Cintas (CTAS) Valuation After Q2 Earnings Beat and Upgraded 2026 Outlook

Cintas (CTAS) just turned in another earnings win, topping second quarter expectations on both revenue and profit while lifting its 2026 sales and EPS outlook, a combination that tends to grab investor attention.

See our latest analysis for Cintas.

The latest beat and higher 2026 guidance arrive in a mixed trading backdrop, with the share price at $187.57 after a softer 90 day share price return of 7.41 percent and a far stronger five year total shareholder return of 132.11 percent. This suggests long term momentum is still intact even as near term enthusiasm cools a bit.

If Cintas earnings strength has you rethinking what quality looks like, now is a good moment to explore fast growing stocks with high insider ownership and see what other leaders are quietly compounding in the background.

With the share price already sitting at a premium multiple and analysts still seeing upside to fair value, the key question now is whether Cintas offers a fresh entry point or if markets are fully pricing in years of steady growth.

Most Popular Narrative: 12.7% Undervalued

With Cintas last closing at $187.57 against a narrative fair value of $214.88, the current setup frames a premium quality story as still underappreciated.

Robust capital allocation (disciplined acquisitions across core businesses, regular share repurchases, increasing dividends) is set to continue fueling EPS growth and long-term shareholder returns, with ample free cash flow for both reinvestment and direct returns.

Want to see why steady growth assumptions still support a premium earnings multiple? The narrative leans on rising margins, powerful cash generation, and surprisingly ambitious profitability targets. Curious how those moving parts stack up to reach that fair value mark?

Result: Fair Value of $214.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting workplace patterns and automation could shrink the uniform rental opportunity set, challenging assumptions around long term demand resilience and margin expansion.

Find out about the key risks to this Cintas narrative.

Another Angle on Valuation

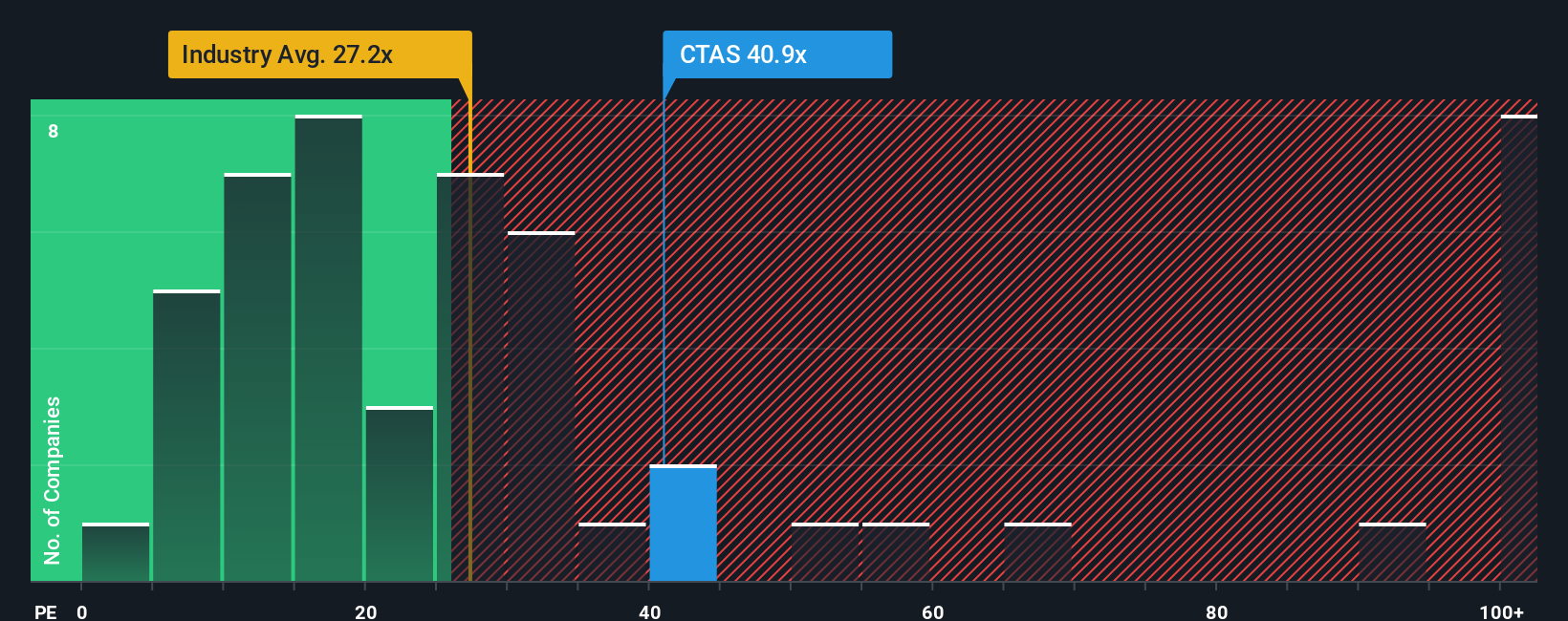

On earnings, the story looks very different. Cintas trades at 39.6 times earnings versus 22.9 times for the US Commercial Services industry and 32.1 times for close peers, while our fair ratio is 32.5 times. That premium points to real valuation risk if growth expectations slip, so it is worth considering whether that still feels comfortable.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Cintas Narrative

If you see the setup differently or prefer to dig into the numbers yourself, you can build a complete view in minutes: Do it your way.

A great starting point for your Cintas research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to level up your watchlist? Use the Simply Wall Street Screener to uncover fresh, data backed ideas that fit your strategy before everyone else does.

- Capitalize on potential mispricings by targeting companies that look overlooked on a cash flow basis through these 914 undervalued stocks based on cash flows before the market catches up.

- Ride the structural shift toward intelligent automation by focusing on innovators powering the next tech wave with these 24 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers with attractive yields using these 12 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報