Redwire (RDW): Evaluating Valuation After New Eight-Figure European Docking Systems Agreement

Redwire (RDW) just landed an eight-figure agreement with Germany-based The Exploration Company to supply two docking systems for its Nyx spacecraft, and the stock quickly reacted to the news.

See our latest analysis for Redwire.

The contract news comes after a volatile stretch for Redwire, with a 1 month share price return of about 51 percent but a year to date share price return still down sharply, while the 3 year total shareholder return above 300 percent shows that long term momentum remains powerful.

If this aerospace win has your attention, it could be a good moment to scan other aerospace and defense names through aerospace and defense stocks for similar growth stories.

With the shares still down more than 50 percent year to date but trading at a steep discount to a 12 dollar price target, is Redwire quietly undervalued here, or are investors already pricing in the next leg of growth?

Most Popular Narrative: 39.5% Undervalued

With Redwire closing at 8 dollars versus a narrative fair value near 13 dollars, the story hinges on aggressive growth, margin expansion, and patience.

The rapid proliferation of commercial satellites and upcoming public/private low Earth orbit projects continues to build demand for Redwire's advanced in-space manufacturing, deployable structures, and subsystems, supporting multi-year visibility on high-margin product sales and recurring earnings.

Want to see how this vision turns into hard numbers? The narrative leans on rapid revenue expansion, rising margins, and a future earnings multiple that might surprise you.

Result: Fair Value of $13.22 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent government funding delays and execution missteps on complex fixed price contracts could derail growth expectations and justify today’s discounted valuation.

Find out about the key risks to this Redwire narrative.

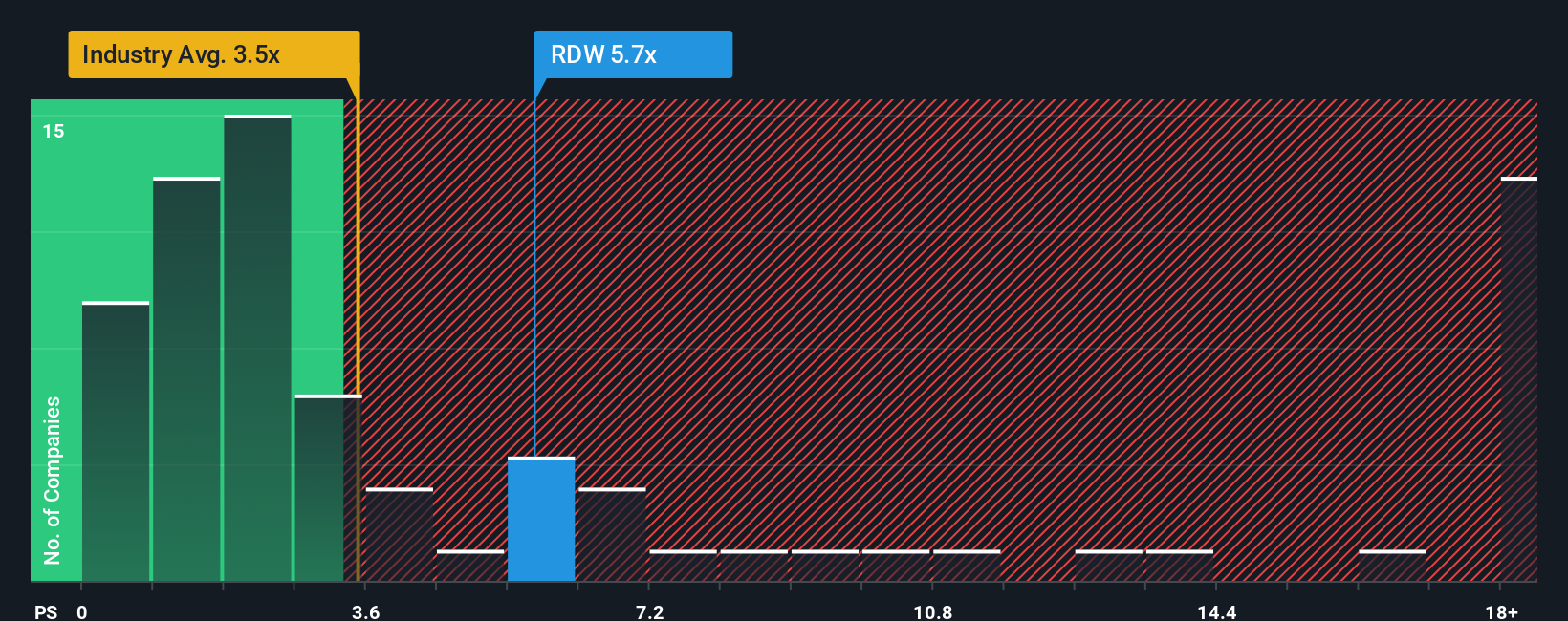

Another View: Price To Sales Flags Caution

While the narrative fair value suggests upside, our price to sales lens is far less forgiving. Redwire trades around 4.5 times sales versus about 3.2 times for the US Aerospace and Defense sector and a 1.7 times fair ratio, implying meaningful downside risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Redwire Narrative

If this angle does not quite match your view, or you would rather dig into the numbers yourself, you can build a custom narrative in minutes: Do it your way.

A great starting point for your Redwire research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready For Your Next Investing Move

Stay a step ahead by scanning fresh opportunities now, or risk watching the next wave of winners pass you by while you sit on the sidelines.

- Explore potential opportunities in these 3634 penny stocks with strong financials that combine small market caps with resilient balance sheets and established financial strength.

- Access structural growth themes through these 29 healthcare AI stocks at the intersection of medical innovation, data intelligence, and long-term demographic demand.

- Identify more stable income ideas using these 12 dividend stocks with yields > 3% focused on consistent payouts that may help support income objectives through different market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報