Assessing WEBTOON Entertainment (WBTN)’s Valuation After Securities Class Action Clears Key Legal Hurdle

A U.S. District Court just denied WEBTOON Entertainment (WBTN) executives’ attempt to toss a securities fraud class action, clearing the way for investors to probe claims they were misled about Monthly Active Users around the IPO.

See our latest analysis for WEBTOON Entertainment.

The lawsuit news lands at a tricky moment for WEBTOON, with a 90 day share price return of negative 39.10 percent and a 1 year total shareholder return of negative 1.30 percent. This hints that sentiment has cooled despite pockets of short term strength.

If this legal overhang has you reassessing your exposure to media names, it could be worth exploring fast growing stocks with high insider ownership as a way to uncover fresh growth ideas with management meaningfully invested alongside shareholders.

With the stock trading below analyst targets, yet still loss making and facing legal uncertainty, is WEBTOON a misunderstood growth platform at a discount, or has the market already priced in all the future upside?

Most Popular Narrative: 18.5% Undervalued

WEBTOON Entertainment's most followed narrative pegs fair value at $15.81 per share, above the last close of $12.88, framing a potential upside story.

The company's increasing ability to adapt proven content IP across media (including originals produced in partnership with major franchises) leverages the rising value of IP and transmedia, driving high margin ancillary revenues and supporting long term earnings power.

Curious how long term content deals, margin expansion, and future earnings expectations combine into that valuation gap? The underlying narrative leans on unusually ambitious growth and profitability assumptions. Want to see exactly which forecasts drive that 18.5 percent discount call?

Result: Fair Value of $15.81 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slowing user growth and unpredictable IP adaptation revenues could quickly challenge the bullish thesis if partnerships and new hits fail to materialize.

Find out about the key risks to this WEBTOON Entertainment narrative.

Another Way to Look at Value

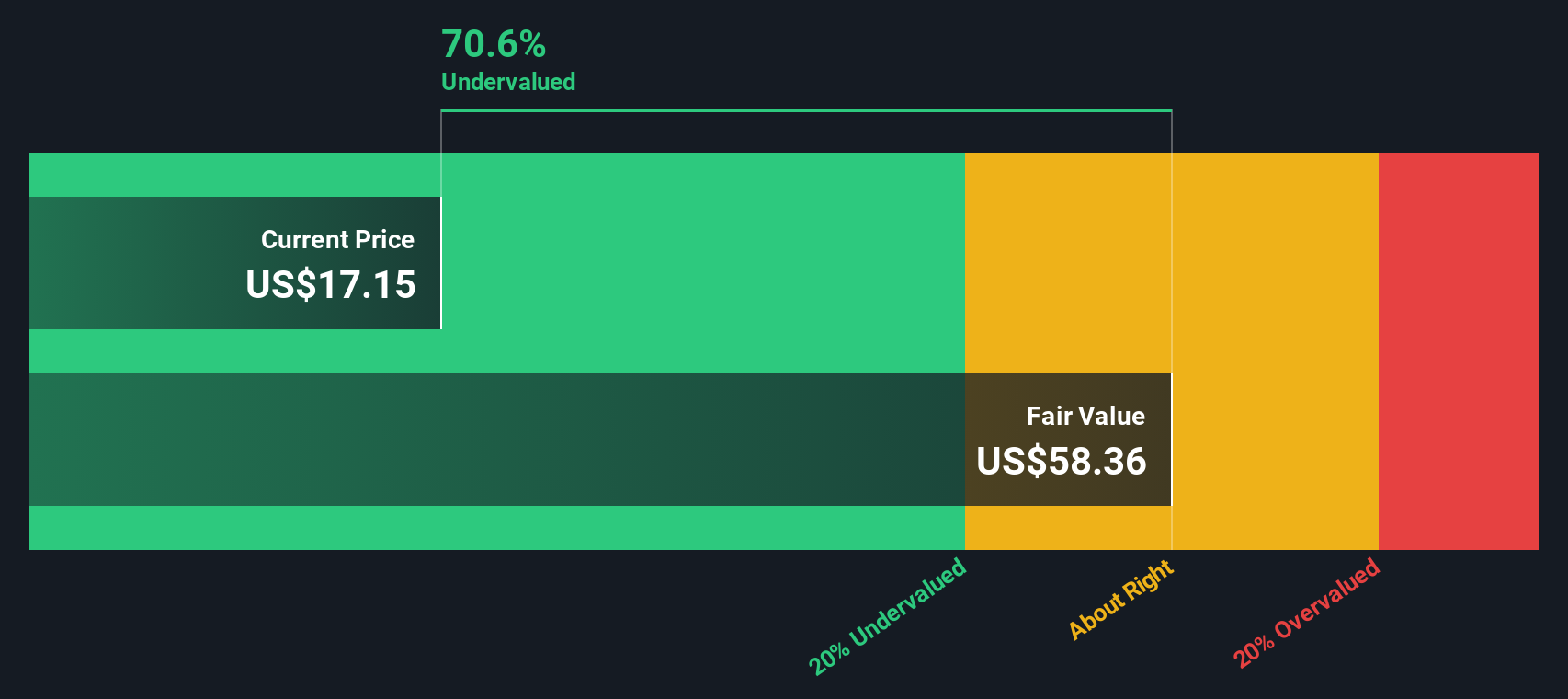

Our DCF model paints a more optimistic picture, suggesting WEBTOON is trading about 54 percent below its fair value estimate of $28.27 per share, a much deeper discount than the narrative-led valuation. Is the market overreacting to short term noise, or is the model too generous about long term cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own WEBTOON Entertainment Narrative

If you see the story differently or want to stress test the assumptions yourself, you can build a custom view in just minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding WEBTOON Entertainment.

Looking for more investment ideas?

Share this with a friend you trust and plan your next moves together, or you may miss out on smart opportunities hiding in plain sight.

- Capture potential mispricing by targeting quality companies that still trade at a discount using these 914 undervalued stocks based on cash flows which is tailored to cash flow strength.

- Explore the next wave of innovation by focusing on breakthrough applications in machine learning and automation with these 24 AI penny stocks guiding your shortlist.

- Identify dependable income streams while rates shift by concentrating on companies yielding over 3 percent through these 12 dividend stocks with yields > 3% designed for payout-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報