Wabtec’s Valuation After Strong Q3 Beat and Frauscher Acquisition Completion

Westinghouse Air Brake Technologies (WAB) just posted third quarter results that topped earnings and revenue expectations, while closing its cash acquisition of Frauscher Sensor Technology Group, a deal that is expected to meaningfully lift future sales.

See our latest analysis for Westinghouse Air Brake Technologies.

Those upbeat results and the Frauscher deal come on top of easing bearish sentiment, with short interest drifting lower and the stock showing solid momentum, including a roughly high single digit 3 month share price return and a strong multi year total shareholder return profile.

If Wabtec’s latest move has you rethinking the rail and defense supply chain, this could be a good moment to explore other aerospace and defense stocks that might fit your strategy.

With Wabtec up strongly over three and five years, trading just below analyst targets and near estimated fair value, investors now face a key question: is this still an attractive entry point, or has the market already priced in its next leg of growth?

Most Popular Narrative Narrative: 7.7% Undervalued

With the narrative fair value sitting modestly above the last close, the implied upside leans on specific growth, margin and capital allocation assumptions.

Strategic, accretive acquisitions (Inspection Technologies, Frauscher, DeLiner Couplers) are expanding Wabtec's technological capabilities and global market share, with management expecting both immediate and substantial incremental EBITDA, margin expansion, and realization of cost/growth synergies to drive improved net margins and free cash flow over the next several years.

Curious how steady, mid single digit revenue growth, rising margins and a premium earnings multiple combine into that upside story? The narrative’s math might surprise you.

Result: Fair Value of $234.09 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer North American freight demand and rising integration risk from recent acquisitions could easily derail those carefully modeled growth and margin assumptions.

Find out about the key risks to this Westinghouse Air Brake Technologies narrative.

Another Lens on Value

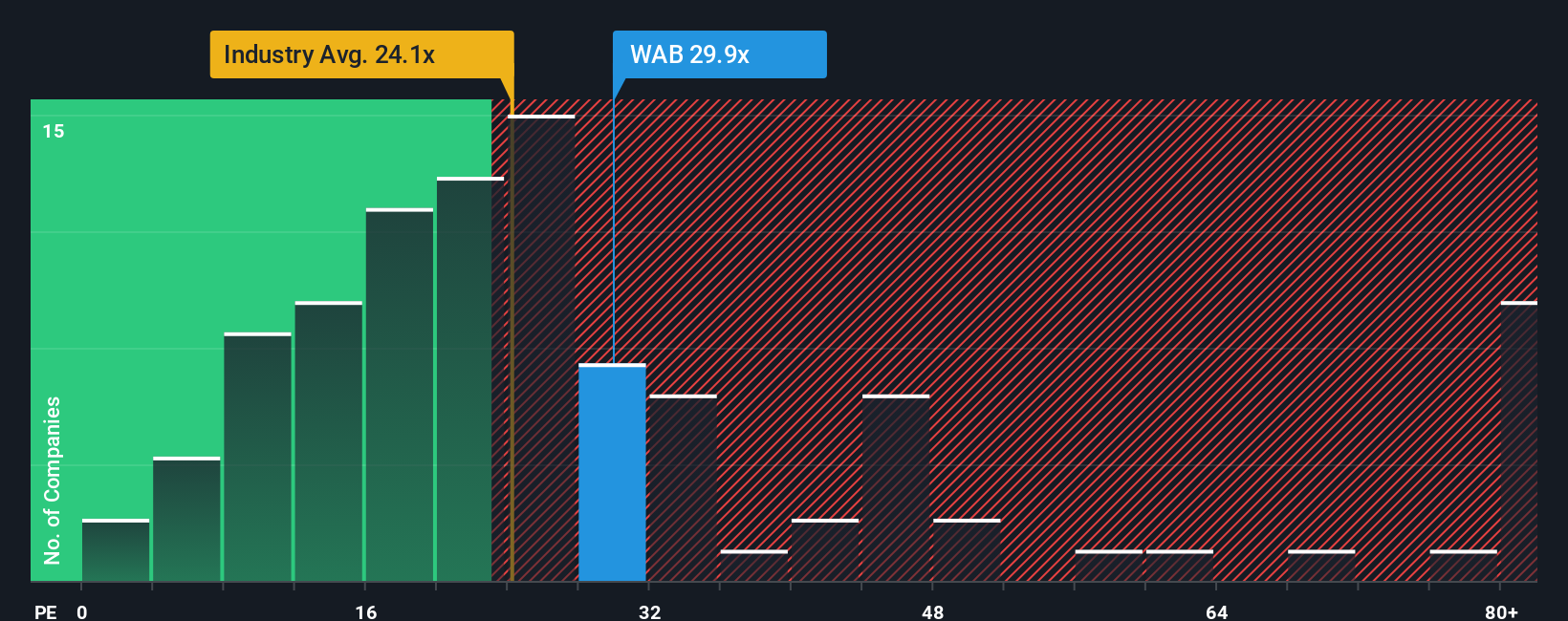

On a simple earnings lens, the story looks very different. Wabtec trades at about 31.4 times earnings, well above both the US Machinery industry at 25.3 times and its own 30.8 times fair ratio. This suggests the market already bakes in a lot of optimism. How much upside is really left if sentiment cools?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Westinghouse Air Brake Technologies Narrative

If you see the story differently or want to stress test the numbers yourself, you can craft a custom narrative in minutes: Do it your way.

A great starting point for your Westinghouse Air Brake Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, explore your next potential opportunity by scanning a few focused stock ideas tailored to different strategies and market themes.

- Explore potential multi baggers early by reviewing these 3631 penny stocks with strong financials that already back their small share prices with established financial strength.

- Consider transformative technology trends with these 24 AI penny stocks that are generating revenue around artificial intelligence, rather than relying on short-term interest alone.

- Evaluate your income strategy with these 12 dividend stocks with yields > 3% that seek to pair attractive yields with sustainable payout profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報