The Bull Case For Ternium (TX) Could Change Following A Shift Toward Value-Focused Analyst Sentiment

- In recent days, analyst coverage of Ternium has turned more favorable, with UBS maintaining a Neutral stance while revising its view and Zacks assigning the stock a high value rating based on its earnings outlook and valuation metrics.

- This combination of mixed but generally positive analyst sentiment and an assessment of Ternium as attractively valued has sharpened investor focus on the company’s earnings potential and position within the steel sector.

- We’ll now look at how this stronger value-focused analyst sentiment could influence Ternium’s existing investment narrative and risk-return profile.

AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Ternium Investment Narrative Recap

To own Ternium, you need to believe it can convert its Latin American footprint and ongoing capacity and efficiency investments into sustainable earnings, despite cyclical steel pricing and heavy capex. The recent shift toward more favorable, value-focused analyst coverage, including UBS’s higher price target and Zacks’ strong value rating, reinforces the near term catalyst of improving margins and cash generation, but it does not fundamentally change the key risk of strained free cash flow during the current investment cycle.

Against this backdrop, the recent decision to approve an interim dividend of US$0.90 per ADS, following lower year on year sales and earnings in Q3 2025, is particularly relevant. It highlights Ternium’s effort to reward shareholders even as profitability remains sensitive to steel prices, imports into Mexico and Brazil, and the execution of its large capex program at Pesqueria, all of which will shape how today’s apparent value opportunity actually plays out.

However, investors should also be aware that if the US$4,000,000,000 capex cycle at Pesqueria underdelivers in its ramp up period or demand is softer than expected, then ...

Read the full narrative on Ternium (it's free!)

Ternium's narrative projects $18.4 billion revenue and $828.7 million earnings by 2028.

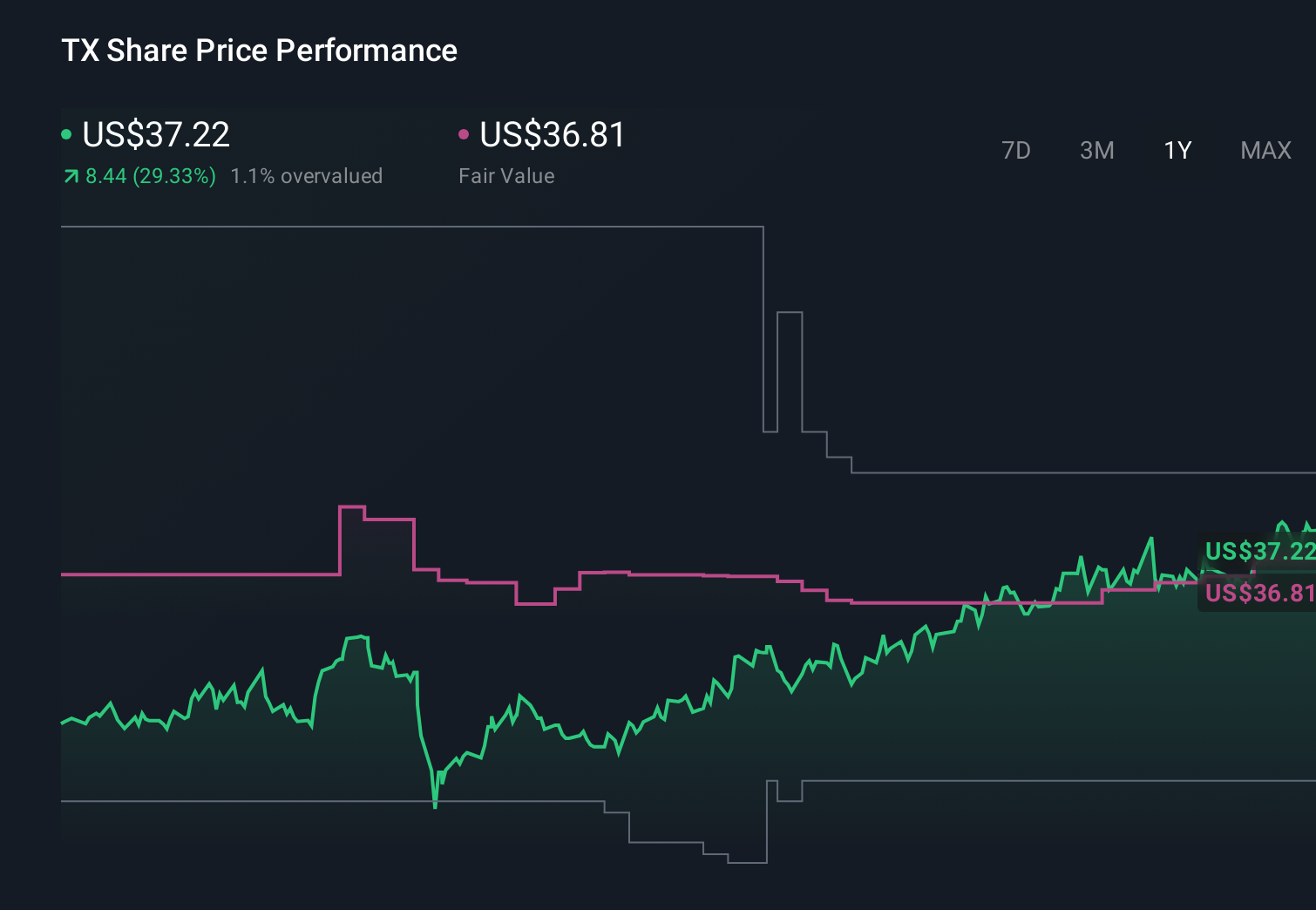

Uncover how Ternium's forecasts yield a $36.81 fair value, in line with its current price.

Exploring Other Perspectives

Seven fair value estimates from the Simply Wall St Community span roughly US$23.49 to US$76.61 per share, showing how far apart individual views can be. Set against this wide range, the market’s current attention on Ternium’s earnings recovery and heavy capex commitments gives you several different angles to weigh before judging its long term performance potential.

Explore 7 other fair value estimates on Ternium - why the stock might be worth over 2x more than the current price!

Build Your Own Ternium Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ternium research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ternium research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ternium's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報