Is Coca-Cola FEMSA Still Attractive After 22% 2025 Surge and Strong DCF Upside?

- Wondering if Coca-Cola FEMSA. de is still worth buying after its strong run, or if the fizz has already gone from the stock price? This article is going to unpack what the market might be missing in its valuation.

- The share price has climbed to around $94.96, delivering roughly 1.8% over the last week, 7.4% over the past month, and 22.1% year to date, alongside 24.1% over 1 year, 51.0% over 3 years, and 155.7% over 5 years. This naturally raises questions about how much upside is left.

- Recent headlines have focused on the company strengthening its distribution footprint and expanding product offerings in key Latin American markets, signaling management is still leaning into growth rather than just defending market share. At the same time, investors have been paying attention to macro shifts in consumer demand and pricing power across beverages, both of which help explain why the market has been willing to rerate the stock.

- Even after this performance, our valuation framework suggests Coca-Cola FEMSA. de scores a solid 5 out of 6 on our undervaluation checks. This sets the stage for a deeper dive into DCFs, multiples, and other methods, before finishing with a more holistic, narrative-driven way to judge whether the stock still represents good value.

Approach 1: Coca-Cola FEMSA. de Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and discounting those cash flows back to today. For Coca-Cola FEMSA. de, the latest twelve month Free Cash Flow is about MX$7.5 billion, and analysts expect this to rise steadily as the business expands its beverage portfolio and distribution network.

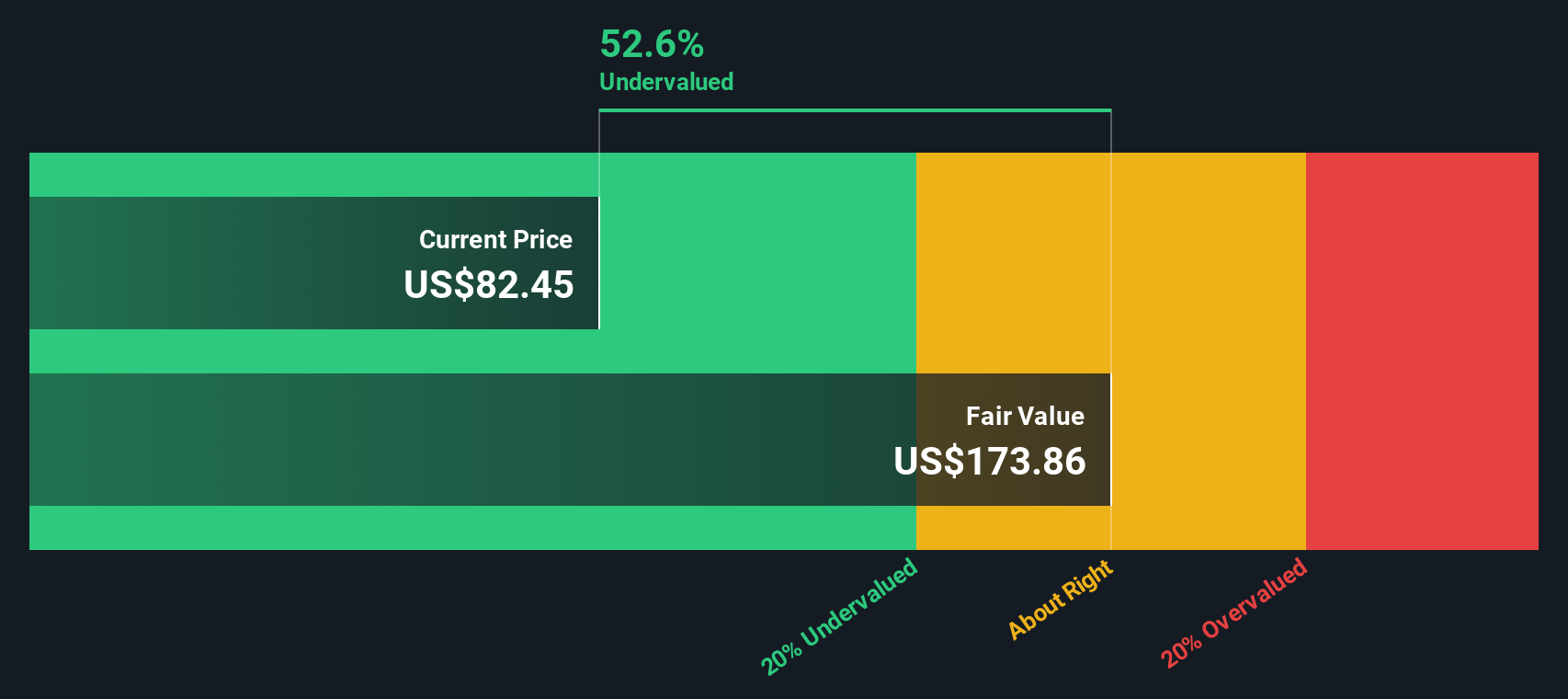

Based on analyst forecasts for the next few years, Simply Wall St extends those trends out to around a decade, with Free Cash Flow projected to reach roughly MX$35.1 billion by 2029 and continue climbing through 2035. Using a 2 Stage Free Cash Flow to Equity model, these future MX$ cash flows are discounted back to arrive at an estimated intrinsic value of about $164.20 per share.

Compared with the current share price near $94.96, the DCF implies the stock is trading at roughly a 42.2% discount to its calculated fair value. This indicates potential upside if these cash flow assumptions play out.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Coca-Cola FEMSA. de is undervalued by 42.2%. Track this in your watchlist or portfolio, or discover 912 more undervalued stocks based on cash flows.

Approach 2: Coca-Cola FEMSA. de Price vs Earnings

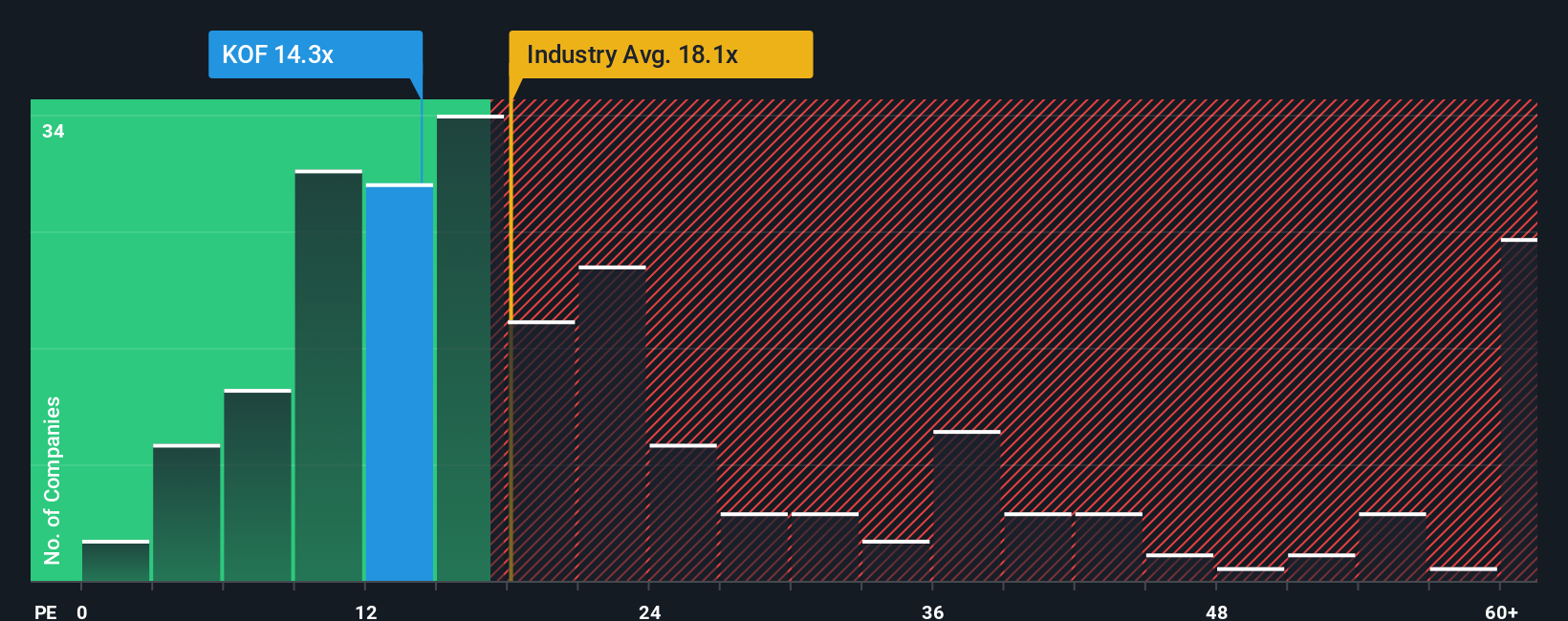

For a profitable, established business like Coca-Cola FEMSA. de, the Price to Earnings, or PE, ratio is a natural starting point because it links what investors pay today to the company’s current earnings power. In general, companies with stronger growth prospects and lower perceived risk can justify a higher PE, while slower growth or higher risk usually calls for a discount to the market.

Coca-Cola FEMSA. de currently trades on a PE of about 15.23x, which is below both the Beverage industry average of roughly 17.72x and the broader peer group sitting closer to 33.58x. Simply Wall St’s proprietary Fair Ratio for the stock comes in at 18.63x, reflecting what would be a reasonable PE once you factor in its earnings growth outlook, profitability, size, industry positioning, and specific risks.

Because the Fair Ratio is tailored to Coca-Cola FEMSA. de, it is more informative than a simple comparison against generic industry or peer averages, which can be skewed by outliers or different business models. With the current PE of 15.23x sitting meaningfully below the Fair Ratio of 18.63x, the multiple analysis points to the shares still trading at an attractive discount.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Coca-Cola FEMSA. de Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. This is a simple way to connect your view of Coca-Cola FEMSA. de’s future to a set of numbers like revenue growth, profit margins and fair value, then compare that fair value to today’s price to see whether you think the stock is a buy, hold or sell.

A Narrative is your story about the company, written in financial terms. You decide how fast revenue might grow, how margins might evolve, and what valuation multiple feels reasonable. The Simply Wall St platform, used by millions of investors, instantly turns that story into a forecast and a fair value estimate on the Community page.

Because Narratives are dynamic, they automatically update when new information arrives, such as earnings, tax changes in Mexico or fresh news about digital expansion in Brazil. This can help you decide if your story still holds or needs to change.

For example, one Coca-Cola FEMSA. de Narrative might assume strong execution and justify a fair value near $200, while a more cautious Narrative could land closer to $93. Seeing these side by side helps you understand how different assumptions, not just different opinions, drive very different decisions.

Do you think there's more to the story for Coca-Cola FEMSA. de? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報