable share buyback that underlines management’s confidence despite ongoing competitive and margin pressure.

See our latest analysis for Sea.

Even with this stronger quarter, Sea’s 30 day share price return of minus 7.13 percent and 90 day share price return of minus 36.79 percent show momentum has cooled. At the same time, a 3 year total shareholder return of 144.33 percent signals the longer term growth story is still very much alive.

If Sea’s rebound has you rethinking growth opportunities, this could be a time to explore high growth tech and AI names through high growth tech and AI stocks for your watchlist.

With shares trading at a steep discount to analyst targets despite accelerating profits and a fresh buyback, is Sea quietly undervalued after a bruising selloff, or is the market already discounting its next leg of growth?

Most Popular Narrative: 36.3% Undervalued

With Sea last closing at $121.97 against a most popular narrative fair value of $191.62, the gap highlights just how ambitious the long term earnings roadmap has become.

Analysts are assuming Sea's revenue will grow by 19.7% annually over the next 3 years.

Analysts expect earnings to reach $4.7 billion (and earnings per share of $7.17) by about September 2028, up from $1.2 billion today.

Curious what kind of profit margins, cash flow ramp, and future earnings multiple are needed to bridge that valuation gap? The narrative spells out a surprisingly aggressive growth and profitability glide path that underpins this higher fair value. Want to see exactly how those moving parts stack together to justify the upside?

Result: Fair Value of $191.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intense competition in e commerce and any stumble in Garena’s flagship titles could quickly compress margins and undermine the current undervaluation story.

Find out about the key risks to this Sea narrative.

Another Angle on Valuation

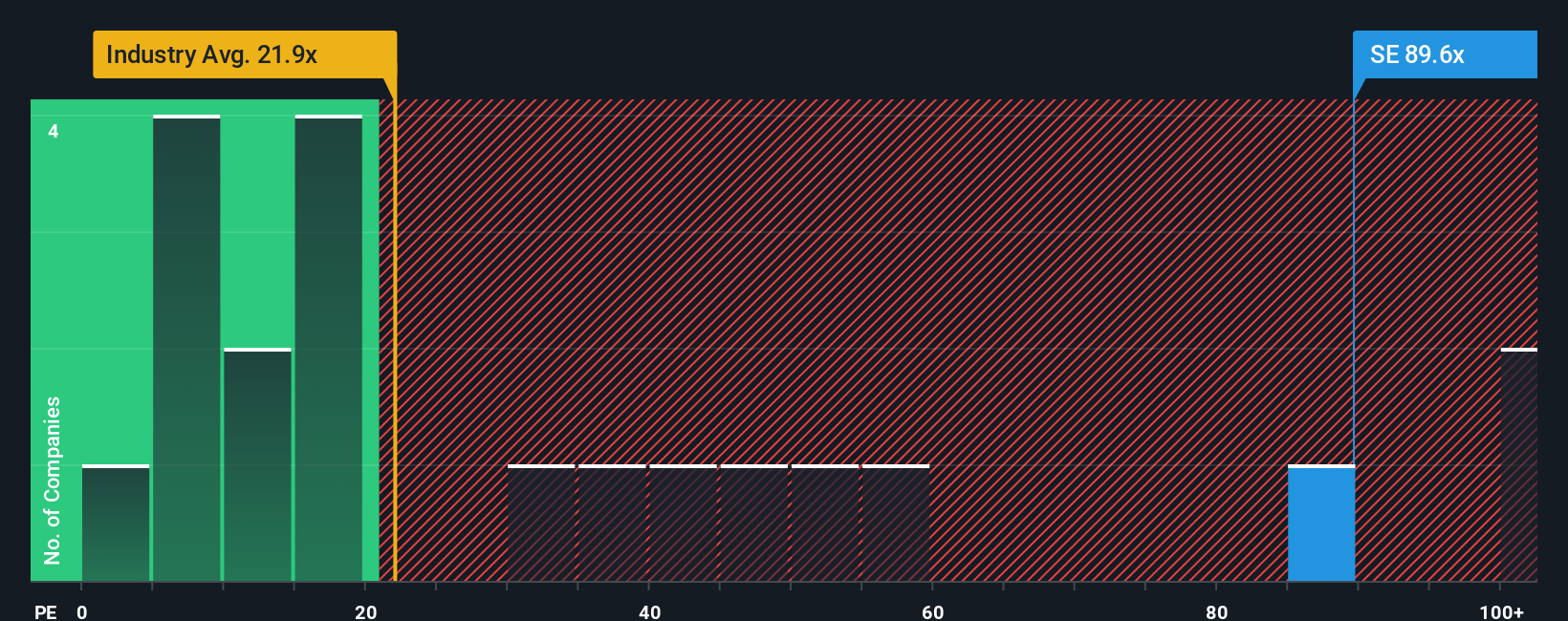

DCF paints Sea as deeply undervalued, but its 50.9x price to earnings ratio versus a 36.7x fair ratio, 46x peers, and 19.6x for the wider industry suggests the market is already paying up for growth. Is the real risk that expectations, not cash flows, are too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sea Narrative

If this perspective does not fully align with your own view, dive into the numbers yourself and craft a custom narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Sea.

Ready for more investment ideas?

If you want your next move to count, do not stop at one company, use Simply Wall Street’s powerful screener to uncover your next edge.

- Target income-focused opportunities by scanning these 12 dividend stocks with yields > 3% that can help anchor your portfolio with reliable cash returns.

- Capitalize on innovation by hunting through these 24 AI penny stocks positioned at the heart of the artificial intelligence transformation.

- Strengthen your margin of safety by reviewing these 914 undervalued stocks based on cash flows that trade below what their cash flows suggest they are worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報