Mitsubishi Logistics (TSE:9301) Valuation Check as It Reshapes Operations for Grid Electricity Storage Expansion

Mitsubishi Logistics (TSE:9301) has approved an organizational reshuffle to kick start its grid electricity storage business, creating a new preparation chamber and adjusting senior roles to support this expansion.

See our latest analysis for Mitsubishi Logistics.

The grid storage push fits into a steady, if unspectacular, year for Mitsubishi Logistics, with an 8.9% 1 month share price return and a powerful 3 year total shareholder return of 111.1% suggesting long term momentum remains firmly intact.

If this shift toward energy infrastructure has caught your attention, it could be a good moment to broaden your watchlist and discover fast growing stocks with high insider ownership.

But with earnings under pressure, modest growth, and the share price already close to analyst targets, is Mitsubishi Logistics still flying under the radar, or are investors fully pricing in its ambitious energy storage plans?

Price-to-Earnings of 8.6x: Is it justified?

Mitsubishi Logistics last closed at ¥1,195, and on a Price to Earnings ratio of 8.6x it screens as modestly valued relative to its sector and the wider Japanese market.

The Price to Earnings, or P E, ratio compares a company’s share price to its per share earnings. It is a core yardstick for mature, profitable infrastructure and logistics businesses where investors focus heavily on steady profitability rather than hyper growth.

In this case, the stock trades on 8.6x earnings, below both the JP market average of 14.3x and the Asian Infrastructure industry average of 13.8x, and also below the 12.3x peer average. This indicates the market is applying a clear discount to Mitsubishi Logistics profitability, even as its recent earnings growth has outpaced the broader industry. However, this sits slightly above our estimated fair P E ratio of 8.2x, a level that the valuation could gravitate toward if sentiment or earnings expectations shift.

Explore the SWS fair ratio for Mitsubishi Logistics

Result: Price-to-Earnings of 8.6x (ABOUT RIGHT)

However, downside risks remain, including sustained earnings pressure from softer logistics demand and the possibility that ambitious grid storage investments deliver slower returns than expected.

Find out about the key risks to this Mitsubishi Logistics narrative.

Another View: Our DCF Signals Caution

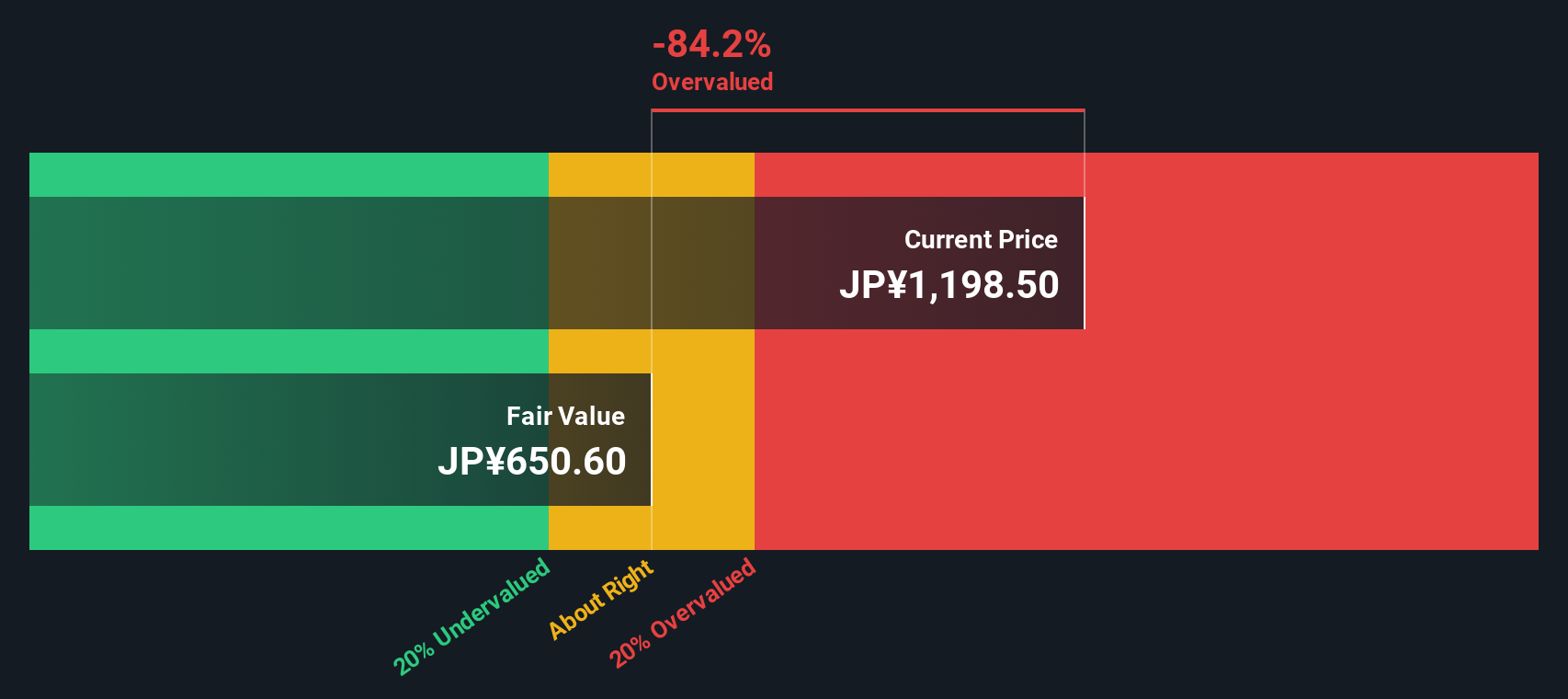

While an 8.6x earnings multiple looks reasonable against peers, our DCF model paints a harsher picture, with fair value estimated at about ¥650. In other words, the shares look materially overvalued on cash flow terms, raising the question of whether recent momentum is running ahead of fundamentals.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mitsubishi Logistics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mitsubishi Logistics Narrative

If you see the picture differently or would rather dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A great starting point for your Mitsubishi Logistics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in your next opportunity by scanning focused stock ideas tailored to different themes, so your portfolio never stands still.

- Capture potential rebound opportunities by targeting beaten down companies with improving fundamentals through these 3634 penny stocks with strong financials.

- Position yourself at the heart of transformative technology by reviewing these 29 healthcare AI stocks shaping the future of medicine and efficiency.

- Strengthen your income stream by zeroing in on companies with established dividend payment histories using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報