Carnival (CCL) Margin Expansion Supports Bullish Profitability Narratives Heading Into Earnings Season

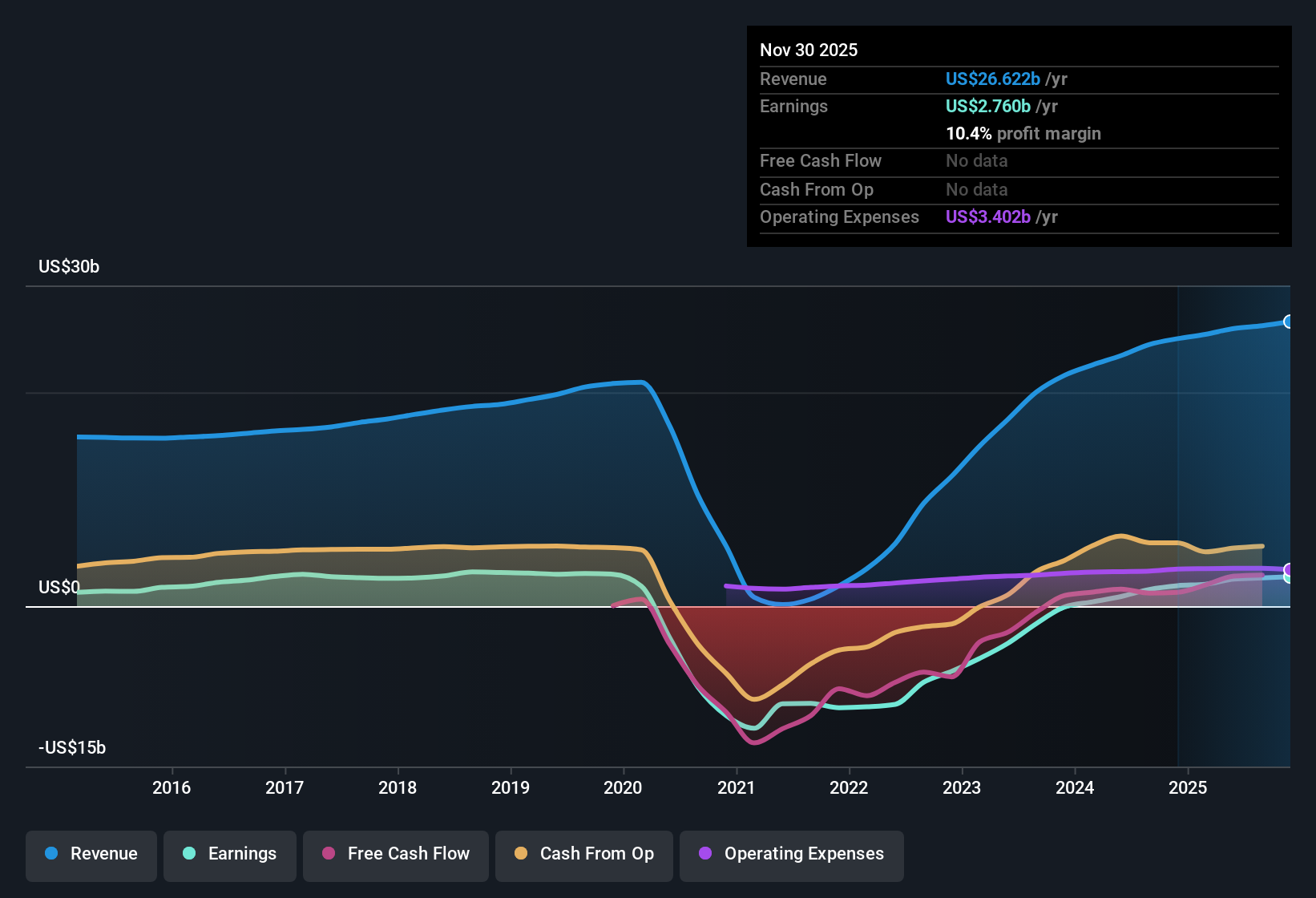

Carnival Corporation (CCL) capped FY 2025 with fourth quarter revenue of about $6.3 billion and basic EPS of $0.32, while trailing 12 month revenue reached roughly $26.6 billion alongside EPS of $2.10. The company has seen revenue move from around $24.5 billion to $26.6 billion over the last six reported trailing 12 month snapshots, with EPS climbing from $1.24 to $2.10, setting up a picture of firmer profitability and healthier margins that investors will be keen to parse in the latest release.

See our full analysis for Carnival Corporation &.With the headline numbers on the table, the next step is to see how this earnings momentum lines up against the prevailing narratives around Carnival, from growth potential to profitability durability.

See what the community is saying about Carnival Corporation &

Margins Strengthen With 10.4% Net Profit

- Over the last twelve months, net income reached about $2.8 billion on $26.6 billion of revenue, giving Carnival a 10.4 percent net profit margin compared with 7.7 percent a year earlier.

- Bulls point to this margin step up as evidence that new destinations and fleet upgrades are paying off, yet

- the trailing EPS of about $2.10 versus $1.50 a year ago lines up with the idea that better pricing and onboard spend are flowing through to shareholders,

- while the relatively modest revenue pace of roughly 3.9 percent expected annual growth means the bullish case leans heavily on further efficiency gains rather than big top line jumps.

Bulls argue that these improving margins could be just the start as new private islands, loyalty perks, and more efficient ships ramp up over the next few years. 🐂 Carnival Corporation & Bull Case

44% Earnings Growth Versus Slower Future Pace

- Trailing twelve month earnings grew 44.1 percent year over year, and analysts expect earnings to grow about 11.4 percent per year from here, which is slower than the broader US market forecast of 16.1 percent.

- Consensus narrative highlights structural growth drivers like new loyalty programs and capacity discipline, and the numbers partly support that view because

- EPS moved from roughly $1.24 to $2.10 over the last six trailing snapshots as net income climbed from about $1.6 billion to $2.8 billion,

- yet the softer revenue outlook of around 3.9 percent annual growth suggests much of the past earnings surge may be catch up from earlier years rather than a pace that can continue indefinitely.

Debt Load Offsets Valuation Discount

- At a share price of $31.12, Carnival trades below a DCF fair value of about $38.11 and at a trailing P E of 14.8 times, compared with roughly 22.6 times for peers and 23.4 times for the US hospitality industry.

- Bears focus on the elevated debt balance as the key risk to that apparent discount because

- the business is now consistently profitable with 5 year earnings growth of 64.8 percent per year, so the main overhang is leverage rather than weak operations,

- and slower forecast revenue growth versus the US market means using that debt to chase aggressive expansion could pressure returns if demand softens or required ship upgrades turn out more expensive than planned.

Skeptics warn that even with a lower P E and a discount to DCF fair value, Carnival's sizeable debt stack could limit how much upside shareholders actually realize if growth underperforms. 🐻 Carnival Corporation & Bear Case

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Carnival Corporation & on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from a different angle and turn that view into a clear narrative in just a few minutes, Do it your way

A great starting point for your Carnival Corporation & research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Carnival's slower projected earnings and revenue growth, combined with its substantial debt burden, raise questions about how resilient its performance will be if conditions tighten.

If that leverage makes you uneasy, use our solid balance sheet and fundamentals stocks screener (1943 results) today to quickly find companies with stronger finances and healthier balance sheets built to handle uncertainty.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報