Intuitive Surgical (ISRG): Reassessing Valuation After Earnings Beat, FDA da Vinci Clearance, and Strategy Shift

Intuitive Surgical (ISRG) just delivered a clean combination of earnings upside, fresh FDA clearances for its da Vinci Single Port system, and a shift to direct distribution in Southern Europe, all pointing toward a bigger, higher margin opportunity set.

See our latest analysis for Intuitive Surgical.

Those beats and new clearances have helped the stock regain momentum, with a 90 day share price return of 28.78% and a five year total shareholder return of 112.81%. This suggests investors still see a long growth runway here.

If Intuitive’s run has you rethinking your exposure to medical innovators, it could be worth exploring other high quality healthcare stocks that are quietly building similar long term stories.

Yet with the share price near all time highs and trading only slightly below analyst targets, the key question now is whether Intuitive is still mispriced on its long term potential or if markets are already discounting years of future growth.

Most Popular Narrative Narrative: 4% Undervalued

With the narrative fair value sitting just above the latest $572.47 close, the story hinges on how far premium growth can stretch investor confidence.

Ongoing product innovation (including full launch of da Vinci 5, integrated force feedback, and digital/AI case insights), coupled with R&D to expand into adjacent specialties, enhances clinical outcomes and surgeon efficiency supporting future procedure growth, higher system ASPs, and increased recurring instrument and accessory revenues.

Curious why steady double digit expansion and resilient margins still support such a rich future earnings multiple? The answer lies in a bold profitability trajectory and a valuation framework more often reserved for market darlings, not cautious compounders. Want to see which specific growth and margin assumptions power that premium price tag?

Result: Fair Value of $596.36 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent international budget constraints and intensifying competition in instruments and systems could slow placements, compress margins, and challenge the current premium valuation case.

Find out about the key risks to this Intuitive Surgical narrative.

Another Lens on Valuation

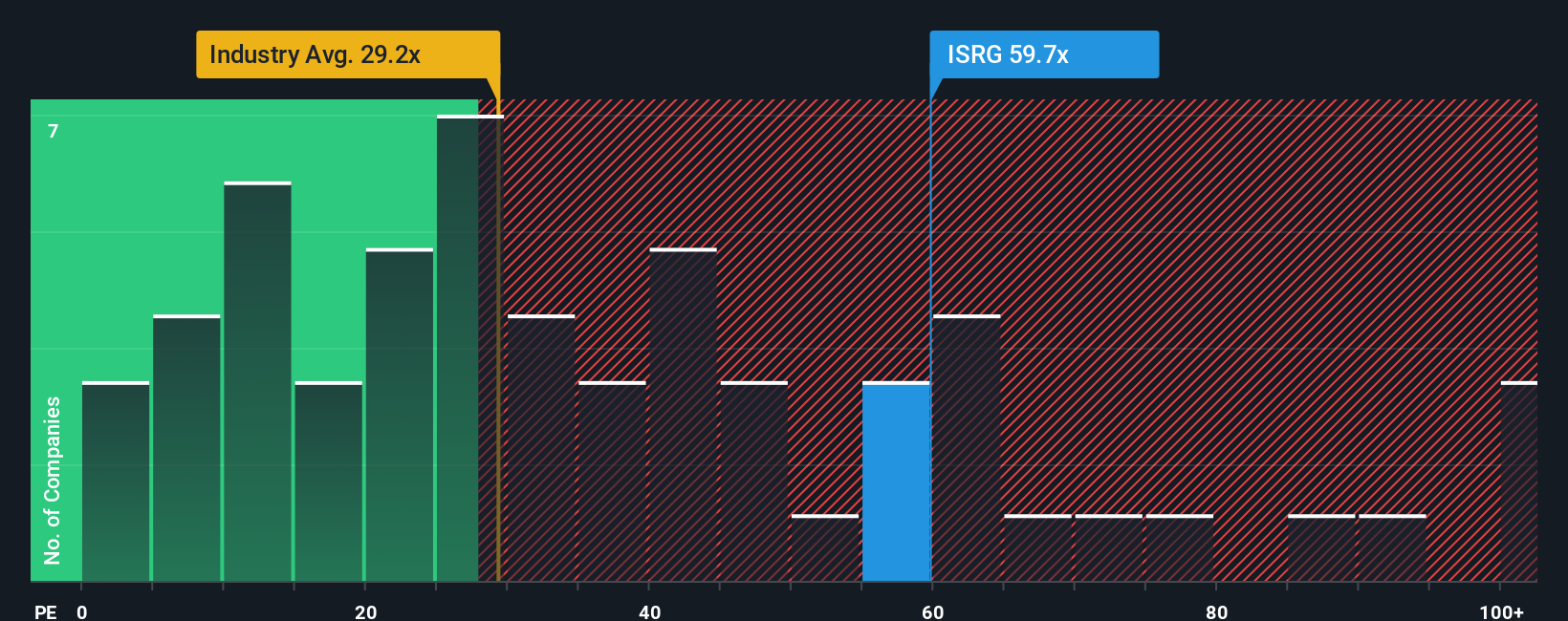

Step away from narrative fair value and the picture looks harsher. On earnings, Intuitive trades at 73.9 times profits, far above the 29.7 times industry average, the 34.8 times peer average, and even our 38.9 times fair ratio, implying meaningful downside if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intuitive Surgical Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Intuitive Surgical.

Ready for more opportunities?

Before Intuitive sets the next benchmark, lock in your next moves with focused stock ideas from the Simply Wall Street Screener that many investors overlook.

- Capture potential mispricings by targeting companies flagged as undervalued through these 911 undervalued stocks based on cash flows, where strong cash flows are not yet fully reflected in current share prices.

- Ride powerful structural trends by zeroing in on innovation leaders using these 24 AI penny stocks, built to spotlight early movers in AI transformation.

- Strengthen your income stream by screening for reliable payers via these 12 dividend stocks with yields > 3%, focusing on yields above 3 percent backed by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報