Badger Meter (BMI) Valuation Check as CFO Transition Reshapes Financial Leadership and Strategy

Badger Meter (BMI) just reshuffled its leadership team, with long time finance insider Daniel Weltzien stepping into the CFO role and former CFO Robert Wrocklage shifting into a key operating position.

See our latest analysis for Badger Meter.

The leadership reshuffle lands after a tough stretch for shareholders, with the stock at $181.64 and a negative year to date share price return, even though the three year total shareholder return above 60 percent still points to a strong longer term story and suggests momentum has cooled rather than vanished.

If this kind of strategic shift has you thinking more broadly about where to find durable growth, it is a good moment to explore high growth tech and AI stocks for other tech names building long term advantage.

With earnings still rising, a premium valuation, and shares trading below analyst targets, the real question is whether Badger Meter is quietly undervalued today or if the market has already priced in its next leg of growth.

Most Popular Narrative Narrative: 17.2% Undervalued

Badger Meter's most followed narrative places fair value at $219.50 per share, comfortably above the recent $181.64 close and framing the stock as mispriced strength rather than fading momentum.

The rapid expansion and integration of IoT-enabled products and real-time analytics, as seen in the rollout of BEACON and new machine-learning-enabled products like Cobalt, are accelerating customer adoption of recurring, higher-margin software and data solutions, contributing to improved revenue visibility and ongoing net margin enhancement.

Want to see how steady mid to high single digit growth, quietly rising margins, and a richer earnings multiple combine into that upside gap? The narrative spells out a detailed profit roadmap, a bolder valuation template, and the cash flow math holding it all together. Curious which assumptions really move the fair value dial, and how far they can stretch? Read on and decide if those numbers stack up.

Result: Fair Value of $219.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on large municipal AMI projects staying on track and on input costs like copper not eroding those margin gains.

Find out about the key risks to this Badger Meter narrative.

Another Take On Valuation

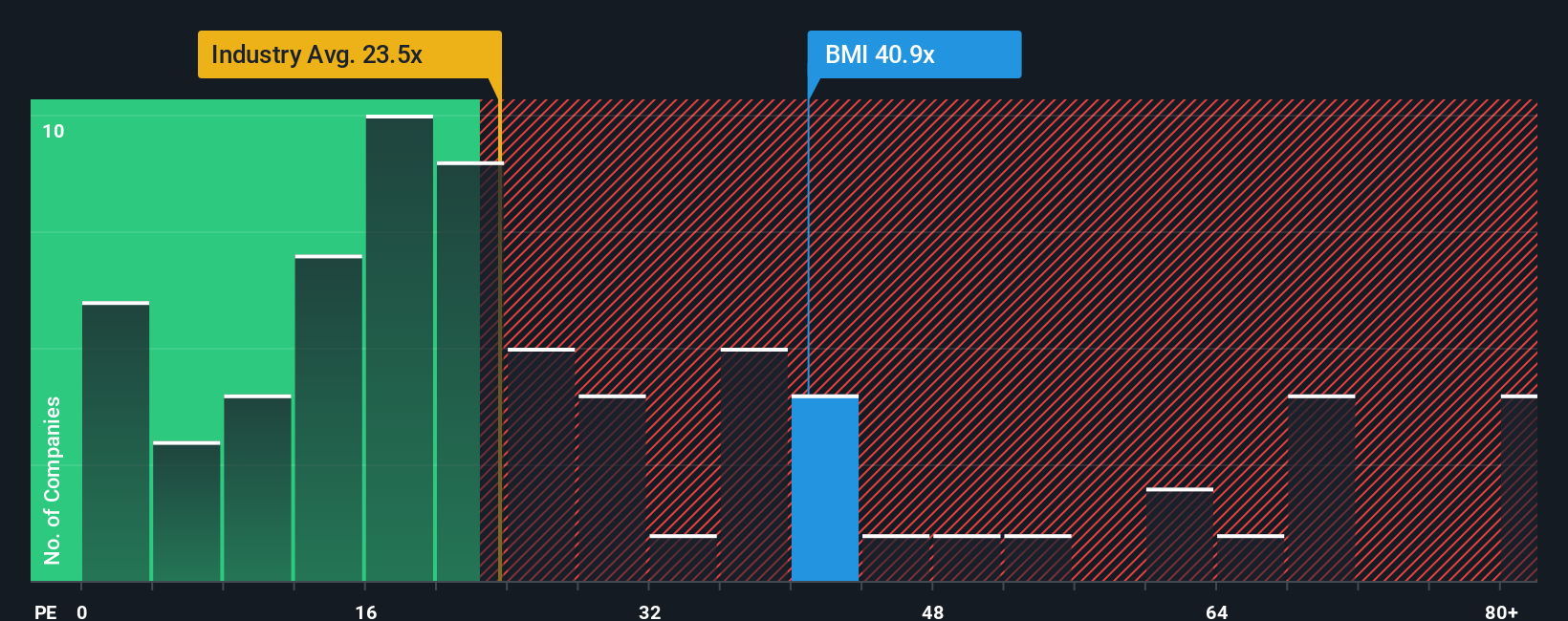

Market based checks paint a very different picture. At about 38.6 times earnings, Badger Meter trades far richer than the US Electronic industry on 24.9 times, its peer average on 21.2 times, and a fair ratio of 22.8 times, implying valuation risk if growth or sentiment cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Badger Meter Narrative

If you see the story differently or want to dig into the numbers yourself, you can shape a full view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Badger Meter.

Looking for more investment ideas?

Do not stop with one compelling narrative when you can line up your next opportunities now and stay ahead of other investors using the Simply Wall St Screener.

- Capture potential bargains early by scanning these 914 undervalued stocks based on cash flows before the market fully recognizes their cash flow strength.

- Ride powerful technological shifts by focusing on these 24 AI penny stocks shaping automation, data intelligence, and the next wave of productivity gains.

- Strengthen your income strategy by targeting these 12 dividend stocks with yields > 3% that can support long term total returns and reduce portfolio volatility.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報